#VeChain X Cloud Computing X PoA

Why I think VeChain is on its way to position itself next to Amazon, Google and Microsoft in the Cloud Computing industry.

Facts

- Data is the new oil of the 21st century.

- The cloud market is currently dominated by a few companies.

1/15

Why I think VeChain is on its way to position itself next to Amazon, Google and Microsoft in the Cloud Computing industry.

Facts

- Data is the new oil of the 21st century.

- The cloud market is currently dominated by a few companies.

1/15

2/15

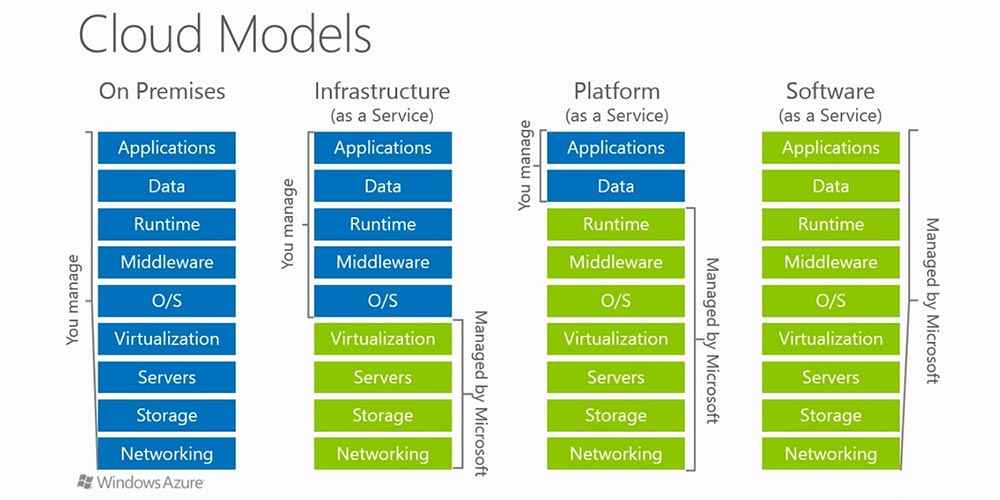

- Cloud computing is the delivery of on-demand computing services typically over the internet and on a pay-as-you-go basis.

