Legal Counsel at @IMFNews. Fmr. lawyer @ecb, @FulbrightPrgrm Scholar, LL.M. @Harvard_Law, PhD @univienna. All views are my own.

How to get URL link on X (Twitter) App

https://twitter.com/GeneralTheorist/status/1289296037753102338?s=202/x

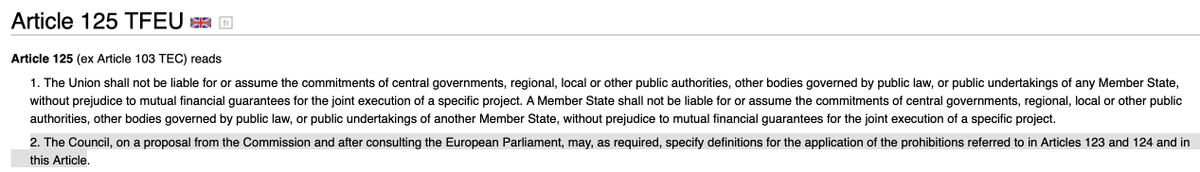

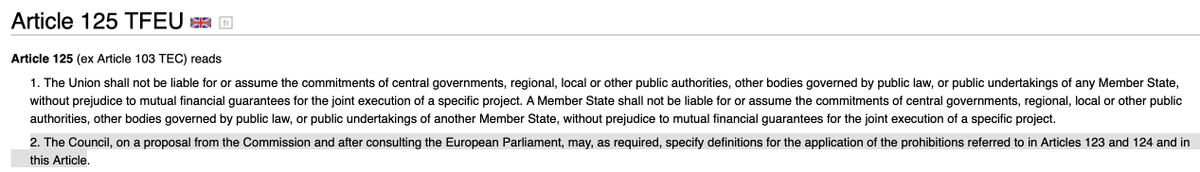

The Council has indeed "specified" the meaning of Art. 123 TFEU in Council Regulation (EC) No 3603/93 (in December 1993). But this essentially means that the definition of the monetary financing prohibition rests on a Regulation that is 27 years old: eur-lex.europa.eu/legal-content/… 2/x

The Council has indeed "specified" the meaning of Art. 123 TFEU in Council Regulation (EC) No 3603/93 (in December 1993). But this essentially means that the definition of the monetary financing prohibition rests on a Regulation that is 27 years old: eur-lex.europa.eu/legal-content/… 2/x

- To recall, +90% of 🇬🇷 sovereign debt was governed by DOMESTIC law, allowing 🇬🇷 to retroactively change the terms of the bonds.

- To recall, +90% of 🇬🇷 sovereign debt was governed by DOMESTIC law, allowing 🇬🇷 to retroactively change the terms of the bonds.

https://twitter.com/dan_azzi/status/1265690621911728128First, 🇱🇧 - like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which 🇱🇧 will restructure its debt should not be forgotten and the pandemic could give 🇱🇧 a stronger hand in negotiations. 2/x

https://twitter.com/GrundSebastian/status/1264772752977862658- Majority of experts recommended #Bundestag to exercise restraint and consider ECB Annual Report/regular hearings/MEP letters @Europarl_EN the appropriate channel to discharge accountability

https://twitter.com/BeckerFriedman/status/1250478737038114818The Corona Credit Facility (CCF) would have preferred creditor status through the @WorldBank - i.e. it would be repaid ahead of private investors. On that basis, the CCF could make concessional loans to recipient countries without a huge credit risk for the @WorldBank. 2/x

https://twitter.com/DelorsBerlin/status/1242866034232754177(i) The PEPP is within the @ECB's mandate, as it seeks to repair monetary policy channels that were affected by the #Covid_19 pandemic. The @EUCourtPress confirmed in Gauweiler "that a programme to safeguard the appropriate transmission of monetary policy is likely to 2/10

https://twitter.com/AzarsTweets/status/12210453818338631682/ According to the Luxembourg Stock Exchange, Lebanon has 27 series of Eurobonds outstanding, all of which are governed by New York law and denominated in USD: bourse.lu/programme/Prog…. The fact that the bonds are governed by NY law is critical for their restructuring.