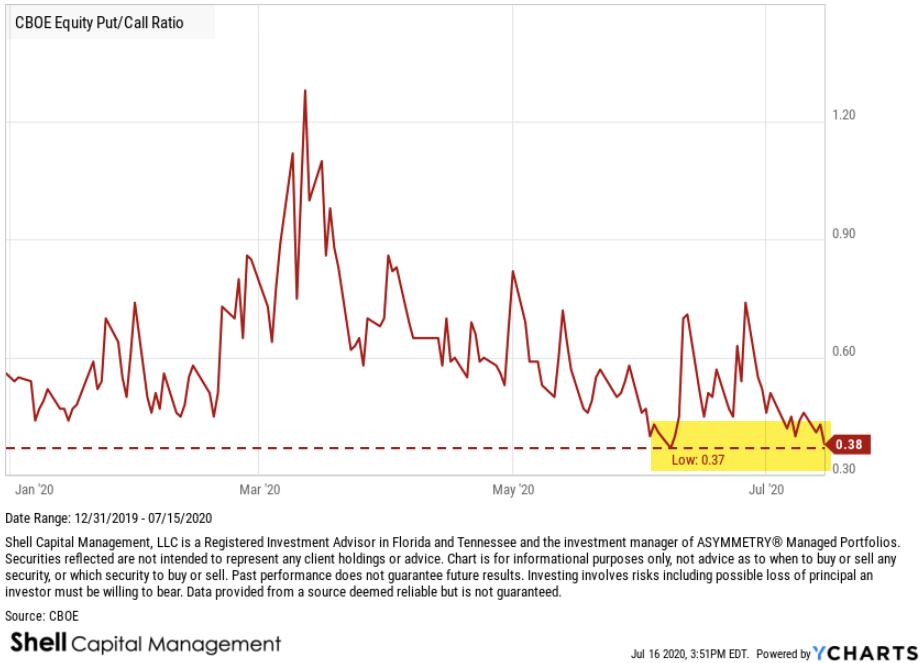

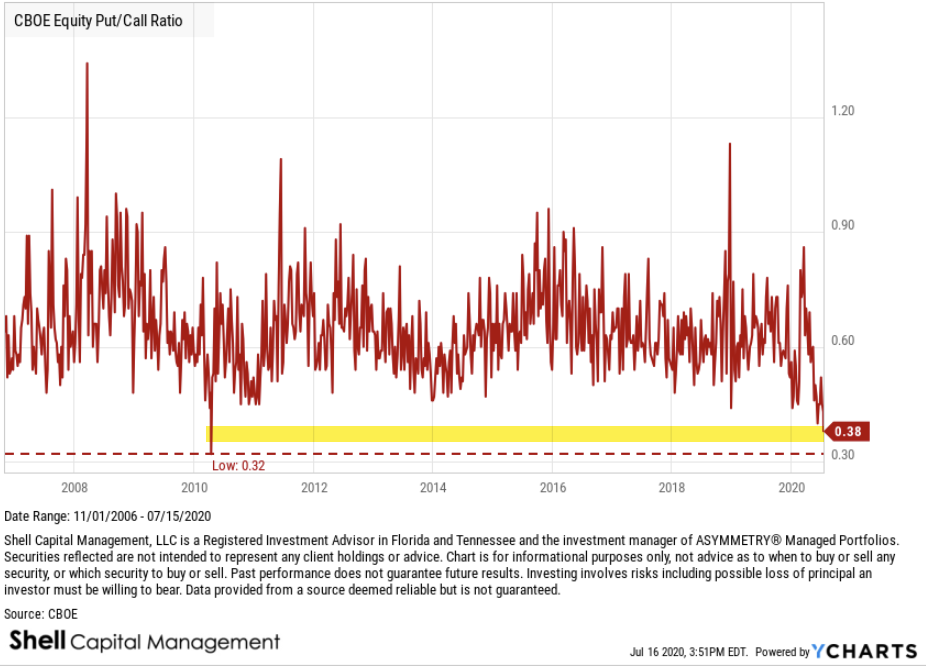

2) Yes, indeed, the CBOE Equity Put/Call Ratio reaching an extremely low level. In fact, it's as low as it has ever been going back to 2006.

