Paper: dropbox.com/s/ibavoq0pvr8p…

Slides: dropbox.com/s/007niykbznui…

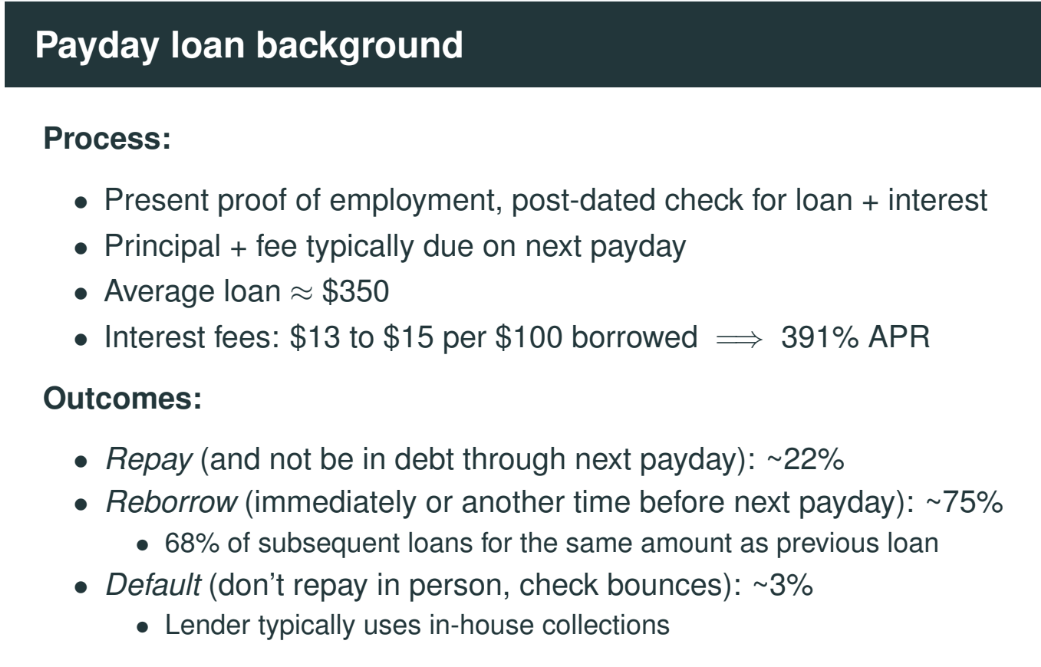

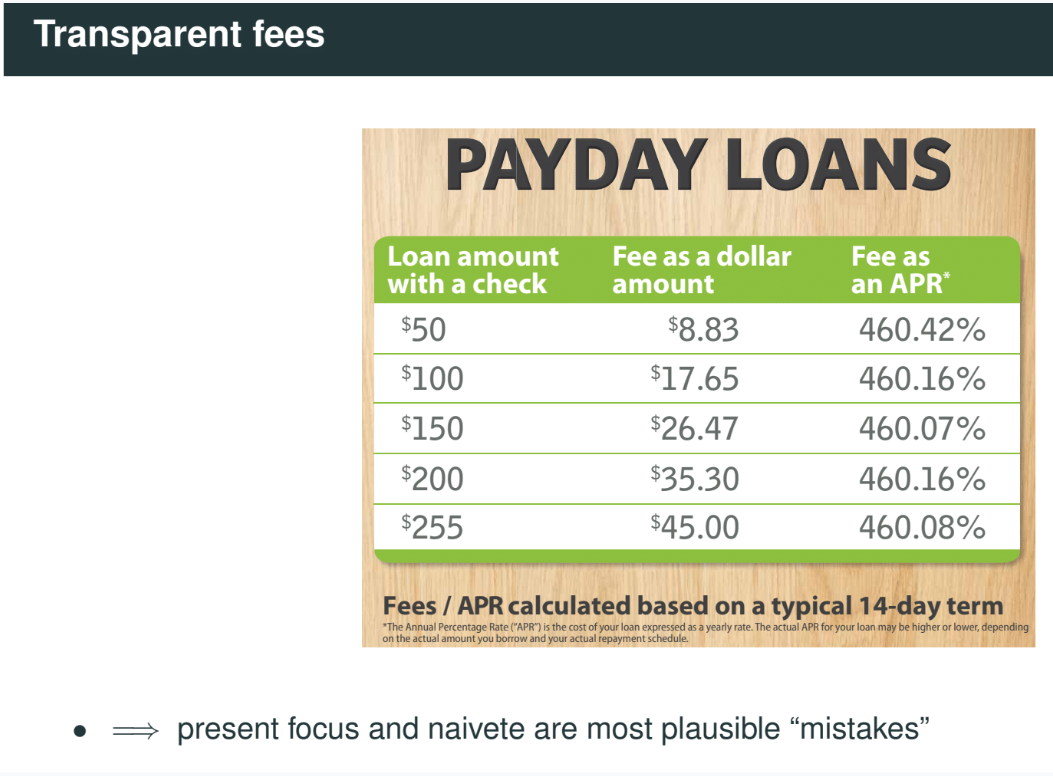