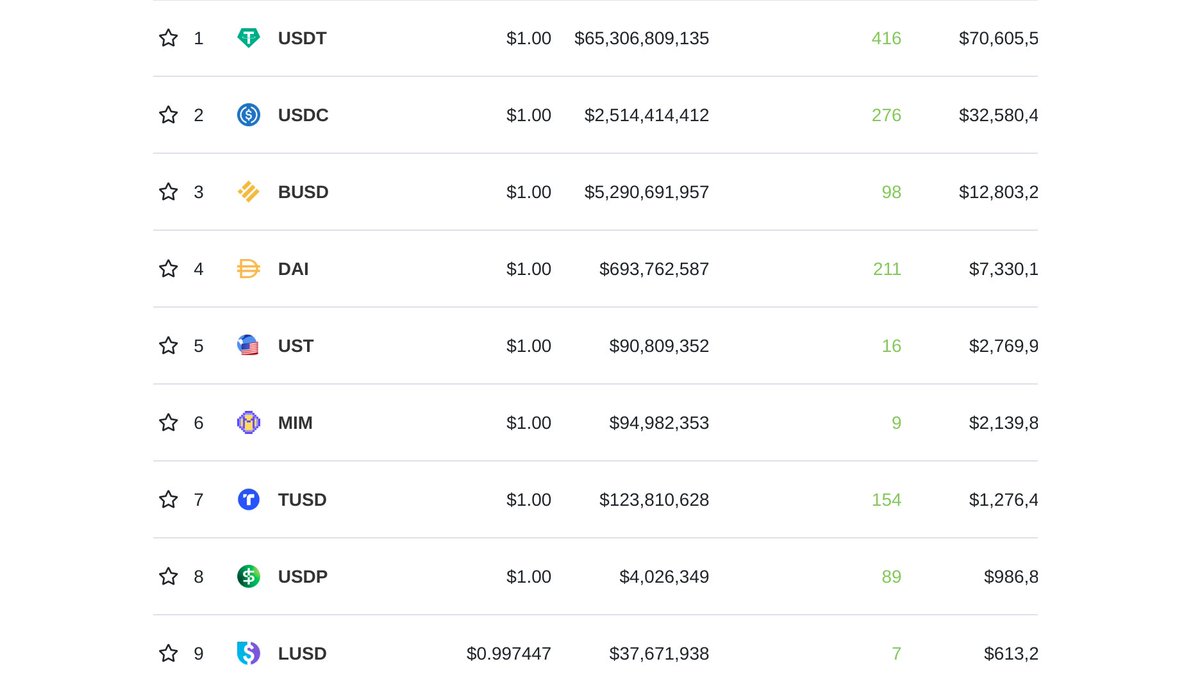

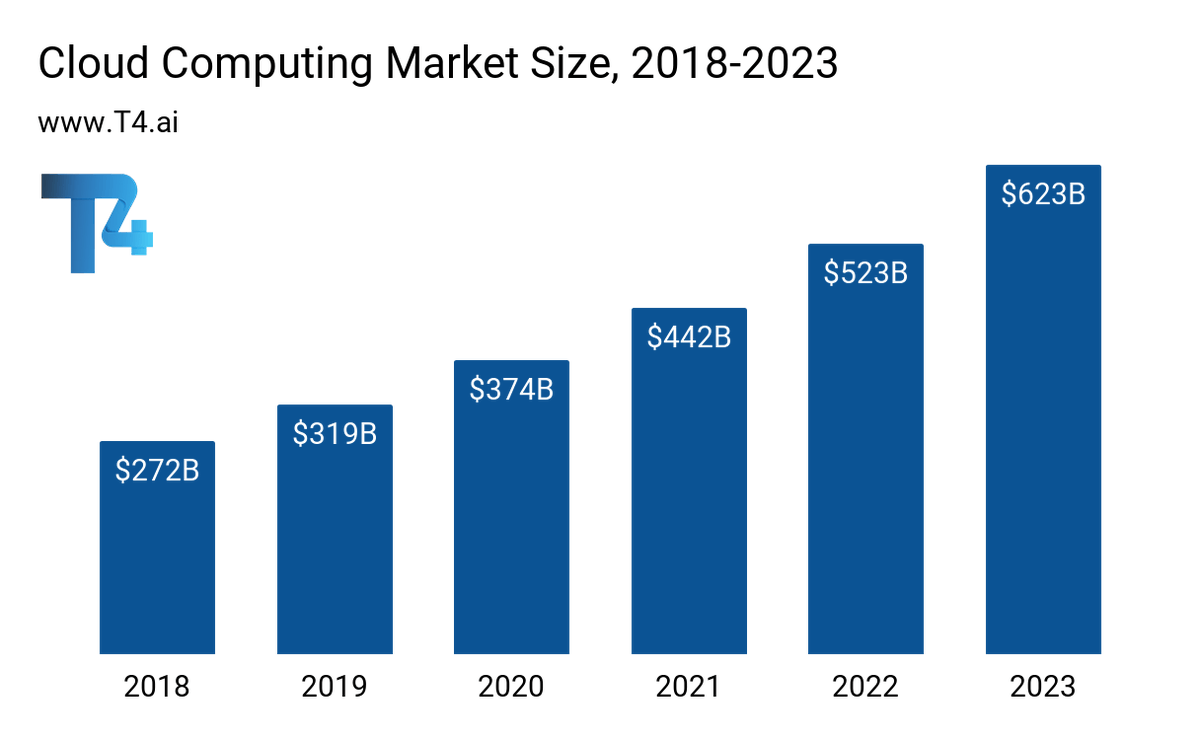

In 2020, the public cloud services market is expected to reach around $374 billion and by 2022 market revenue is forecast to exceed $520 billion.

