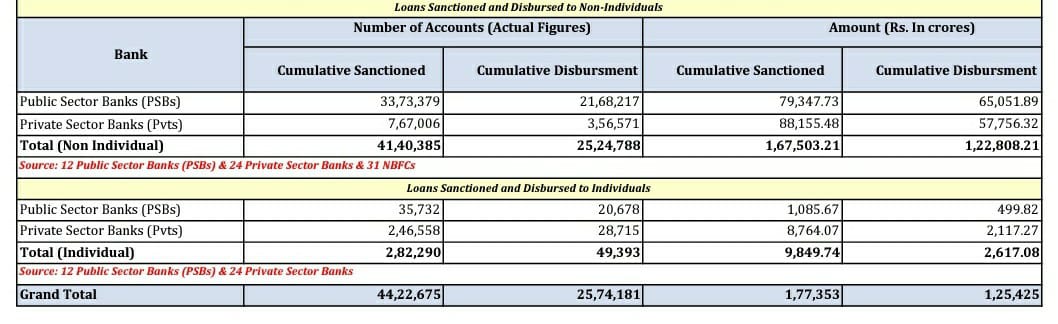

The Partial Credit Guarantee Scheme (PCGS) was revamped under the #AatmanirbharBharat Package to support the liability side of NBFCs by providing a 20% portfolio guarantee to Public Sector Banks for the purchase of Bonds/Commercial Papers rated AA and below issued by NBFCs.

As of 10 July 2020, under the extended PCGS, #PSBs have approved for purchase Bonds/Commercial Papers issued by 67 NBFCs amounting to Rs 14,667 crore, of which Rs 6,845 crore is for Bonds/CPs rated below AA, providing liquidity support to NBFCs with lower rated Bonds/CPs.

Further, the purchase of Bonds/Commercial Papers of Rs 6,125 crore, including Rs 5,550 crore of Bonds/Commercial Papers rated below AA, is currently under various stages of approval/at negotiation stage.

• • •

Missing some Tweet in this thread? You can try to

force a refresh