Ever wonder why bitcoin transaction fees are sometimes high, sometimes low?

Did you know that sending 0.001 bitcoin can cost more than sending 10,000 bitcoins depending on the situation?

I'll explain all this below 👇

A new Block is mined roughly once every 10 minutes.

And each Block has a maximum size of about 2 megabytes.

In other words, blockchain space is Scarce!

This is where the Transaction Fees come into play

As a result, an interesting market develops...

Striking that balance is a very interesting problem to solve

When there is very high transaction volume, it takes a super high fee rate to get included

When volume is low, your transaction can get included with lower fee rates

(The "Mempool" is the collection of pending transactions, which are all not yet finalized, and competing to get mined in a block)

jochen-hoenicke.de/queue/#0,24h

Notice how nothing here references the value sent - interestingly the value of bitcoin sent actually has no impact on fees!

Its not the value of the bitcoin that makes a transaction more expensive, but rather the total data that it uses.

So in summary:

(Total Fee) = (Fee Rate sats/byte) x (Tx Size bytes)

1) The Fee Rate, which depends on the volume of transactions at the time (and you can choose this to be higher or lower depending on how fast you want it to confirm)

2) Data used in the transaction

Let's dive into 2:

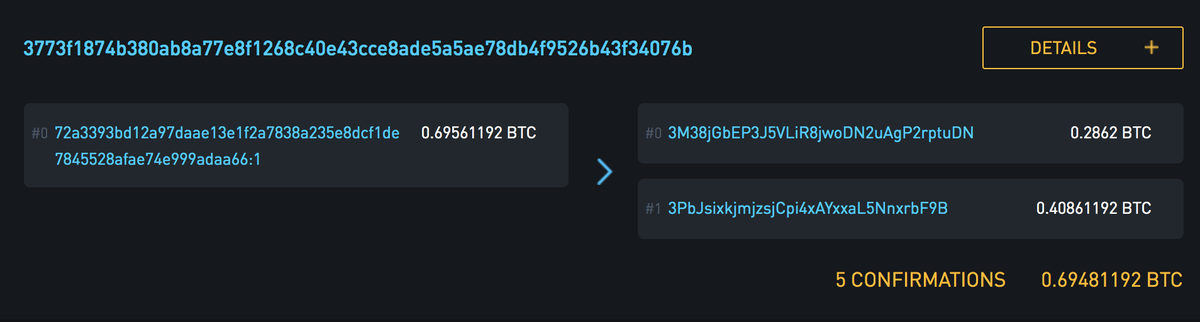

Let's see if the fee rate the website calculated is correct...

(44101 Sats) / (667 Bytes) = 66.1 Sats/Byte, looks good!

To demonstrate, imagine there are two faithful bitcoiners, Alice and Bob, each of whom buys $10 of bitcoin every day on @CashApp 😉

Like good bitcoiners, both of them withdraw all their funds to their own cold storage...

Alice withdraws her fulls balance once every 2 weeks, but Bob withdraws his full balance once every day!

Now imagine 10 weeks later, they each want to deposit all their funds back into @CashApp - who's going to pay more in fees?

Alice will have 5 high-value UTXOs to spend, so her transaction will have 5 inputs and 1 output.

But Bob will have 70 low-value UTXOs, so his transaction will have 70 inputs and 1 output!

He's going to have to pay far more in fees!

In another thread I can talk about how Bob could get around his issue (consolidation transactions), but we'll save that for another time...

What happens if transaction pays too low of a fee rate?

Sometimes transactions can be pending for hours, days or even weeks, at which point some nodes in the network actually drop the transaction and forget about it

And finally, most bitcoin wallets are good enough now to estimate fees for you, so don't worry!

We also covered how the size of the transaction matters a lot when calculating fees.

Hope you enjoyed the thread! Leave any questions in the comments, and be sure to follow me if you want to stay updated with all my future threads... we're just getting started going down this rabbit hole!!

In what situation would a 10,000 BTC transaction pay less in fees than a 0.001 BTC transaction?