- Cloud computing is the delivery of on-demand computing services typically over the internet and on a pay-as-you-go basis.

In 2020, the public cloud services market is expected to reach around $374 billion and by 2022 market revenue is forecast to exceed $520 billion.

3/15 IaaS

Infrastructure as a service (IaaS) is one of the three main categories of cloud computing services.

IaaS is a form of cloud computing that provides virtualized computing resources over the internet: servers, virtual machines, storage and networks.

Infrastructure as a service (IaaS) is one of the three main categories of cloud computing services.

IaaS is a form of cloud computing that provides virtualized computing resources over the internet: servers, virtual machines, storage and networks.

4/15 IaaS Payments

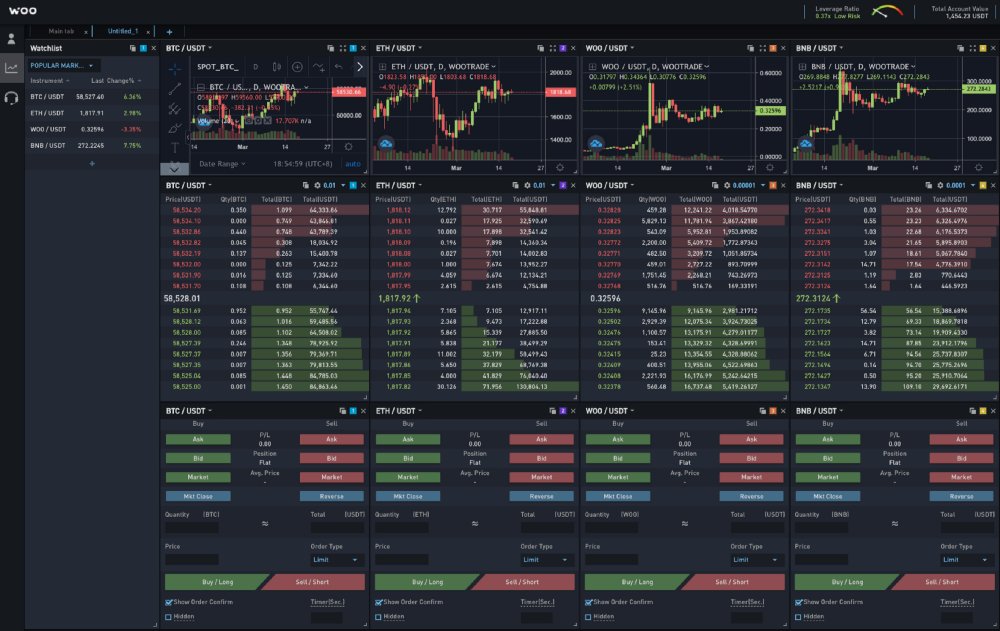

To pay for these services, the IaaS providers have credits:

You need AWS credits to pay for Amazon Web Services. There are GCP credits for computing services on the Google Cloud platform and Microsoft has Azure Credits for the Microsoft Azure platform.

To pay for these services, the IaaS providers have credits:

You need AWS credits to pay for Amazon Web Services. There are GCP credits for computing services on the Google Cloud platform and Microsoft has Azure Credits for the Microsoft Azure platform.

5/15 IaaS vs Blockchain

Blockchain technology is a form of storing data and executing programs. The difference with current IaaS providers is that the data/programs on a decentralized blockchain are trustless and immutable. Features that a centralized IaaS can never provide.

Blockchain technology is a form of storing data and executing programs. The difference with current IaaS providers is that the data/programs on a decentralized blockchain are trustless and immutable. Features that a centralized IaaS can never provide.

6/15 Proof of Authority Consensus Algorithm

VeChain works with the PoA consensus algorithm.

Only 101 companies verified by the VeChain Foundation can add blocks to the blockchain. They put their companies' reputation and coins at stake.

E.g. DNVGL, PWC, BYD and Deloitte

VeChain works with the PoA consensus algorithm.

Only 101 companies verified by the VeChain Foundation can add blocks to the blockchain. They put their companies' reputation and coins at stake.

