For a detailed version visit:

fundsindia.com/blog/mf-resear…

It all starts with the simple question:

Is this the time to buy Gilt Funds?

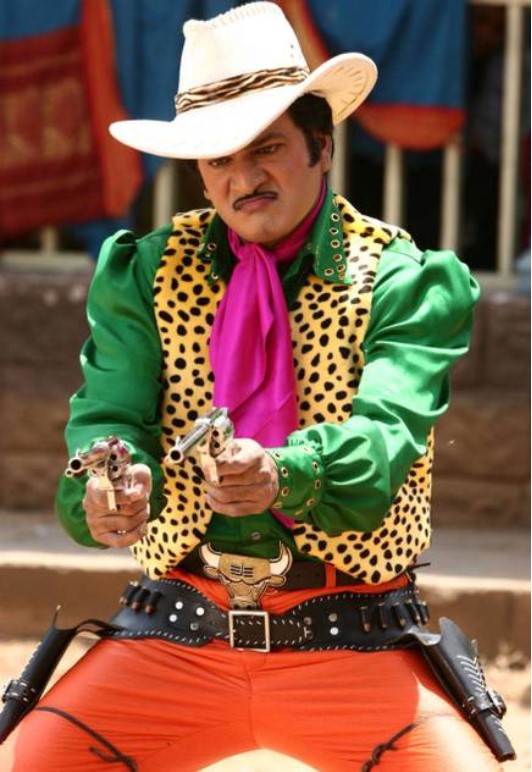

Let us find the answer using different vantage points from 6 eccentric folks..

For a detailed version visit:

fundsindia.com/blog/mf-resear…

It all starts with the simple question:

Is this the time to buy Gilt Funds?

Let us find the answer using different vantage points from 6 eccentric folks..

Reaction 2: A lot of credit risk funds have given poor returns in the last 1-2 years.

FT recently has closed 6 of its credit risk oriented funds!

Conclusion:

I guess it is better to stay away from credit risk and stick to safe high credit quality debt funds.

Wow! Great SAFETY & Great RETURNS - Let me buy Gilt funds..

This is a perspective that most of us have..but hang on.. let us check the other perspectives as well..

What will be my future returns?

1 Year Returns = Net YTM + NAV changes due interest rate movement*

NAV changes due interest rate movement = (-1) (Modified Duration) * (Change in yields)

He has 4 questions:

Q1: Do past returns predict future returns in Gilt funds

Gilt funds - wider range of return outcomes - Usually above average returns are followed by below average returns which is mostly a reflection of interest rate movements.

Low Global Interest Rates

RBI may absorb Fiscal deficit funding

Higher spreads

Now that we heard these 6 different view points, how do we wrap our heads around these..

Final View:

Gilt funds Charachteristics

1) No Credit Risk

2) But interest rate risk is high

3) Need to time interest rate cycle - easier said than done - Several factors affect interest rate cycle

4)Taxation Constraints for tactically moving out

Not a big fan of the category due to:

The need to time interest rate cycle – even seasoned fund managers have got this wrong often

Higher volatility leading to inconsistent investor experience

Exiting before 3 years leads to higher short term taxation

For investors wanting to take a shot at higher returns via gilt funds, have a framework to exit the category as you see initial signs of the interest rate cycle turning. Worst case be prepared to hold it for a longer time frame (5-7 years) to even out the volatility.