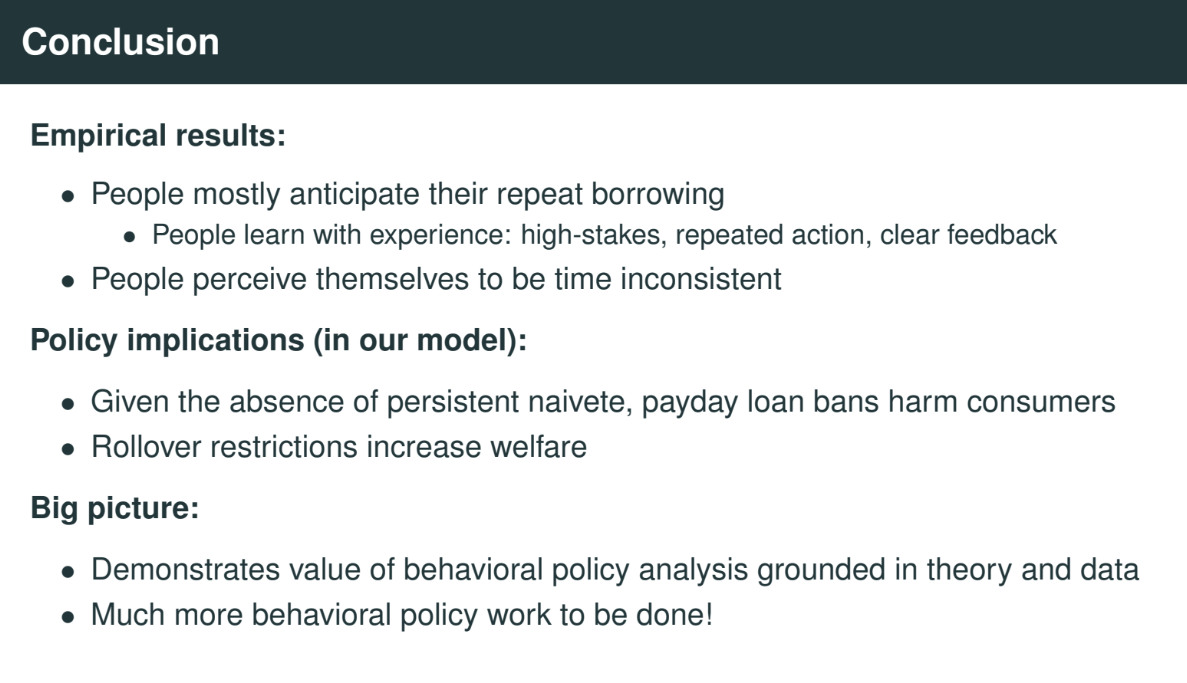

Many policies motivated by concerns that consumers don’t act in their own best interest or are “exploited” by firms

Must develop tools for:

