Allow me to elaborate in this thread.

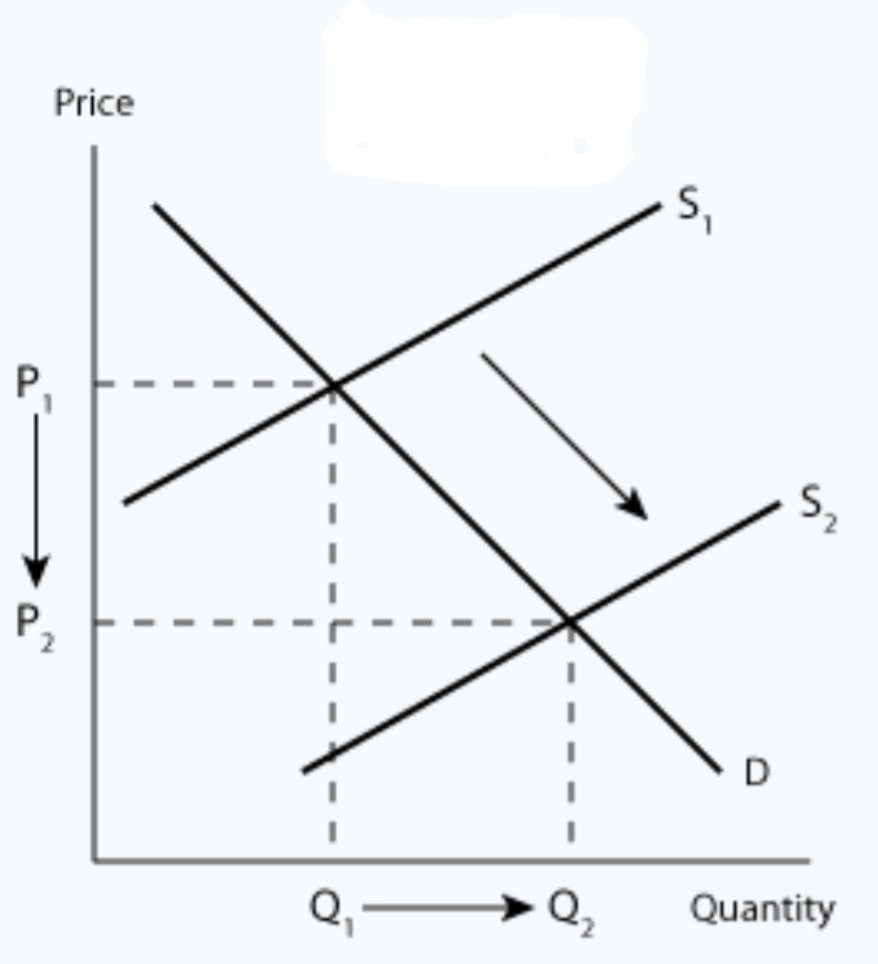

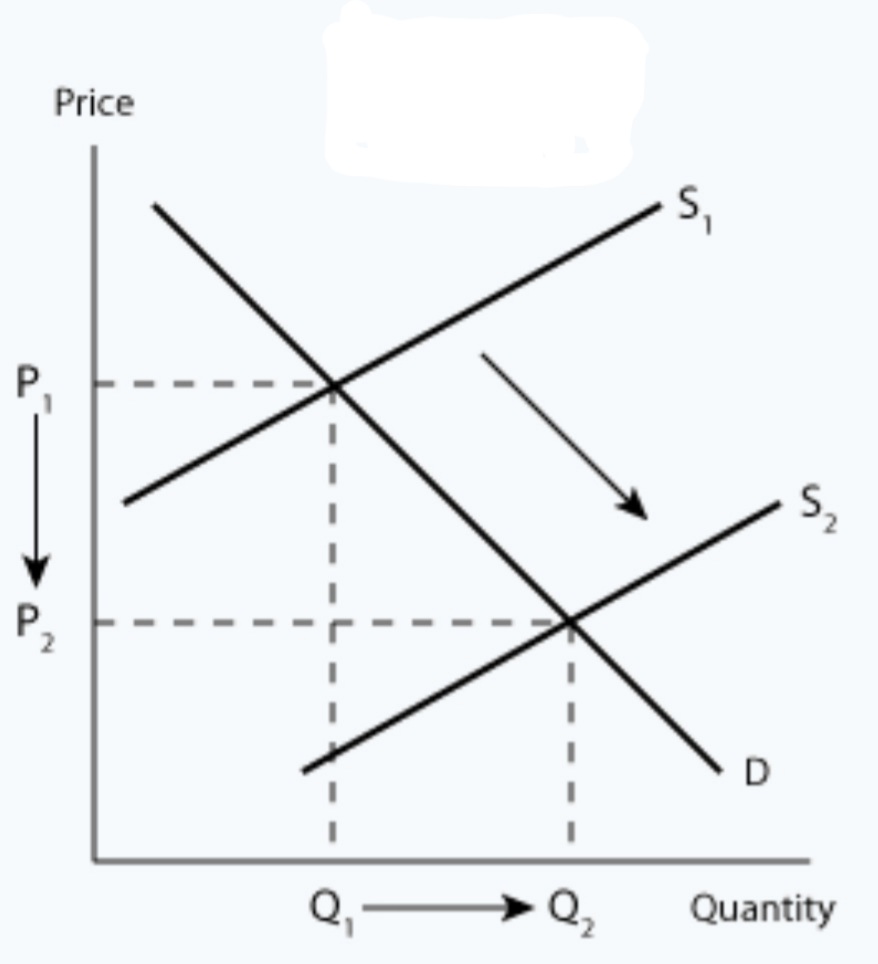

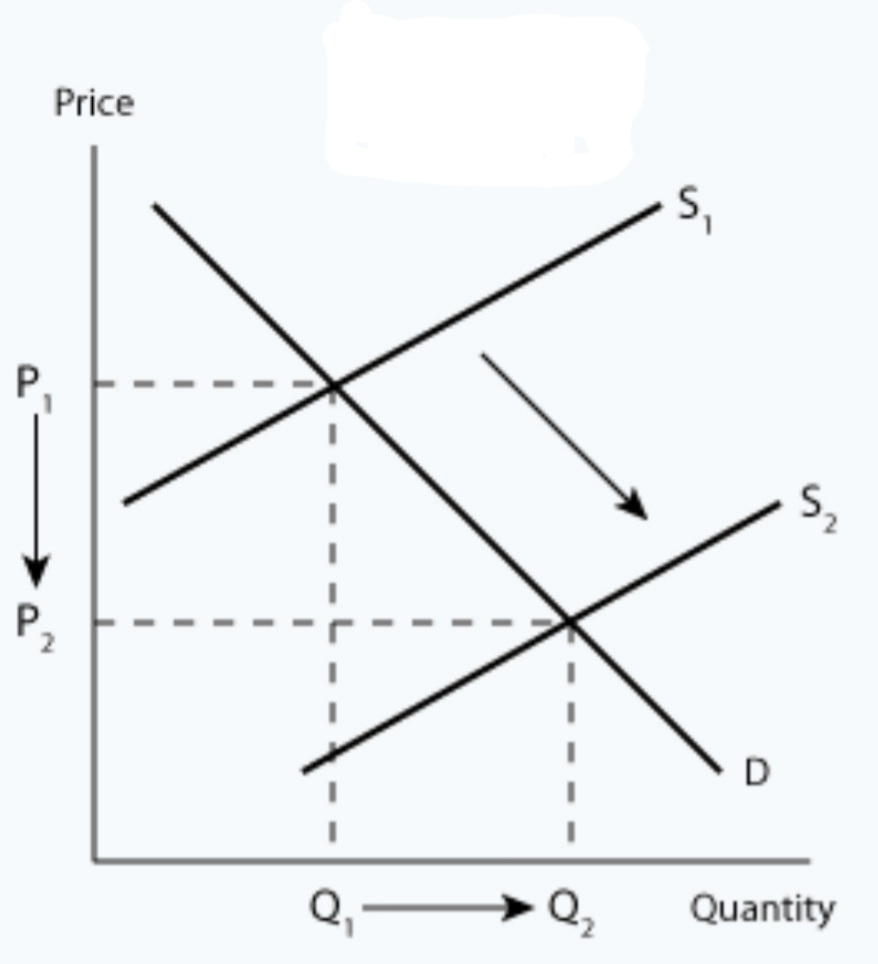

1. Corporate objectives (ex: high margin/niche products vs. mass market/market share)

2. Market size & opportunity for the specific product

3. Competitive product offerings

4. Product manufacturing cost

5. Brand/perceived value

Lets first remember that Model Y is only shipping to NA, and only AWD/Performance variants.

Lets also remember that...

Any price cut $TSLA makes today is to ensure that sales 4-9 weeks from now are balanced with production.

$TSLA keeps inventory levels pretty low.

While price is obviously a demand lever, there are other ways to influence demand w/o cutting price (ex: mass advertising - which $TSLA does not do).

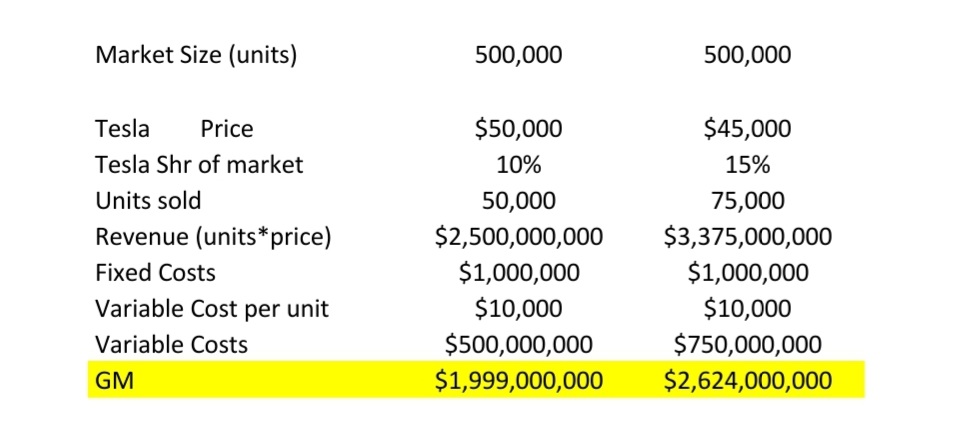

As GA4 increases & GA5 comes online, scale ⏫ and costs ⏬. Tesla will always prioritize volume & mkt shr.

We also need to consider variable production costs.

$TSLA's new pricing agreement with Panasonic (effective April 1) surely helped here. Any cost savings on the battery can be passed on via a price cut (same for 3/S/X) cuts.

$TSLA may have chosen to pass those savings on now and avoid another price cut in Q4.

I think the price cut happened bc:

- Production/supply has or will improve significantly in the next 4 weeks

- $TSLA has chosen higher volume at the cost of GM%, in line with their corporate stategy

- $TSLA wants to inc. demand run-rate to keep inventory low

$TSLA exited Q2 making ~2.5k Model Ys/week. By end of Q3, they will be over 4k/week. I also expect demand run rate to grow over time organically as awareness increases with more Ys on the road.

WoM advertising + cars on the road = $TSLA sells more cars.