E.g. DNVGL, PWC, BYD and Deloitte

7/15 The VeChainThor Blockchain

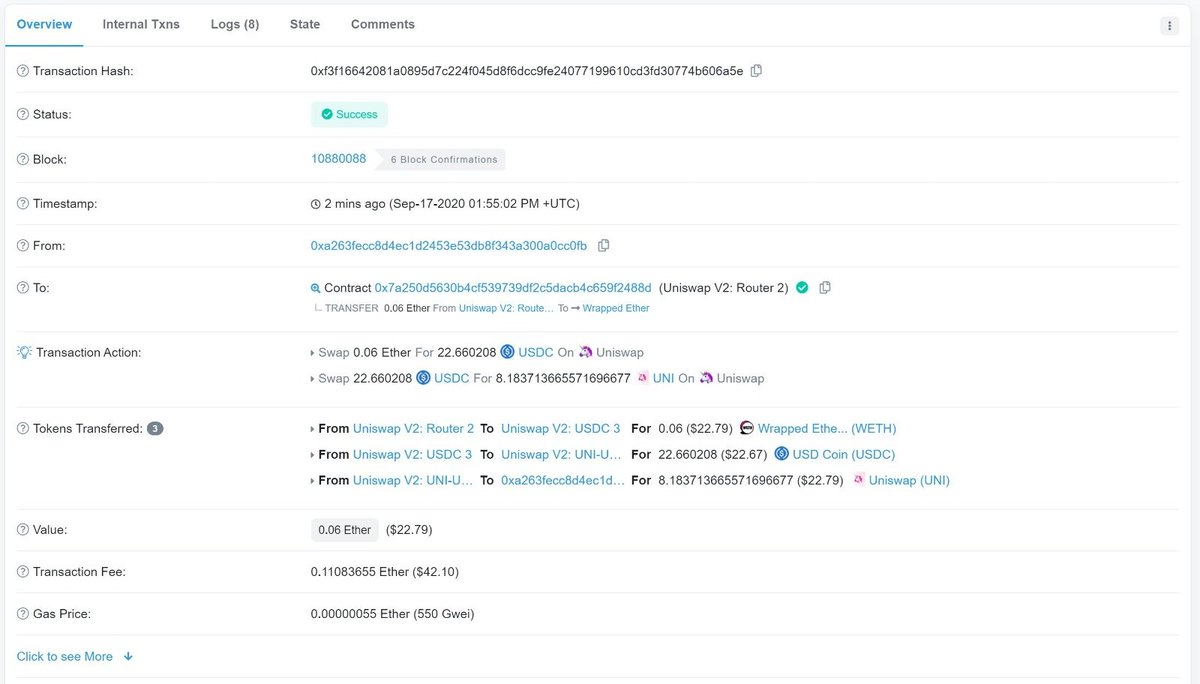

As stated before, a blockchain is basically an IaaS. You can store data and run programs (smart contracts) on a virtual machine.