• Measurement of alleged mistakes

• Behavioral welfare evaluation of proposed policies

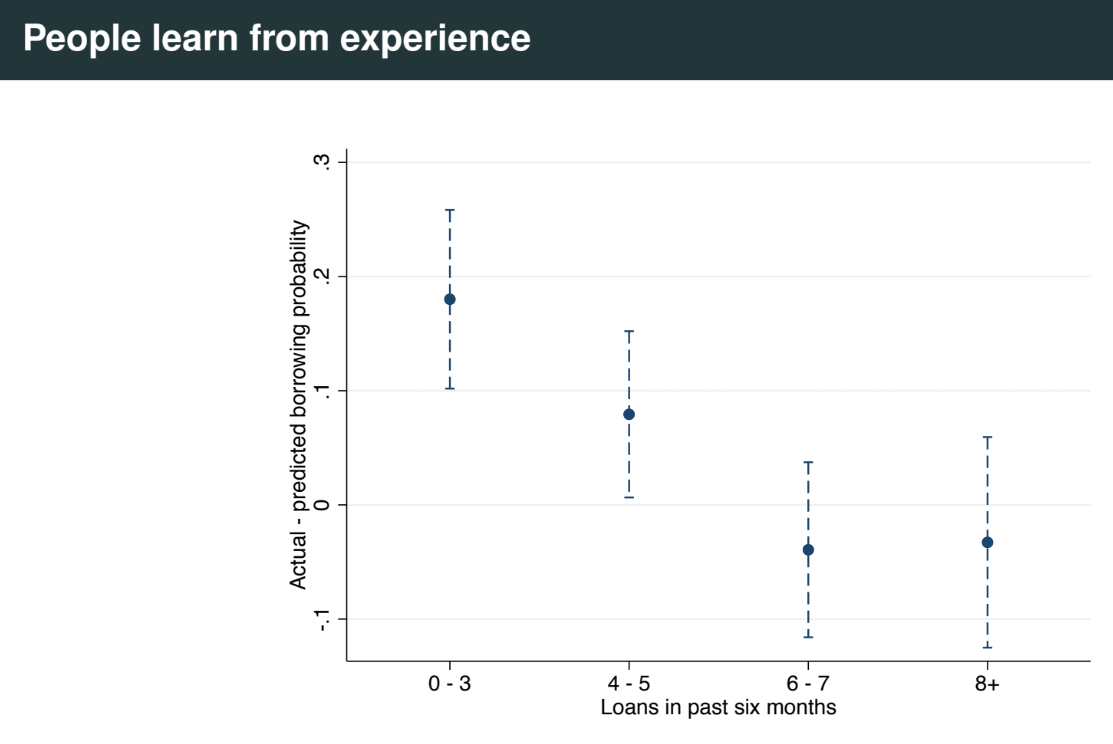

1. Do people anticipate repeat borrowing?

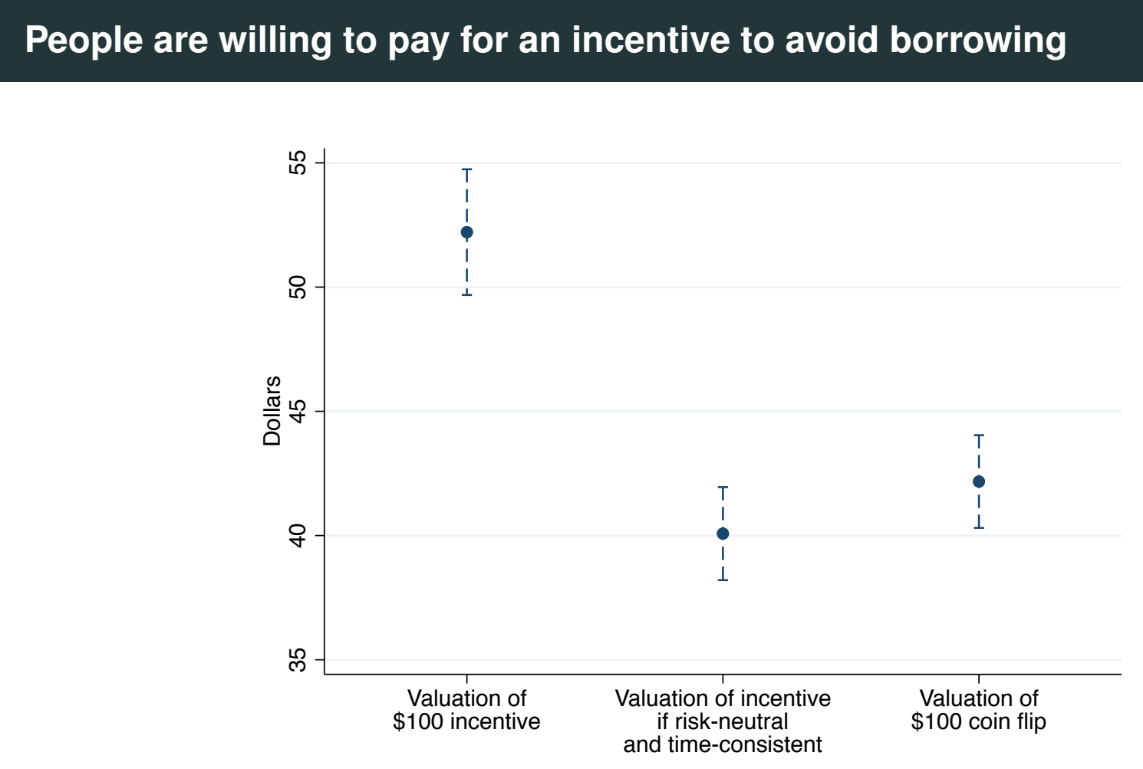

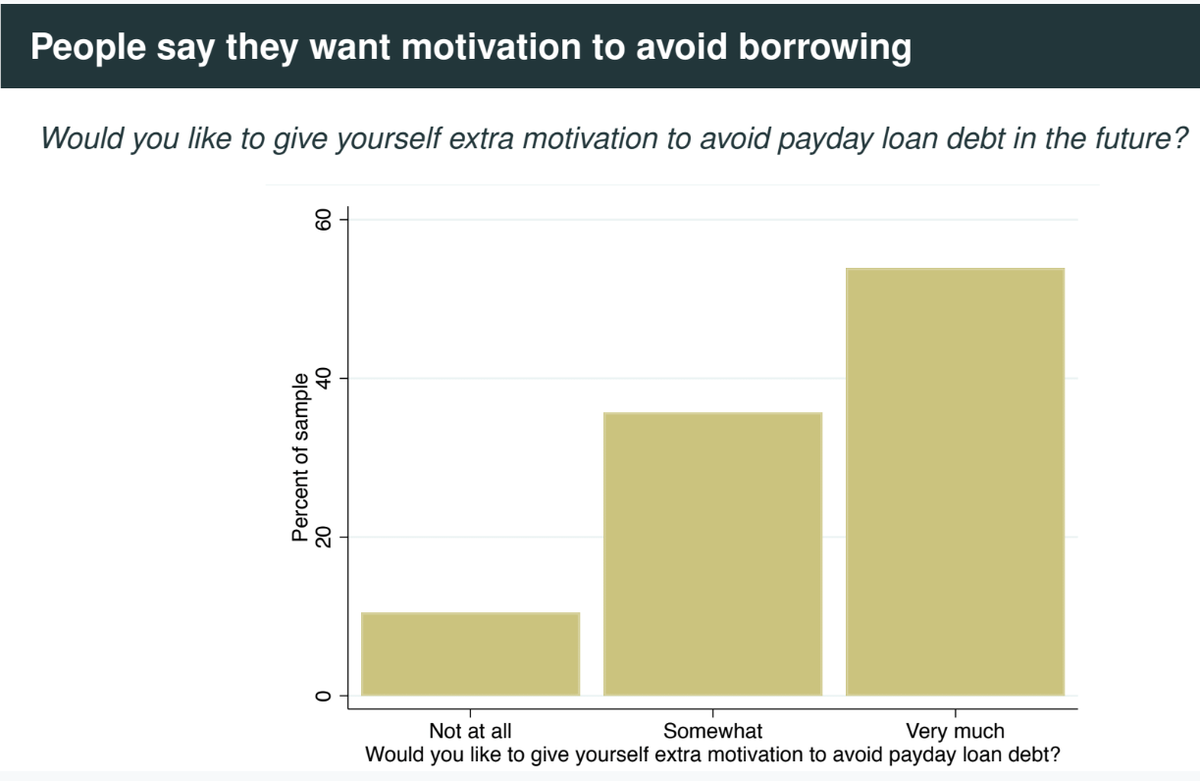