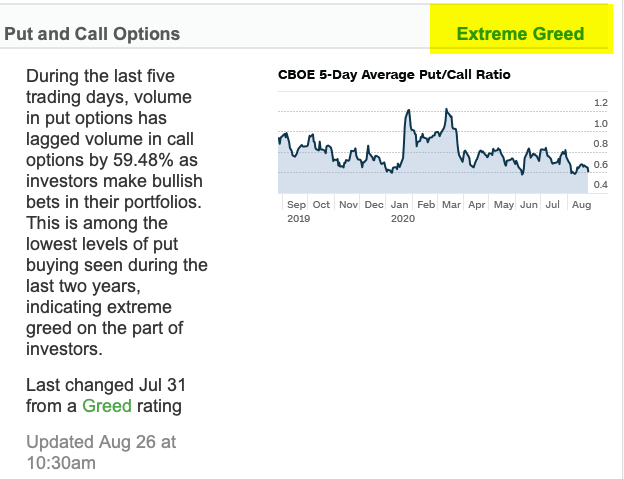

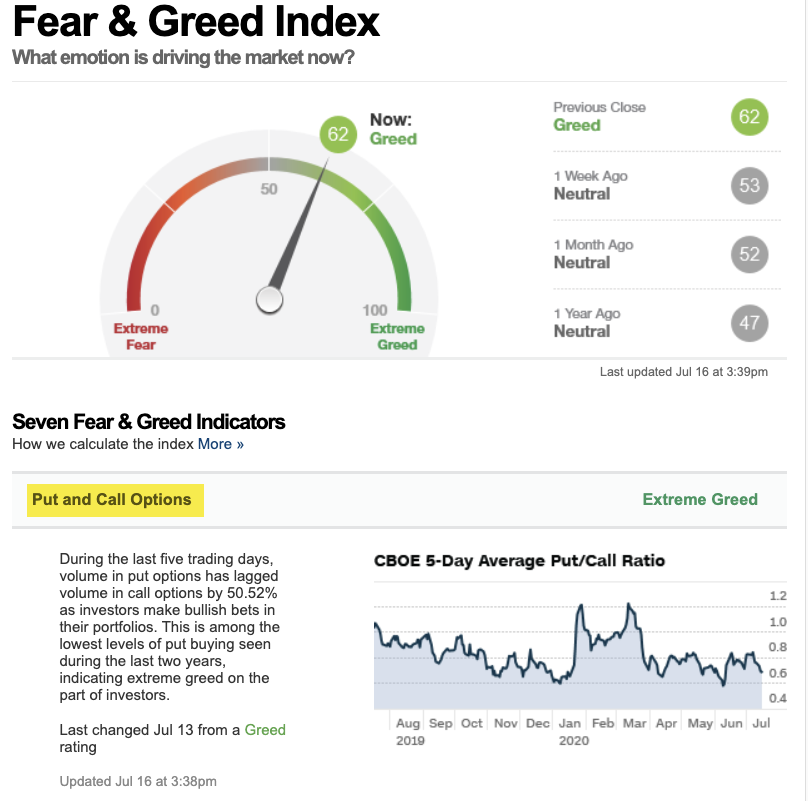

3) Normally, we consider such a low level to be an example of extreme complacency and GREED DRIVING THE MARKET. For example, the CBOE Equity Put/Call Ratio is the first of seven indicators used in the Fear & Greed Index.