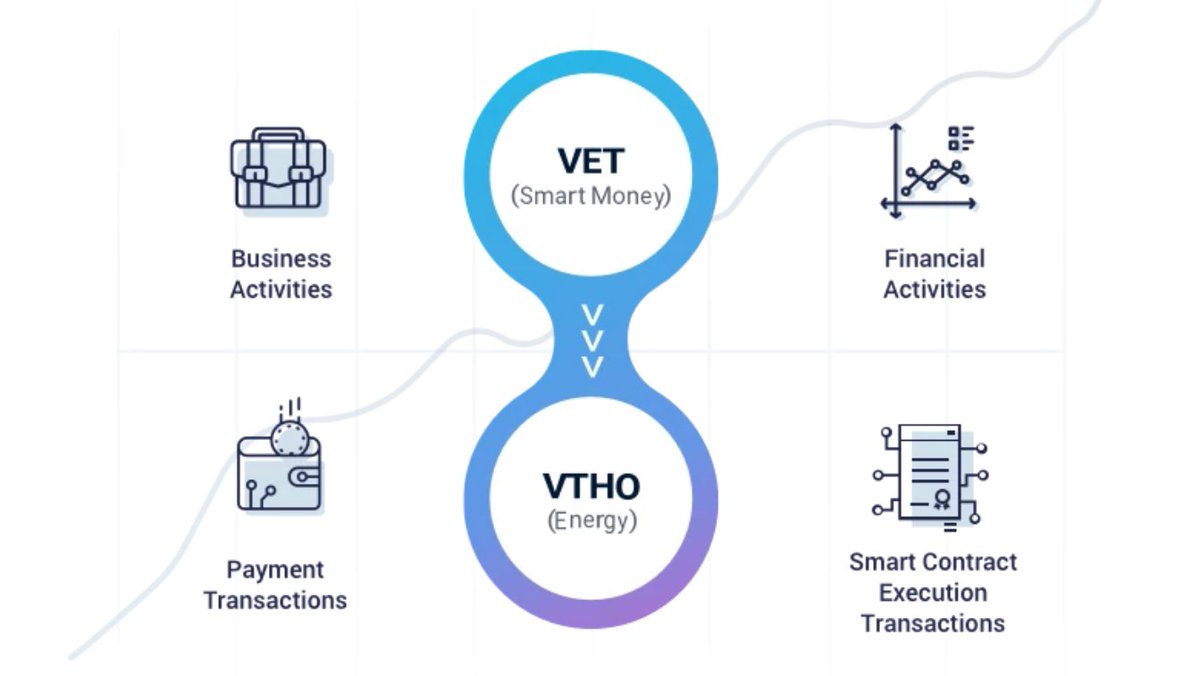

In order to use the VeChainThor blockchain you need to pay . You can see as a decentralized credit.

As stated before, a blockchain is basically an IaaS. You can store data and run programs (smart contracts) on a virtual machine.

In order to use the VeChainThor blockchain you need to pay . You can see as a decentralized credit.

