I hope I can explain why the disconnect is far more rational than many believe.

bloomberg.com/opinion/articl…

1/

Americans are experiencing an economy that is very negative + a market that is very positive.

No wonder investors are so confused!

2/

Both seem to ignore new record highs in coronavirus infections, economic weakness + myriad re-opening stumbles.

I have a theory why...

3/

All of the above? Maybe not

4/

Japan, South Korea, Germany, others not only have managed to wrestle pandemic into submission, their economies are far ahead of ours into their re-openings.

6/

They also are key revenue producers for FAANMGs.

Data suggest much of the world is way ahead of the U.S. not only in terms of managing their pandemics, but in their economic recoveries.

bit.ly/3fnOx8U

7/

USA figures are 3.30 million confirmed cases of Covid-19 and 135,205 deaths.

We have 4.2% of world’s population, but ~25% of infections + deaths.

8/

All they require of customers is a computing device and a network connection; they are not limited by geography – either domestically or internationally. Their users do not need to go to an office.

9/

Two thirds of the gains in the S&P500 past 5 years have been driven by just 6 U.S. companies.

thetimes.co.uk/article/is-thi…

10/

“Since 2015, the market capitalization of the S&P 500 has increased by $6 trillion. Of this, $4 trillion has come from the big six tech names: Microsoft, Apple, Amazon, Facebook, Alphabet (the owner of Google) + Netflix”

11/

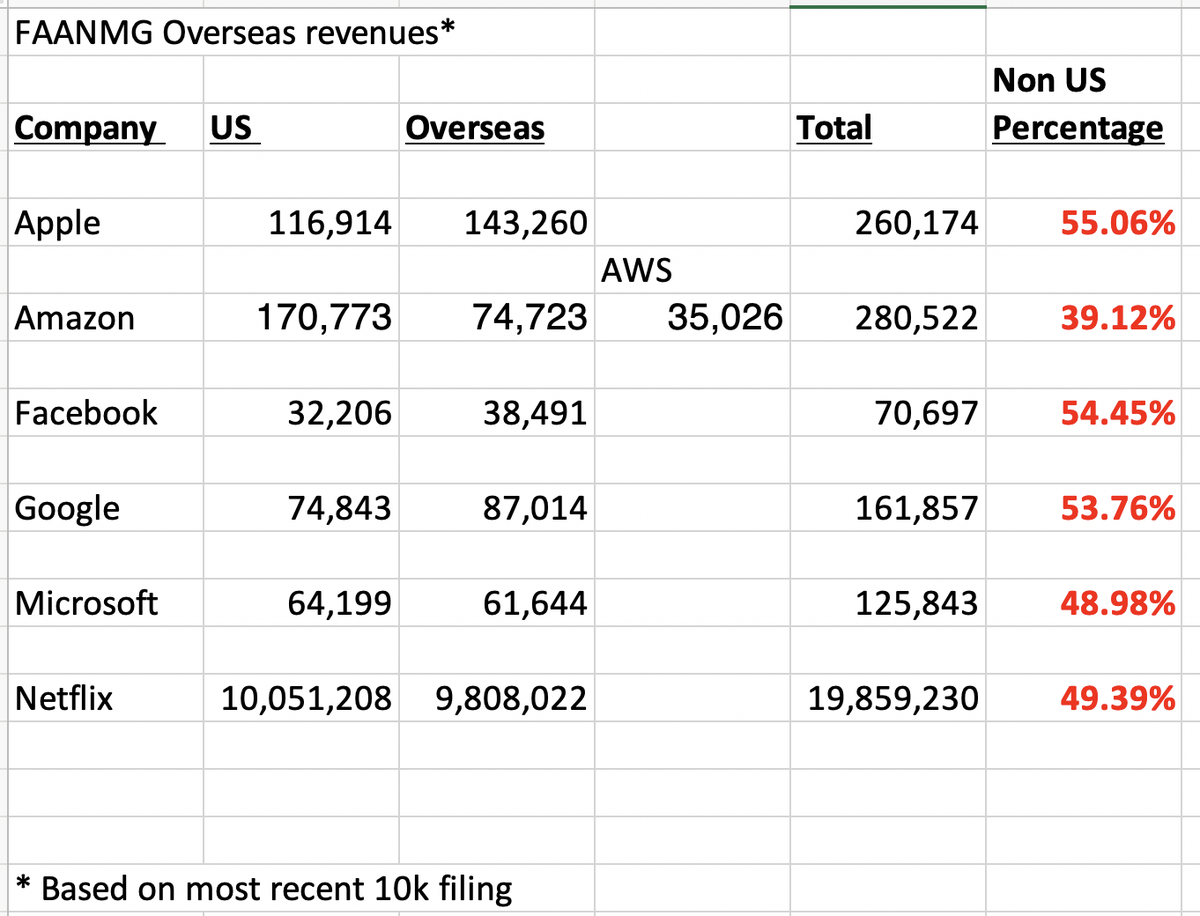

FAANMG derives much more of their revenues from overseas than most stocks:

According to S&P, percentage of S&P500 company revenue from foreign countries was 42.9% in 2018 (2019 update due in August)

Its as much as 50% higher for FAANMGs

12/

$AAPL generates >55% of its revs outside USA. Some Qs, oversea revs = 60%.

$FB & $GOOG revs, its 54.5% / 53.8% respectively.

$MSFT + $NFLX, is about ~1/2 domestic + 1/2 overseas, 49.0% / 49.4% respectively.

13/

Event hat doesn't matter -- you will be hard pressed to think of many other companies that have benefitted more from US lockdown than $AMZN

14/

$NFLX average growth of 21% in 2019, domestic lagged at 7%.

$FB has more users in India than USA; fast growth in Brazil/Indonesia.

$GOOG Asia, Latin and South America faster revenue growth than USA.

15/

It is a very effective one-two punch for this group of stocks. It explains a lot of the market’s gains.

Even more details at @bopinion

bloomberg.com/opinion/articl…

END