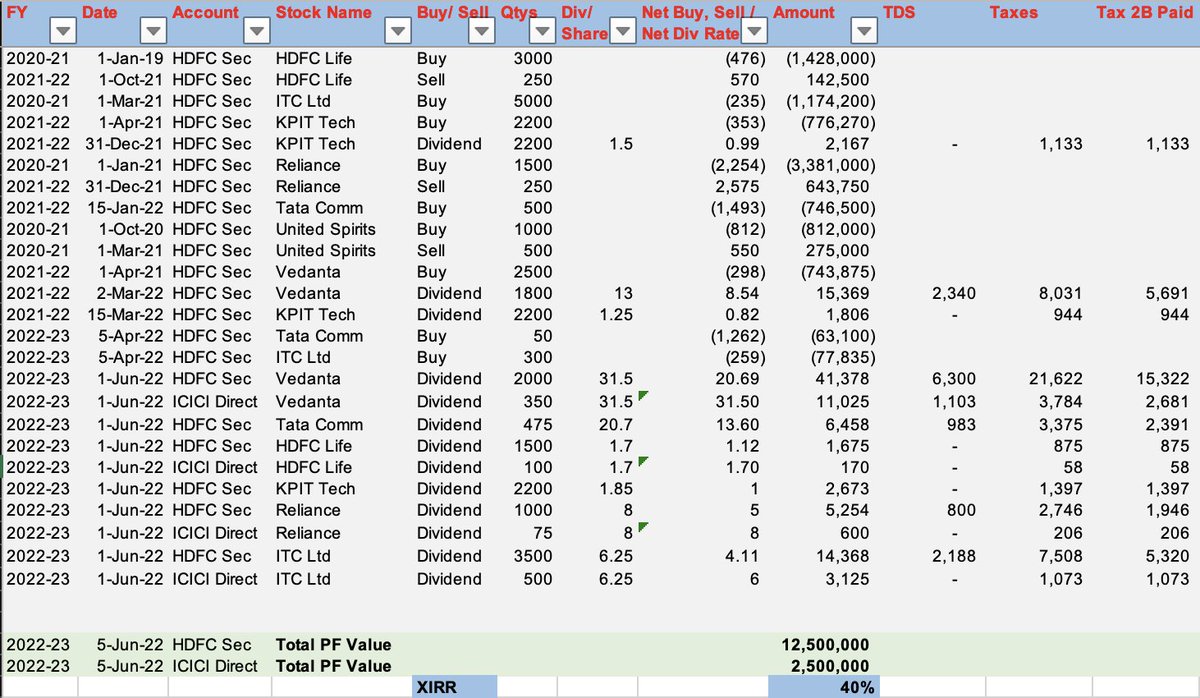

Individual Investor | Bullish on 🇮🇳 | Enjoying Wealth Creation Journey My views are personal not recommendations.

++ a Fitness Enthusiast🙂

9 subscribers

How to get URL link on X (Twitter) App

DSP Value Fund top 15 holdings👇

DSP Value Fund top 15 holdings👇

ET Link:

ET Link:

Enterprises

Enterprises

1. Mega 🧵 on 'Wealth-Creation through Asset Allocation'⇟⇟

1. Mega 🧵 on 'Wealth-Creation through Asset Allocation'⇟⇟https://twitter.com/Kiran24Rajput/status/1492517120122699779?s=20&t=q0BE3P_UZsg_cLLWSINS6w

2. Prerequisites

2. Prerequisites

2

2

There are 2,500 Mutual Funds.

There are 2,500 Mutual Funds.

⓸ IRCTC is one of the most visited websites of India and is maintained and developed by Centre for Railway Information Systems (CRIS)

⓸ IRCTC is one of the most visited websites of India and is maintained and developed by Centre for Railway Information Systems (CRIS)