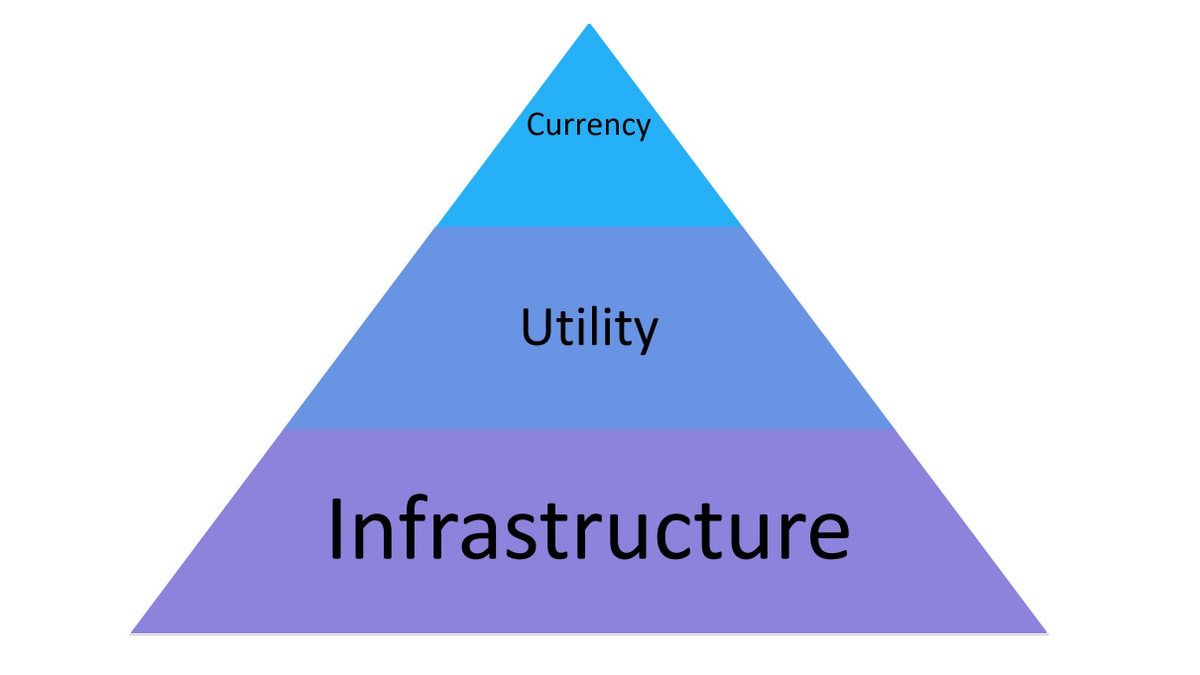

8/15 Infrastructure Token

Therefore, in my opinion we should call "Infrastructure token", not "Utility token".

We only have to pay the network to store data or run programs.

Therefore, in my opinion we should call "Infrastructure token", not "Utility token".

We only have to pay the network to store data or run programs.

9/15 Block Reward

An important difference between PoW/PoS and PoA:

PoW and PoS "miners" are rewarded by producing blocks. Full or not, there is a reward.

PoA "miners" are only rewarded by the amount/size of txs in the block.

No txs -> No tx costs -> No revenue

An important difference between PoW/PoS and PoA:

PoW and PoS "miners" are rewarded by producing blocks. Full or not, there is a reward.

PoA "miners" are only rewarded by the amount/size of txs in the block.

No txs -> No tx costs -> No revenue

10/15

All the nodes are incentivized to bring users on the blockchain. More users means more revenue.

They do this by helping with the development of the ecosystem. E.g.

- @DNVGL created a digital asset wallet to provide to their 900.000 clients.

All the nodes are incentivized to bring users on the blockchain. More users means more revenue.

They do this by helping with the development of the ecosystem. E.g.

- @DNVGL created a digital asset wallet to provide to their 900.000 clients.

https://twitter.com/Martijncvv/status/1197240546651234310

11/15

- @Deloitte built a number of open-source tools, including a block explorer and a tool for managing and creating smart contracts.

- Channel partner @PwC helped with Walmart China and Sam's Club's food safety traceability systems.

- @Deloitte built a number of open-source tools, including a block explorer and a tool for managing and creating smart contracts.

- Channel partner @PwC helped with Walmart China and Sam's Club's food safety traceability systems.

12/15

- VeChain developed ToolChain, a platform offering diverse services which simplify blockchain integration.

Every company focuses on their own strength, market and clients.

- VeChain developed ToolChain, a platform offering diverse services which simplify blockchain integration.

Every company focuses on their own strength, market and clients.

13/15

To get back to where we started:

"Why I think VeChain is on its way to position itself next to Amazon, Google and Microsoft in the Cloud Computing industry."

To get back to where we started:

"Why I think VeChain is on its way to position itself next to Amazon, Google and Microsoft in the Cloud Computing industry."

14/15

Public blockchains are a completely new technology within the Cloud Computing Services. A technology which can not be dominated by one company because of the decentralized fundamentals.

It's also global and not focused on a certain region in the world.

Public blockchains are a completely new technology within the Cloud Computing Services. A technology which can not be dominated by one company because of the decentralized fundamentals.

It's also global and not focused on a certain region in the world.

15/15

The VeChain blockchain is an IaaS, existing of 101 companies with 101 different business models, services and client networks.

The network effect and strength of PoA is very powerful and in my opinion very overlooked.

Exciting times ahead.

🙏

💙

The VeChain blockchain is an IaaS, existing of 101 companies with 101 different business models, services and client networks.

The network effect and strength of PoA is very powerful and in my opinion very overlooked.

Exciting times ahead.

🙏

💙

If you want to like or RT, please RT the first tweet of the thread. 👌

More explanation threads about #VeChain, check the comments on the tweet below or click #EducationVET for single explanation Tweets.

More explanation threads about #VeChain, check the comments on the tweet below or click #EducationVET for single explanation Tweets.

https://twitter.com/Martijncvv/status/1218895904469651456

• • •

Missing some Tweet in this thread? You can try to

force a refresh