Monmouth has it 47% Trump, 47% Biden in Georgia: monmouth.edu/polling-instit…

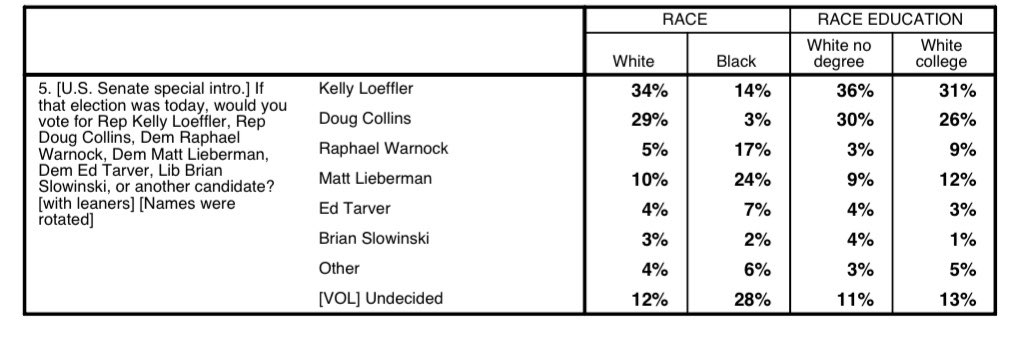

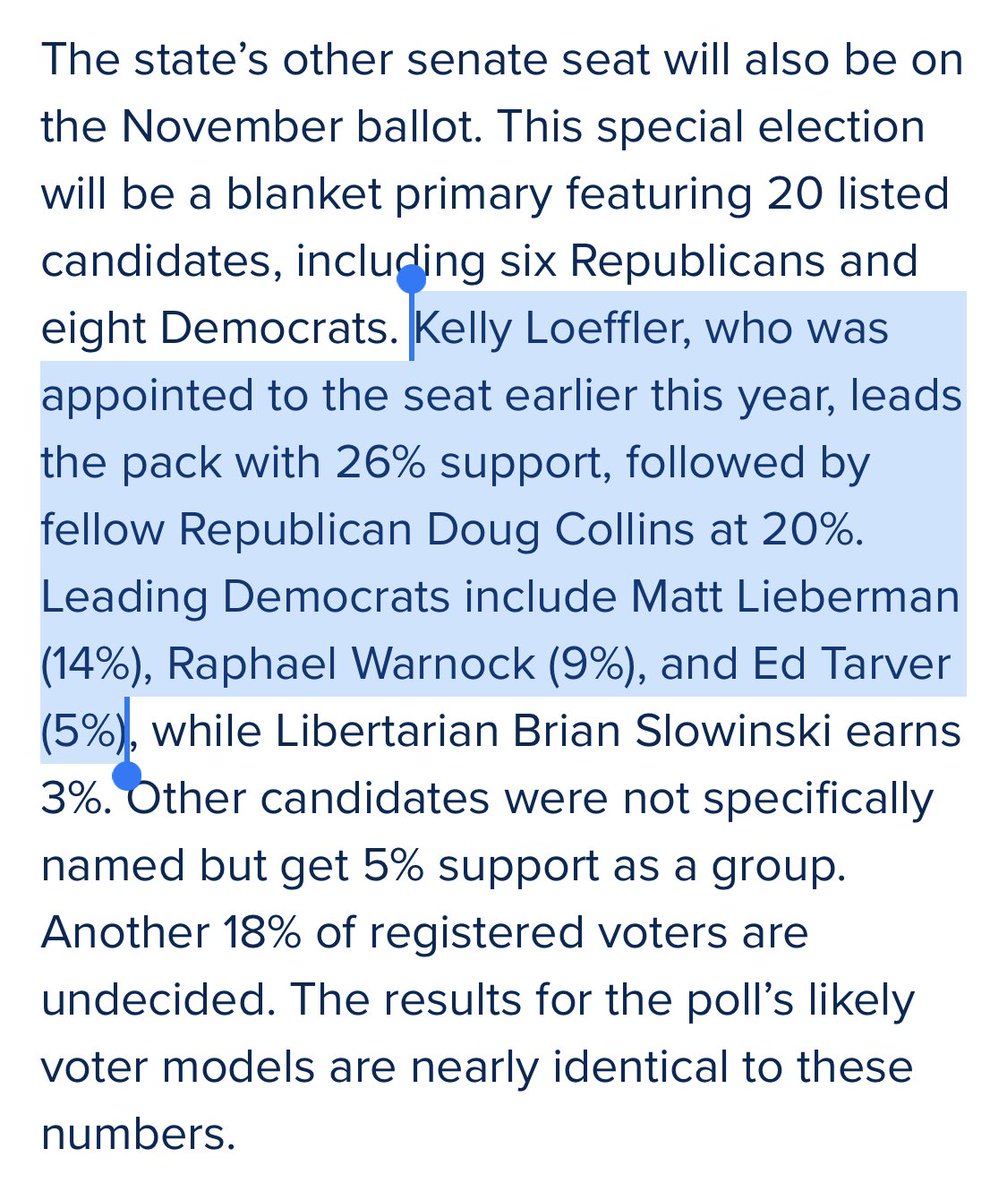

The results in the Senate special elections are interesting. They’ve got Loeffler ahead of Collins. And it remains puzzling why Raphael Warnock continues to have no traction among Dems despite being endorsed by everyone:

The two Georgia Dems who the voters have rallied around statewide over the past few years are Abrams and Ossoff. For whatever reason, Stacey Evans, Teresa Tomlinson, and so far Warnock haven’t. I think Lucy McBath and Jen Jordan would have succeeded but they passed on 2020.

If there’s a common thread it’s being able to connect both with black voters and with college-educated metro Atlanta white voters.

• • •

Missing some Tweet in this thread? You can try to

force a refresh