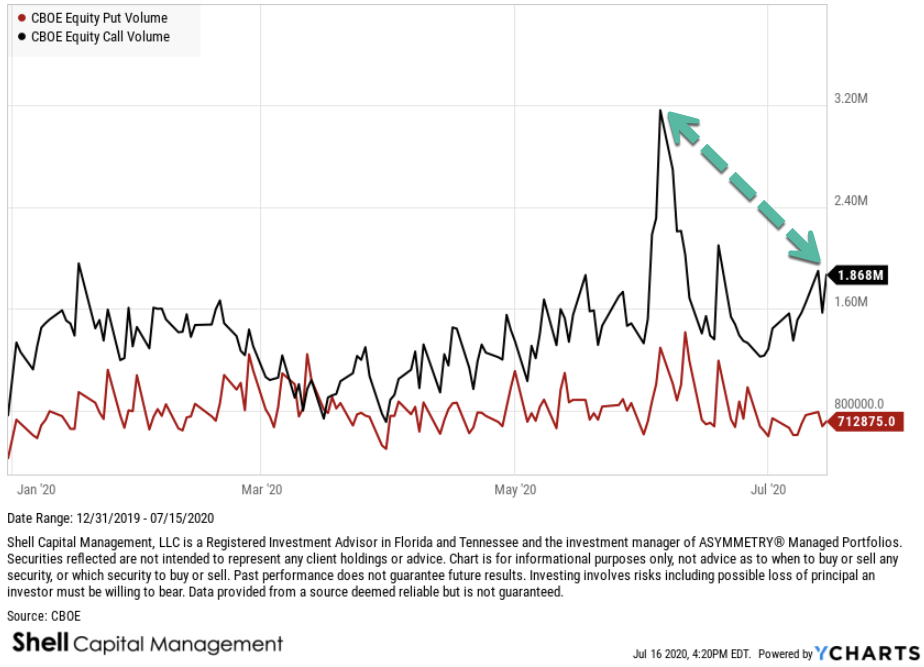

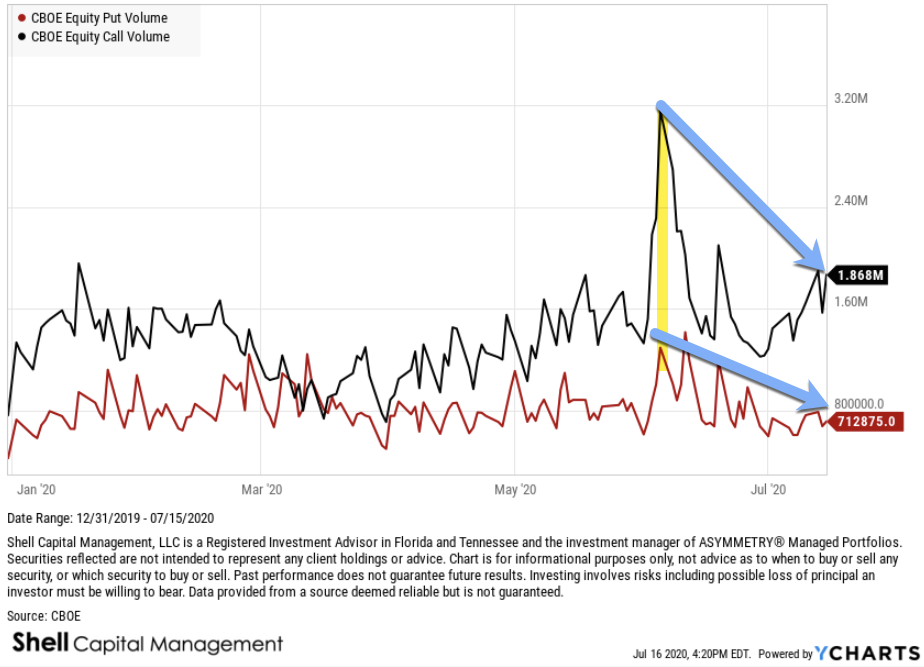

4) When the ratio is trending down and at a low level, it's because equity Call option volume is greater than the equity Put option volume. When there's more trading volume in equity calls, we assume options traders buying speculative calls, so they are bullish. VERY bullish now.

5) When the market is so one-sidedly bullish, it's a contrarian indicator suggesting over-enthusiasm. That is, we assume the calls are mostly speculative positions and puts are defensive, so the demand is on the long side. It's an imperfect assumption, but I generally agree.

6) I pointed out a similar extreme read out early June, when Call Volume spiked up to a historically high level. Indeed, the stock market had a -6% down day afterward. This time is a little different, and the chart shows why. Call volume isn't nearly as high, relatively speaking.

7) Call volume isn't as high as it was in June, but put volume is also lower. So, the ratio is at the same low level at 0.38, but the absolute volume is different. It's still probably an indication of enthusiasm and complacency, but it may not have the delta it had last time.

and if you liked this one, you'll love the next:

https://twitter.com/MikeWShell/status/1283871872287936513

@SoberLook ☝🏼

• • •

Missing some Tweet in this thread? You can try to

force a refresh