1/

The generalization of this argument is instructive.

When faced with danger, do nothing to mitigate the danger, otherwise you'll feel safe and forget there's a danger.

The generalization of this argument is instructive.

When faced with danger, do nothing to mitigate the danger, otherwise you'll feel safe and forget there's a danger.

https://twitter.com/ole_b_peters/status/1282626431818911745

2/

When it's cold, don't put on clothes, or else you might forget it's cold and die of hypothermia or slip on surprise-ice.

In a car: don't put on your seat belt, are you crazy?

Traffic lights: always cross at red to avoid that false sense of safety.

When it's cold, don't put on clothes, or else you might forget it's cold and die of hypothermia or slip on surprise-ice.

In a car: don't put on your seat belt, are you crazy?

Traffic lights: always cross at red to avoid that false sense of safety.

3/

Ill? Well don't go to the doctor, he'd put you right at ease!

Vaccines. Are you kidding me!

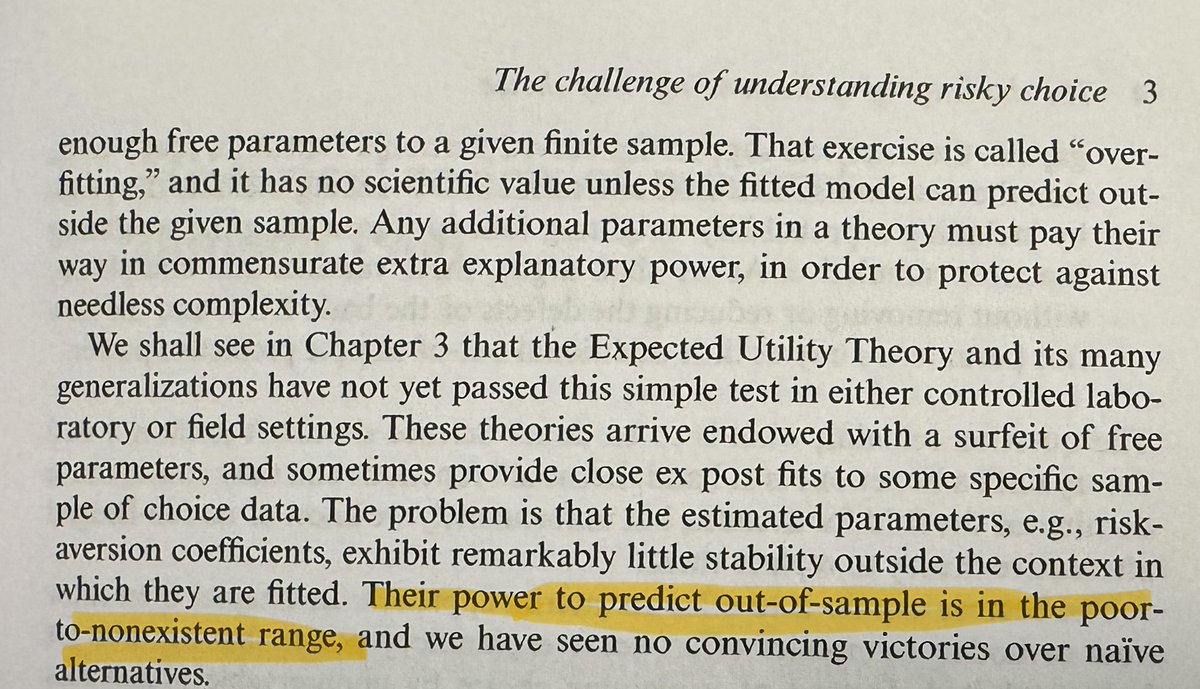

Insurance. The behavioral economists have covered that: only if you suffer from cognitive maladaptation will you insure your belongings.

Ill? Well don't go to the doctor, he'd put you right at ease!

Vaccines. Are you kidding me!

Insurance. The behavioral economists have covered that: only if you suffer from cognitive maladaptation will you insure your belongings.

4/

Hungry? Whatever you do, just don't eat or else you might starve.

Confused? Don't read Joseph Heller.

Hungry? Whatever you do, just don't eat or else you might starve.

Confused? Don't read Joseph Heller.

• • •

Missing some Tweet in this thread? You can try to

force a refresh