But KYB hasn't seen the same innovations. Infact, KYB in banking and FinTech has gotten more onerous over the past 10 years.

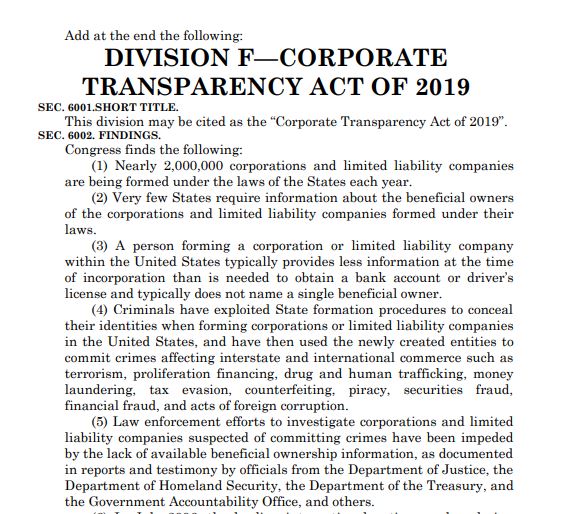

The issue? We did nothing to identify beneficial owners of private businesses.

en.wikipedia.org/wiki/Panama_Pa…

(bet @iankar_ thought I was going to slip and write FinTechs)

It really depends on a few things.

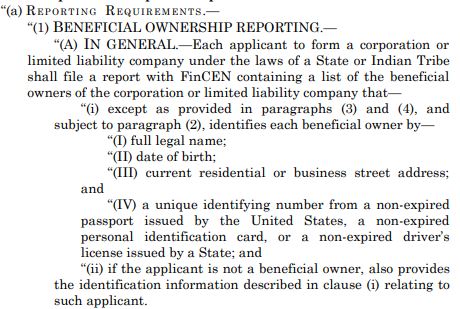

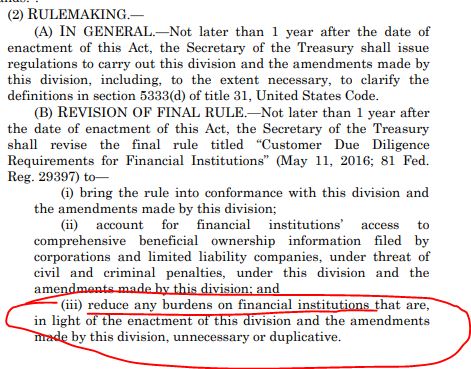

Can the data be accessed in real time to satisfy KYC? Will it have an API? What does the "consent" from the customer look like?

But a fast, real-time, non-rate-limited solution that banks can ping to get data? That could shut out bad actors.

Looking at EWS, probably not.