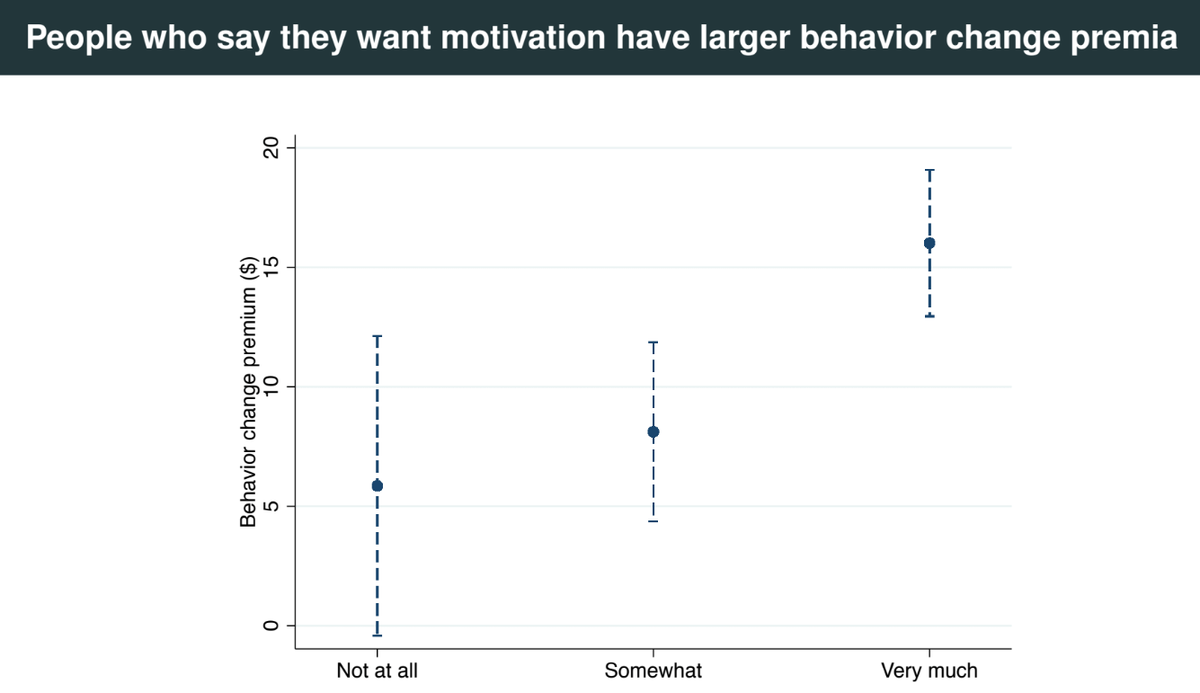

2. Do people want an incentive to avoid avoid future borrowing? (⇒ perceived time inconsistency)

3. How risk averse are people?

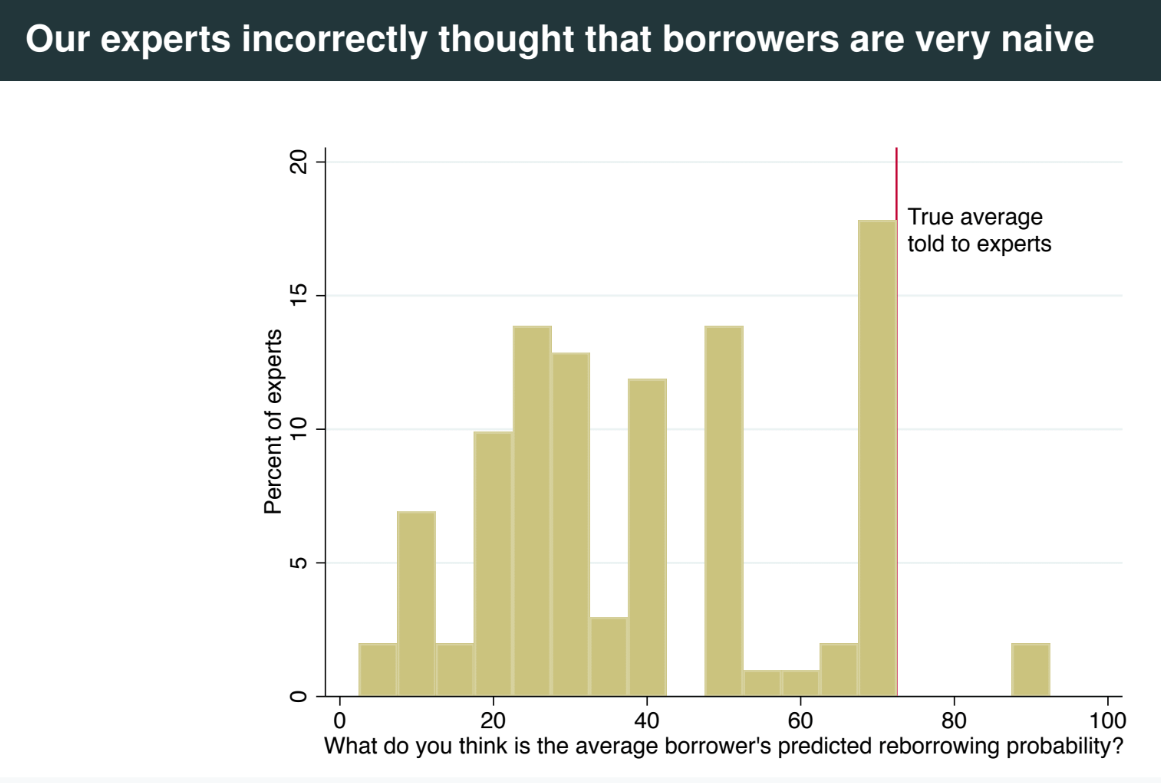

(most inexperienced quartile of borrowers [#pt] with worst prediction, was off by 18%-pnts, would be 52% in this figure)

(The behavior change premium on average was $12 see #pt)

(~37% don't want legal rollover restrictions, 35% neutral, 30% do want legal restrictions)

