How to get URL link on X (Twitter) App

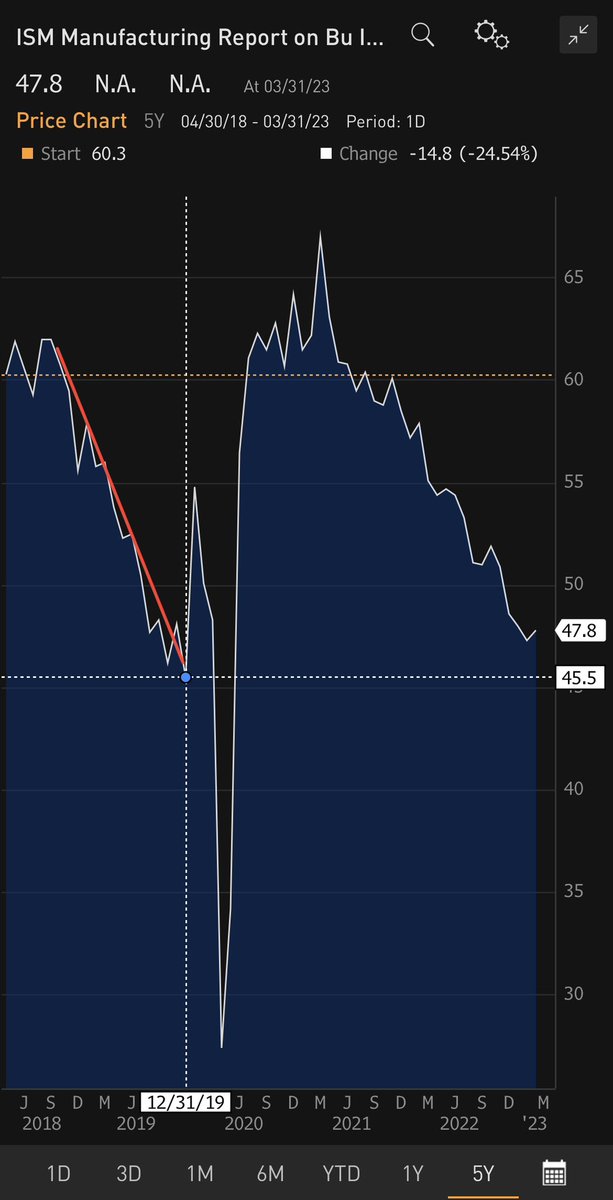

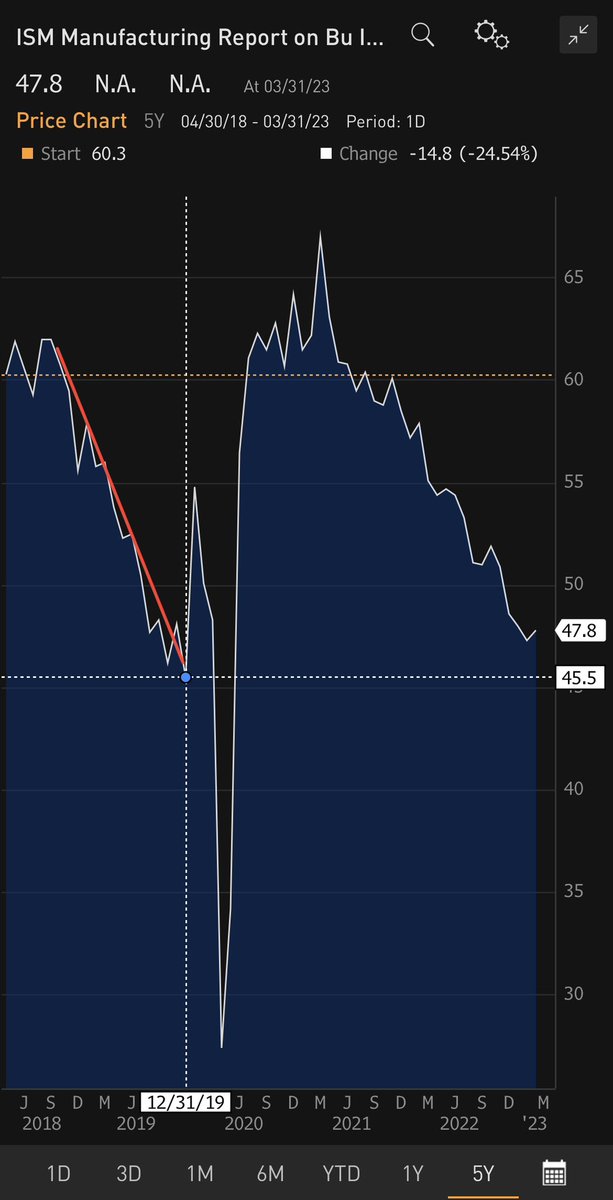

This is part of what made the March 2020 equity selloff so tough — we were at the start of a cyclical upturn. And obviously, we then got one a month later from stimulus and such, but it’s important in the context of thinking about typical recession risk dynamics.

This is part of what made the March 2020 equity selloff so tough — we were at the start of a cyclical upturn. And obviously, we then got one a month later from stimulus and such, but it’s important in the context of thinking about typical recession risk dynamics.

