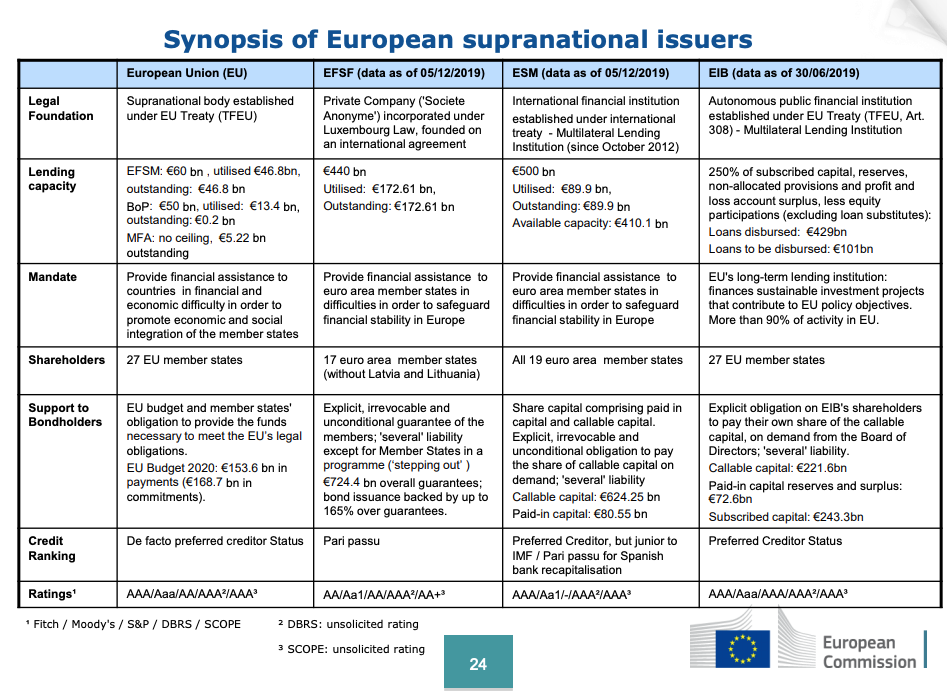

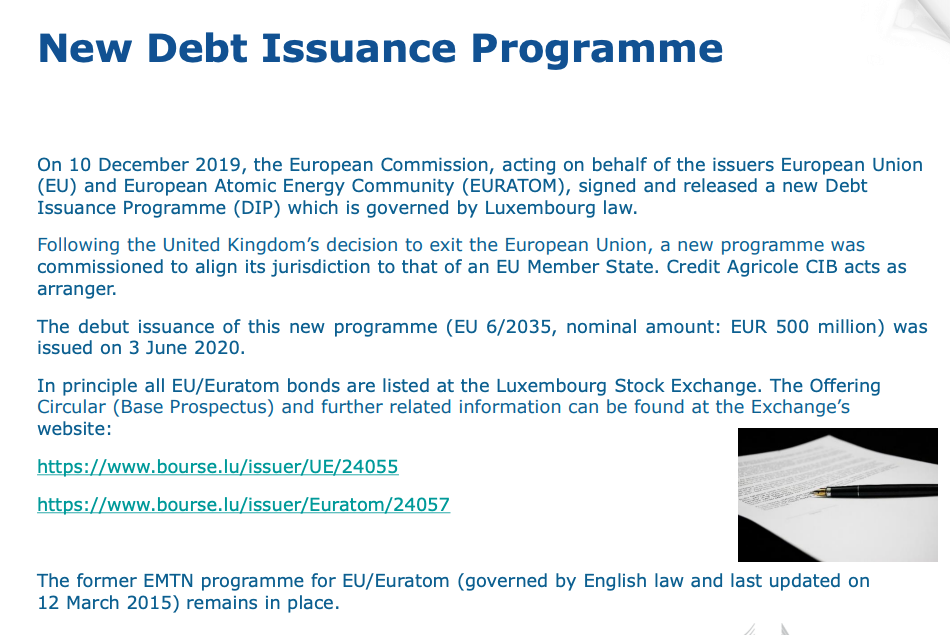

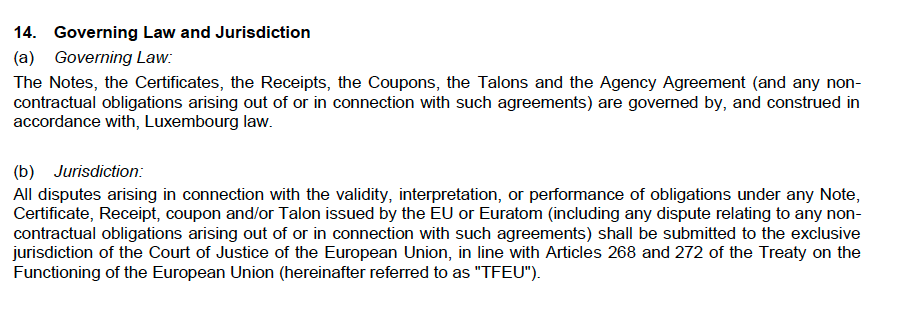

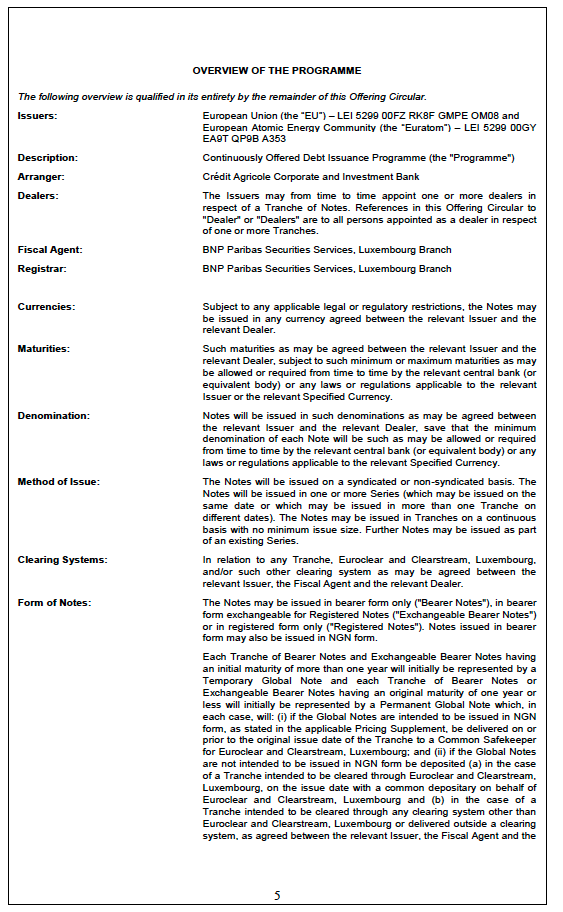

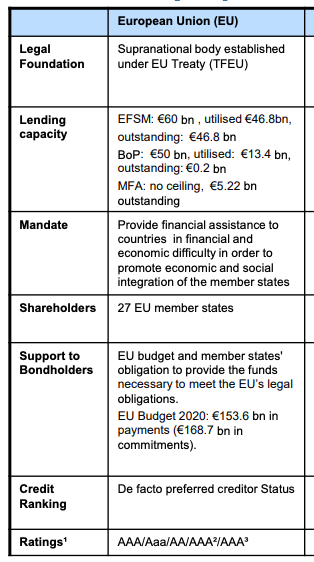