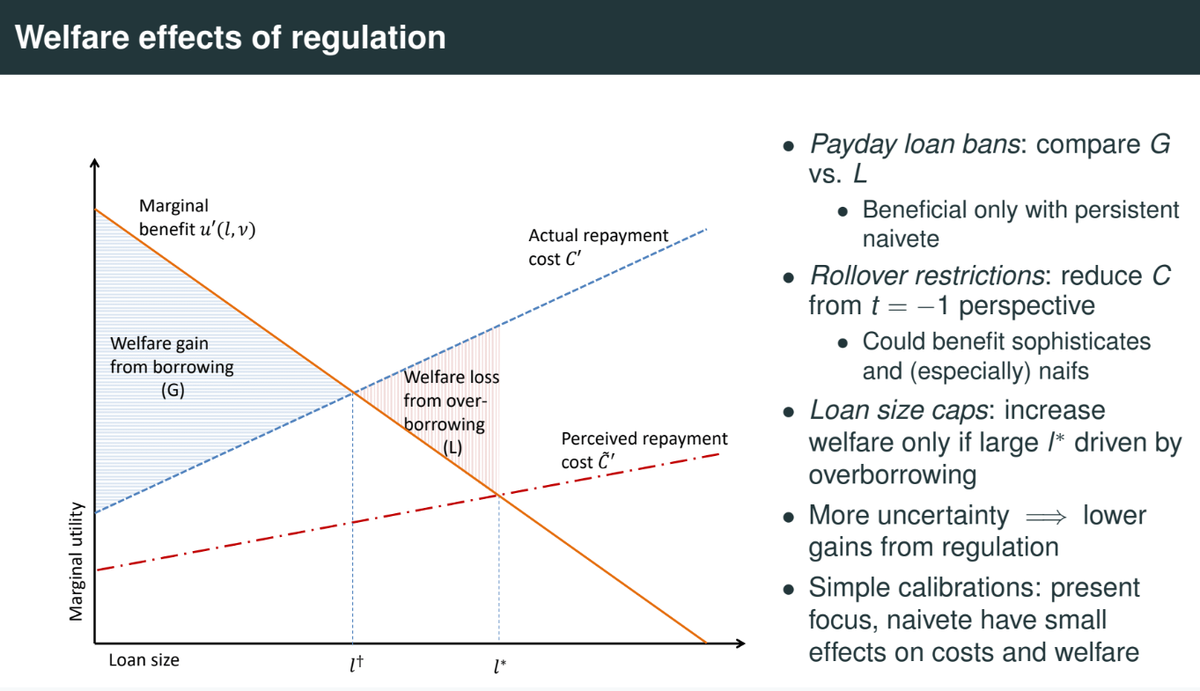

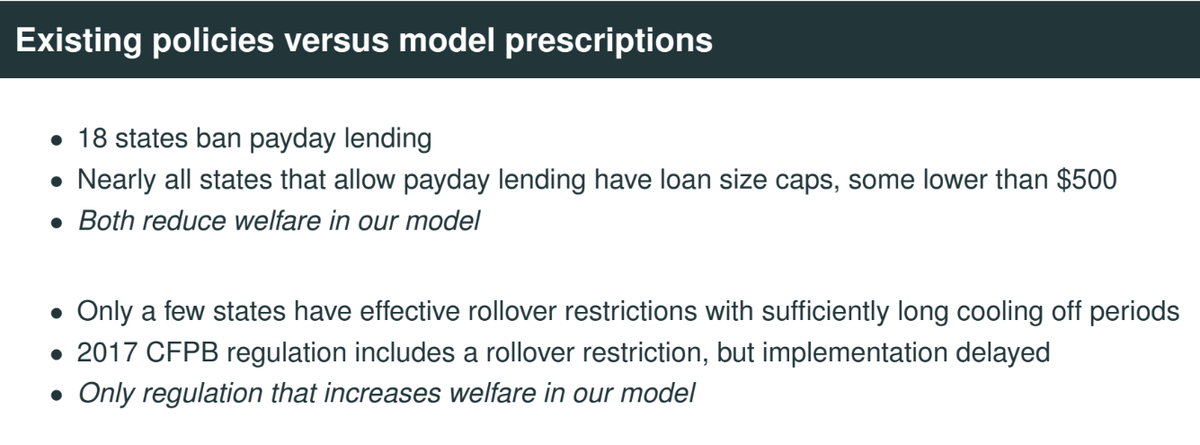

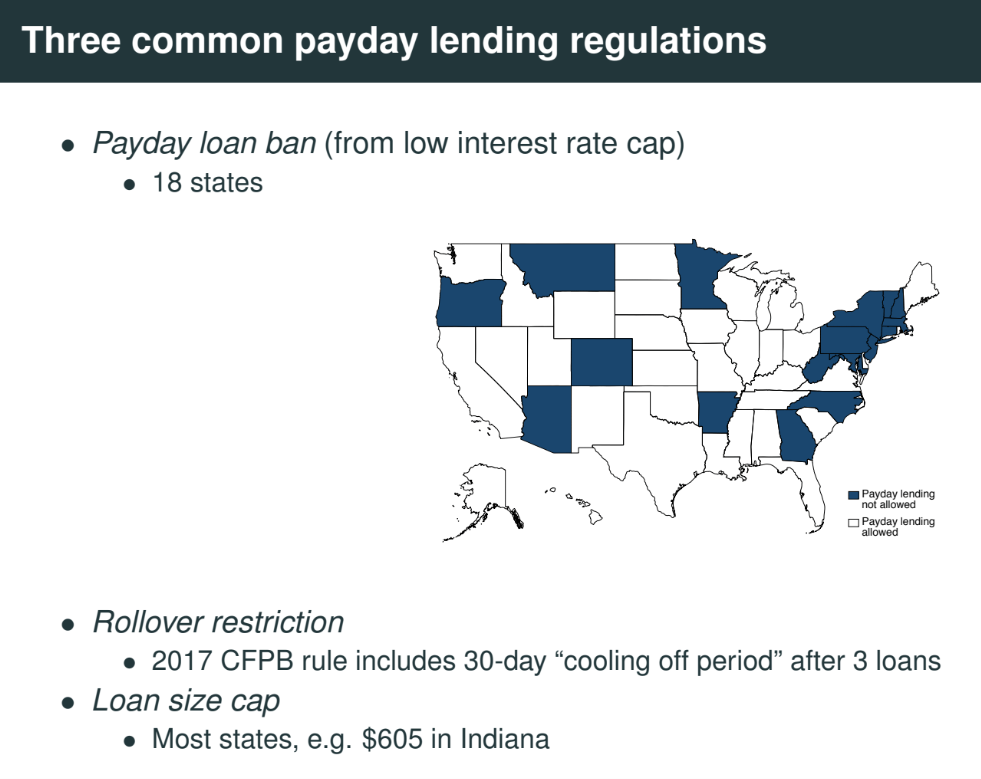

Three common payday lending regulations

1⃣ Payday loan ban (from low interest rate cap) (also in Netherlands, cap =14% APR; afm.nl/nl-nl/professi…)

2⃣ Rollover restriction

3⃣ Loan size cap

Instead of eliminating all high cost borrowing it just forces people to go to an even higher interest rate source of high cost borrowing"