**Wealth Creation**

What majority of Indians do with their savings?

Small Savings: Cash, FD/RD, LIC, VPF, Cheat Funds (Chit*) & Beesi*

Thread 👇

What majority of Indians do with their savings?

Small Savings: Cash, FD/RD, LIC, VPF, Cheat Funds (Chit*) & Beesi*

Thread 👇

2) Big Savings: 2nd Flat, Land, Chit, Co- Op Banks, Invest in Relative/Friend’s Business, stash cash in bank locker/ home.

Sometime greed pushes them to invest in Multi-Level Marketing (Ponzi Schemes). Most of the time, the investors are victim of the ‘Fraud’ or mere returns.

Sometime greed pushes them to invest in Multi-Level Marketing (Ponzi Schemes). Most of the time, the investors are victim of the ‘Fraud’ or mere returns.

3) How about investing in legit businesses & create *Wealth*. Let’s understand what constitutes Asset Classes. 👇

4) Asset Allocation refers to investing the savings in different legit asset classes: 💰💰

1.Equity

2.Debt

3.Gold

4.Real Estate

5.Farming

6.Cash

7.Bitcoin (Now)

👇

1.Equity

2.Debt

3.Gold

4.Real Estate

5.Farming

6.Cash

7.Bitcoin (Now)

👇

5) Start Investment journey at very young age, continue till we achieve financial freedom. Discipline savings & investment does help to achieve financial independence early or late 40’s.

Fin Independence is not Amway - MLM. Fin Ind is ~Time is yours not your employer's

👇

Fin Independence is not Amway - MLM. Fin Ind is ~Time is yours not your employer's

👇

6) Ensure the below before journey:

1.Term Insurance (not LIC’s Life Insurance)

2.Medical Insurance (Outside your work)

3.Emergency Fund

4.May be own House (if you are strong enough to withstand Social Stigma, better to stay in a rented house)

👇

1.Term Insurance (not LIC’s Life Insurance)

2.Medical Insurance (Outside your work)

3.Emergency Fund

4.May be own House (if you are strong enough to withstand Social Stigma, better to stay in a rented house)

👇

7) What should be the allocation percentage, asset class definition, age etc? There are plenty of content available in public domain. Please Read. 📜

8) While its extremely imp to spread the risk by investing in different asset classes to hedge your portfolio in the scenarios like ~Depression, Pandemic, Political Crises etc

Not to forget, the above such situation is also an platform to create a big “Wealth” in next 10-12 yrs

Not to forget, the above such situation is also an platform to create a big “Wealth” in next 10-12 yrs

9) Let me talk about one of the low penetrated asset class in India ~ “EQUITY”

What is Equity?

For standard definition & explanation, just Google it. For me, investing in Equity is an opportunity to partner with successful businesses.

👇

What is Equity?

For standard definition & explanation, just Google it. For me, investing in Equity is an opportunity to partner with successful businesses.

👇

10) How the math works: If in a growing sector a best stock should give a conservative CAGR of 15-20%.

Let’s assume, you partner with a growing & ethical business by investing:

Lumpsum: 2.5 Lac

Add Monthly: 10,000

Add Inflation: 5%

......

Let’s assume, you partner with a growing & ethical business by investing:

Lumpsum: 2.5 Lac

Add Monthly: 10,000

Add Inflation: 5%

......

11) ......

Now, let’s see what will happen after 15 years @ 15% CAGR: Rs 1,08,94,936.46 (1 Crore & above)

(dividends not added)

and that’s the ~ Power of Compounding

Here is one ~

Now, let’s see what will happen after 15 years @ 15% CAGR: Rs 1,08,94,936.46 (1 Crore & above)

(dividends not added)

and that’s the ~ Power of Compounding

Here is one ~

https://twitter.com/Kiran24Rajput/status/1284132865203032066?s=20

12) How I should invest in Equities? If an individual ready to put efforts during weekends, after office hrs understand the economy, sectors, Capital Cycles & fundamentals invest directly in stocks.

👇

👇

13) If you don’t understand these concepts, simply invest in few good Multicap Mutual Funds. The compounding math still remains the same.

👇

👇

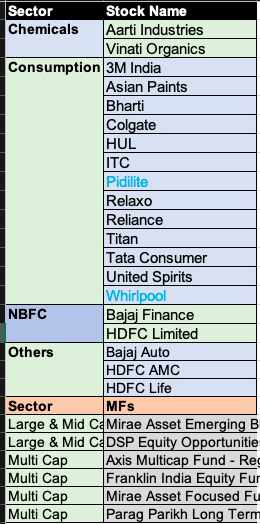

14) Few List of stocks & MFs identified for education purpose only not investment recommendation:

Sector, Stock & MFs:

Sector, Stock & MFs:

@threadreaderapp Unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh