•Started as a division of Asian Paints in 1980

•Leading producer of Synthetic Rubber & Synthetic Latex in India

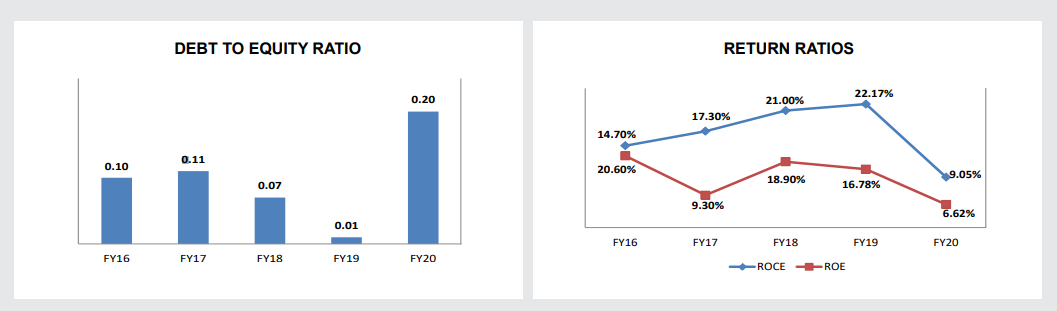

•FY19: Rev 626 Cr, EBITDA 676 Cr, PAT 47 Cr.

•Current Market Cap: Only 650 Cr

Read our notes on AR19-20 to know more

@finbloggers

Notes from MDA

•Global synthetic latex polymers market fragmented due to presence of many regional and a few global players

•Consolidation & customization is prevalent

•Globally, the carpet, gloves and construction industries drive the growth for synthetic latex

Notes from MDA

•In India, growth comes from end-use industries like paper & paper board, paints & coatings, adhesives, water proofing/construction, etc

•No major substitutes of synthetic latex polymers in their functional aspects across various application segments

Notes from MDA

•Mkt size for nitrile latex:1400 KT p.a. & valued at USD 1.32 billion in 2019.

•The market has been growing at a CAGR of 5.5% between 2010 & 2018.

•Projected to grow at about 8% CAGR by 2026

The Covid-19 pandemic has further boosted the demand

Notes from MDA

•Asia Pacific leads production of global synthetic rubber -autos lead the growth.

•Rise in population, large manufacturing base of auto industry & availability of competitive labour, India offers great opportunities.

Notes from MDA

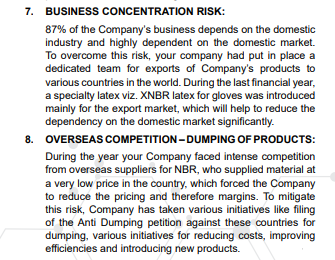

•80% of NBR is imported- Good potential for Indian manufacturers of Nitrile Rubber.

•Long-term growth of this segment can be attributed to the growing demand for NBR across the automotive and industrial applications in the medium to long term

Notes from MDA

•Major RMs are petro products.

•Vulnerable to crude prices

•Drop in Rev due to product mix & reduced net realization

•Intense overseas competition & slowdown in a few industries such as construction and auto, profits were impacted severely.

Notes from MDA

•Strong BS with 30 Cr Debt, reasonable WC cycle, Inv worth 62 Cr as on 31.03.2020

•Recipient of Total Productive Maintenance (TPM) Excellence in Consistent TPM Commitment Award for Taloja Plant

•In the process of implementing TPM in the Valia plant

Notes from MDA

•Outlook for FY21 due to COVID looks challenging

•Slowdown in demand plus intense dumping of NBR in India at very low prices is detrimental for the industry

•Approached the relevant authorities for the imposition of a revised anti-dumping duty on NBR.

Notes from MDA

•Sales from the new product for the hand gloves industry has started in FY20

•They aim to make it one of the future growth drivers.

•Intend to install new capacity for this

•Open for developing adjacent products organically & inorganic opportunities

Management does not disclose everything in AR.

If you are curious to know about the prospect of their new product Apcobuild, do check the last 6 concalls below:

smartsyncservices.com/apcotex-indust…

If you found value in this thread don’t forget to L & RT🙂

End