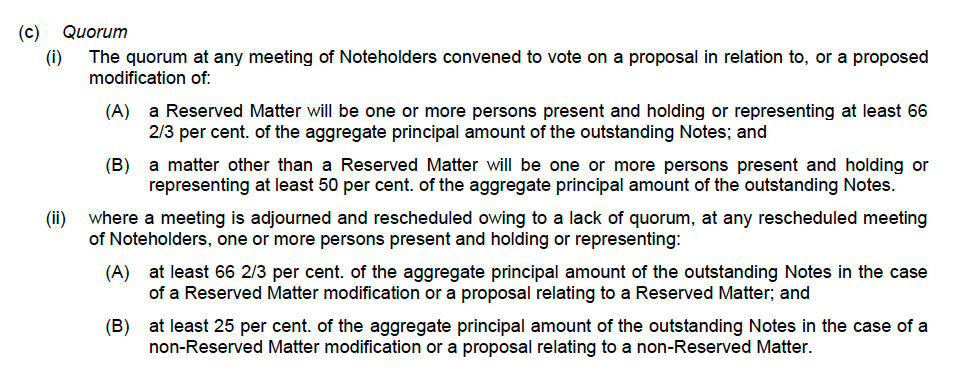

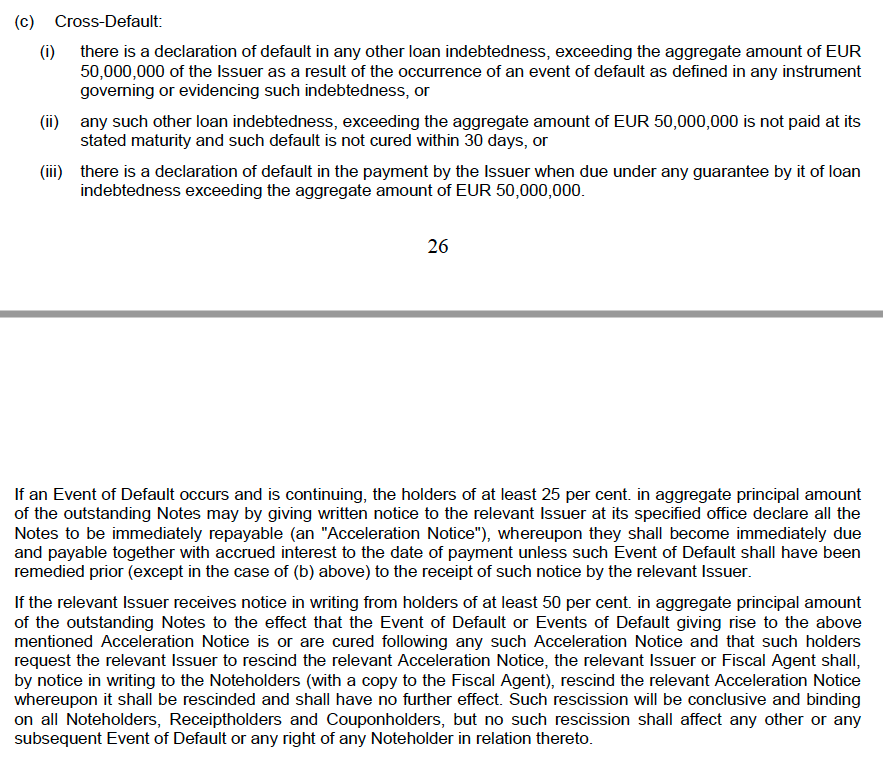

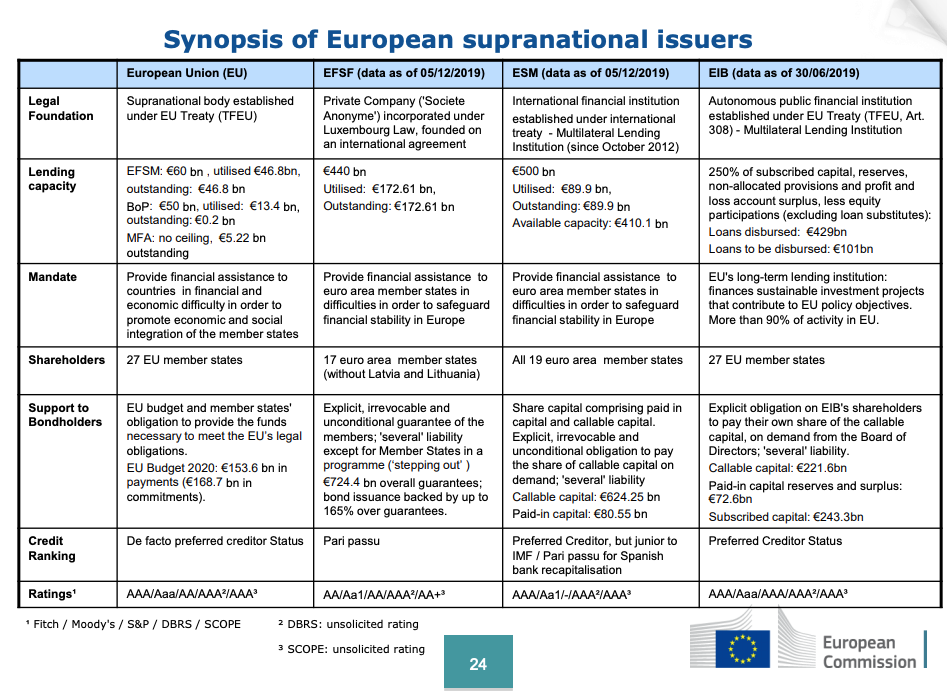

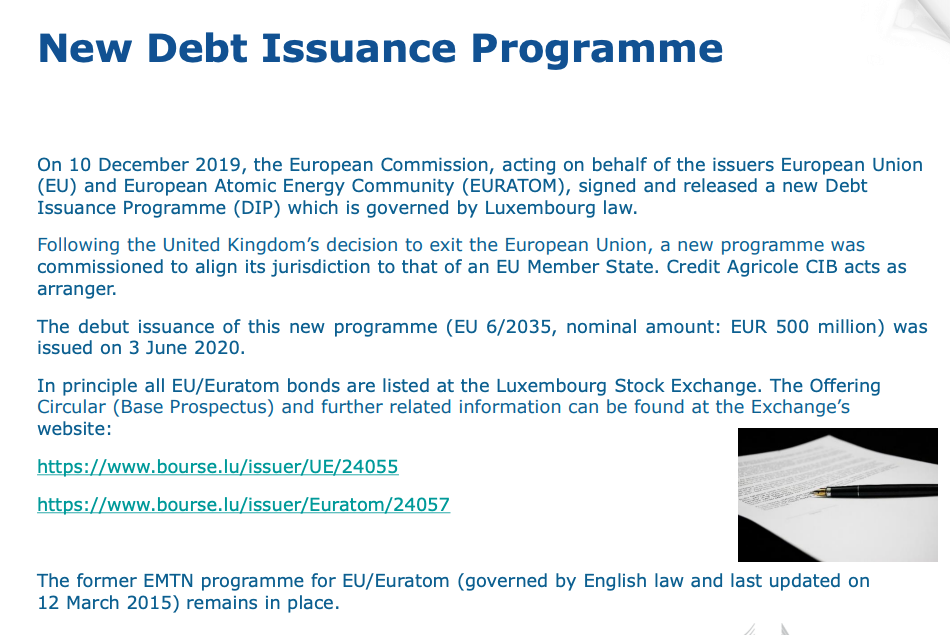

But what type of debt instruments will the EU (via the @EU_Commission) actually issue?

Let's take a closer look. A (longer) thread. 1/x

ft.com/content/da0f71…

Keep Current with Sebastian Grund

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!