Payments stuff at Modern Treasury. Former Stripe, Square, Lithic, Cap One. Views are mine, and not my company's.

How to get URL link on X (Twitter) App

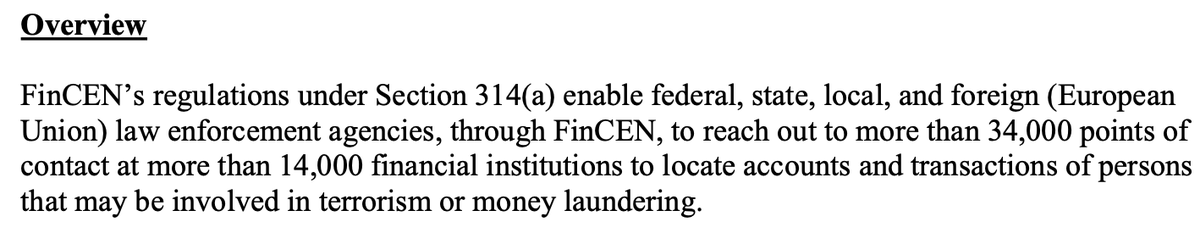

https://twitter.com/regulatorynerd/status/18157710916522764122/ First — there is undeniably tightening in the community bank and fintech sponsor banking space. I have heard solid rumblings that regulators have poked sponsors and told them to slim down the number of programs they have in order to better focus existing staff.

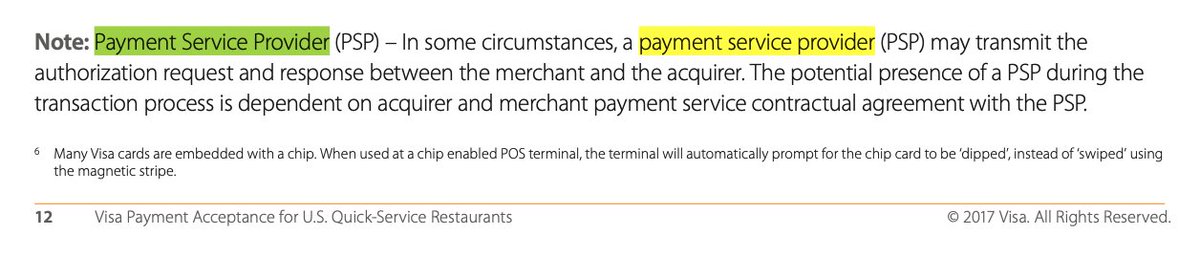

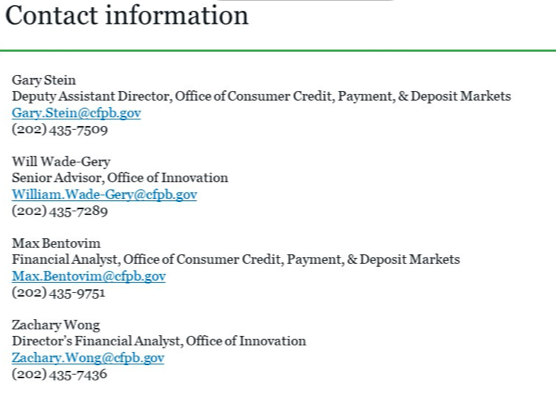

https://twitter.com/matthewstoller/status/17012226166509408462/ Currently there's some sticking points in TILA and Reg Z that make innovating in charge cards or secured cards difficult. But first, let's recap a few industry practices in the card industry.

https://twitter.com/mikulaja/status/16856385062808657922/ First, as a technical matter, I am going to discuss publicly available information. You can find everything in this thread by looking at various company terms, going on LinkedIn or pulling on general market knowledge about these types of operations.

https://twitter.com/CaitlinLong_/status/16266613716087193622/ I'm skeptical on crypto as an asset, and tend to agree with @TBakerBroadmoor about how the current product usage smacks of gambling.

2/ but first, have you heard about non-tech Giant privacy.com?

2/ but first, have you heard about non-tech Giant privacy.com?

The Square team is super sharp, so I assume they negotiated for an exclusive ABA routing number for the checking account product. This + a contractual right to move the ABA BIN would allow them to migrate the ABA routing number without having to reissue checks.

The Square team is super sharp, so I assume they negotiated for an exclusive ABA routing number for the checking account product. This + a contractual right to move the ABA BIN would allow them to migrate the ABA routing number without having to reissue checks.

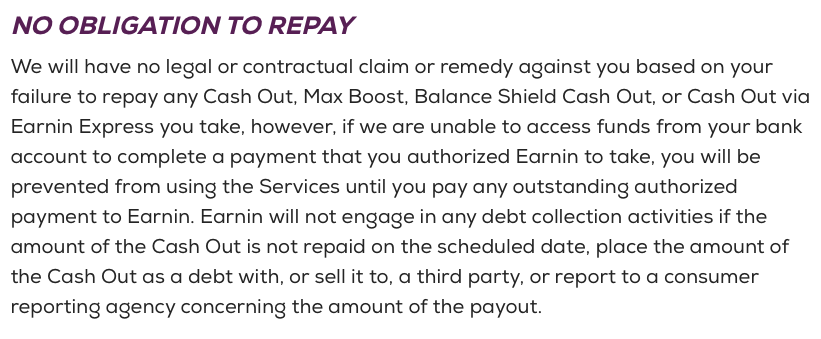

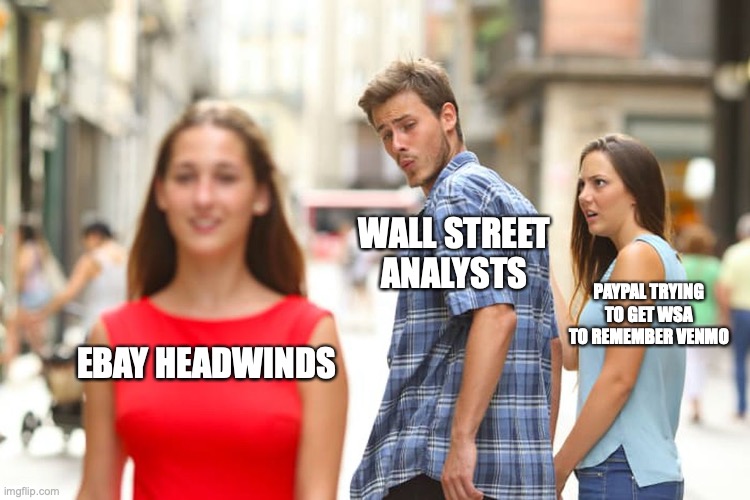

https://twitter.com/ohadsamet/status/13443609069023518722/ First some background. Synchrony Financial, who issues the Venmo credit card, was issued an approval order for a novel credit card product.

https://twitter.com/homsit/status/1343620045398798336This isn’t to say that in-house counsel need to enable law breaking or non-compliance. It’s about navigating the grey.

https://twitter.com/AlexH_Johnson/status/12987160625910087692/ First a brief detour --