-5th largest agrochem. company in the world (Mark. Cap: 34,699 Cr.)

-ROCE: 10.36 %

-ROE: 14.87 %

-D/E: 1.52

-Trading at a discounted price based on both P/S ratio (0.97) and Trailing P/E

@saketreddy @unseenvalue @caniravkaria @nid_rockz @ThetaVegaCap @DhanValue

-MF increased their holding last month

-Wider footprint and extensive product portfolio to drive growth

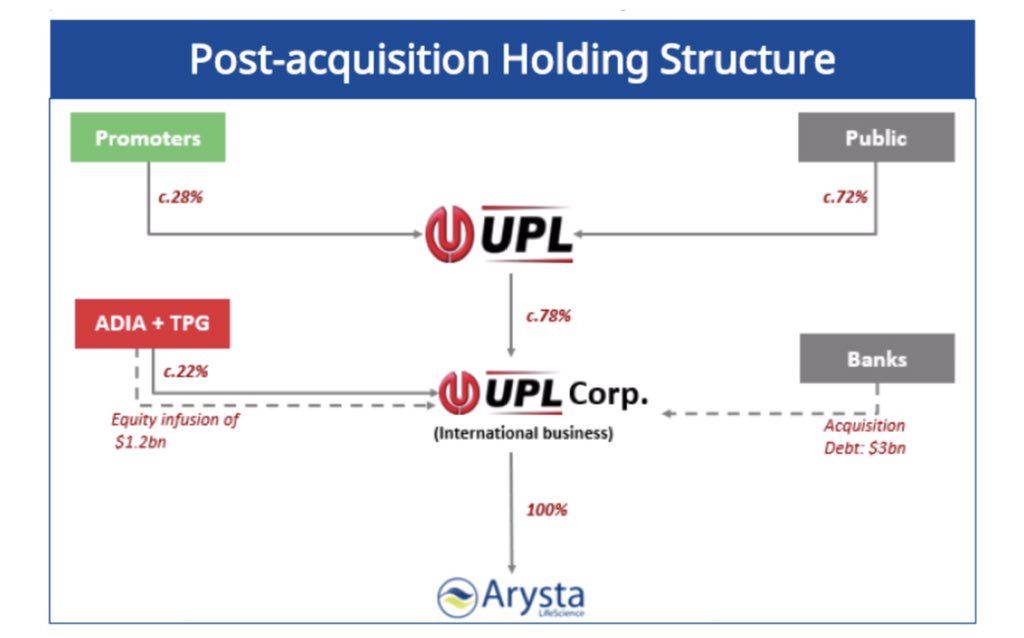

-Arysta merger synergies to improve margins

-Long term revenue based on the company’s robust R&D initiatives on several new products

#Macquarie

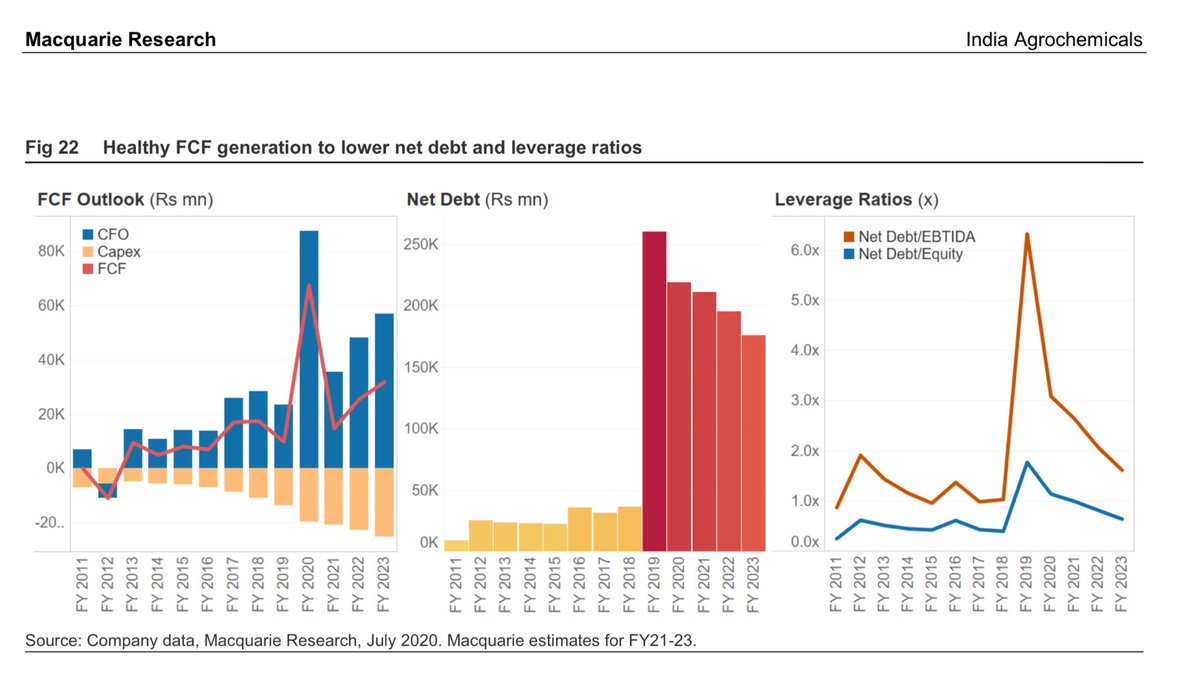

-UPL is expected to generate healthy cumulative FCF of Rs72bn over the next 3 years.

-Leverage to decline. Healthy FCF generation to support deleveraging for UPL.

300 crore * 70 ~ 21,000 crore.

@caniravkaria @Viral_ortho @saketreddy @nid_rockz @investor994 @Subrama76307360