In Bonds & Yields 101, we covered the concept of Yield in its most basic form: Current Yield.

Current Yield is just the return an investor would earn if she purchased a bond and held it for a year.

Current Yield = Annual Coupon / Price

At issuance, the Current Yield and Yield to Maturity are equal, but they deviate over time.

Say you buy a Hertz bond (don't do this!) that matures in 1 year and has a 10% coupon rate and a $1,000 par value. You pay $800 for the bond.

Current Yield = $100 / $800 = 12.5%

YTM = (Interest+Principal) / Price - 1

YTM = ($100+$1000) / $800 - 1

YTM = 37.5%

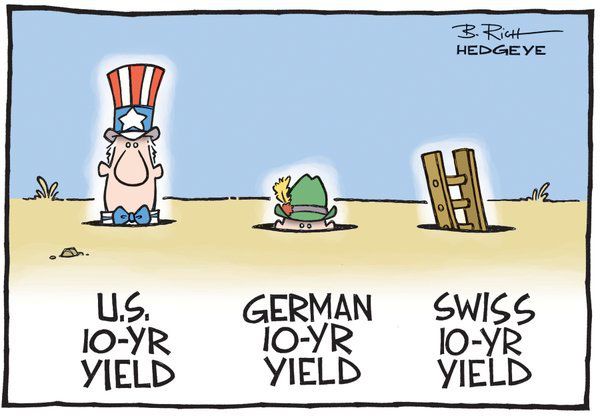

Now that we have the basics down, let's take a look at a very relevant (and weird) topic: negative yields.

You buy a US Treasury bond (safe!) that matures in 1 year and has a 1% coupon rate and a $1,000 par value. You pay $1,100 for the bond.

YTM = ($10+$1000) / $1,100 - 1

YTM = -8.2%

Negative yield!

An investor is PAYING for the right to loan money - weird!

Why might this happen?

▪️ Flight to safety

▪️ Central Bank "yield curve control"

▪️ Deflation risk

While far from comprehensive, I hope this was a helpful primer on the concept of Yield to Maturity and how negative yields may arise in this environment.

Stay tuned for more in this series...