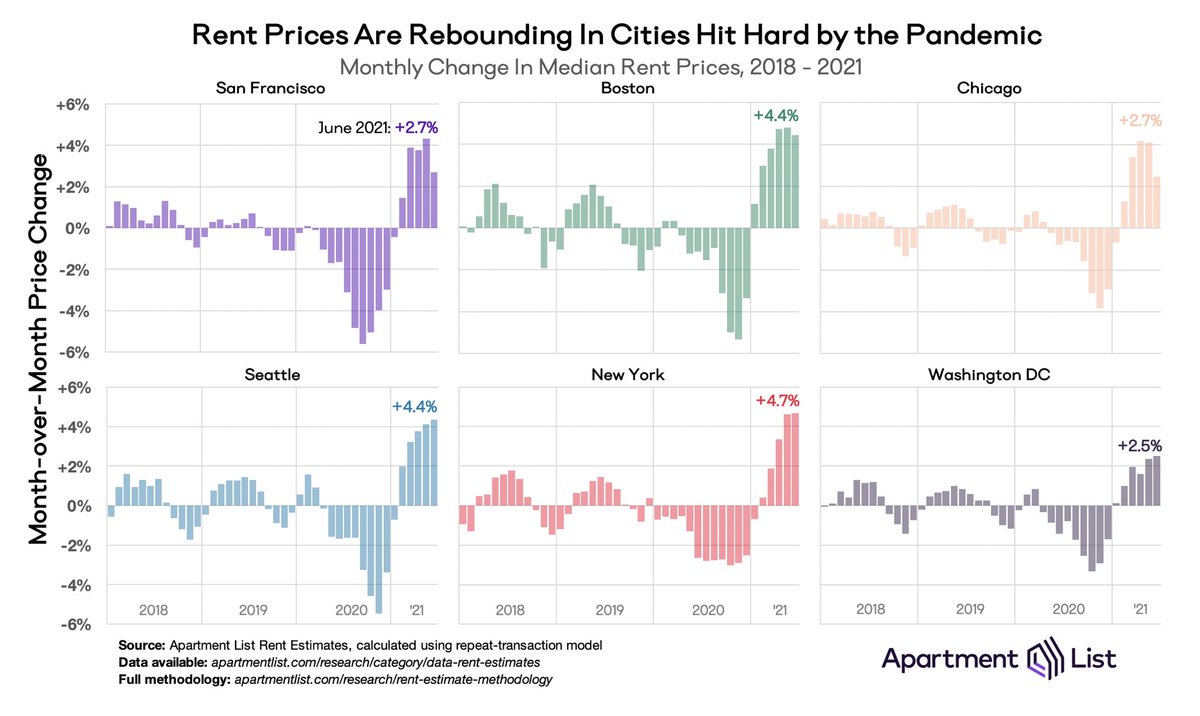

Between the move in rates, equities (and what both have done/will do to decision-making by key economic actors), plus supply chain healing, I think the inflation trajectory will be good enough in 6 months, it’s now just waiting for the data to confirm.

Between the move in rates, equities (and what both have done/will do to decision-making by key economic actors), plus supply chain healing, I think the inflation trajectory will be good enough in 6 months, it’s now just waiting for the data to confirm.

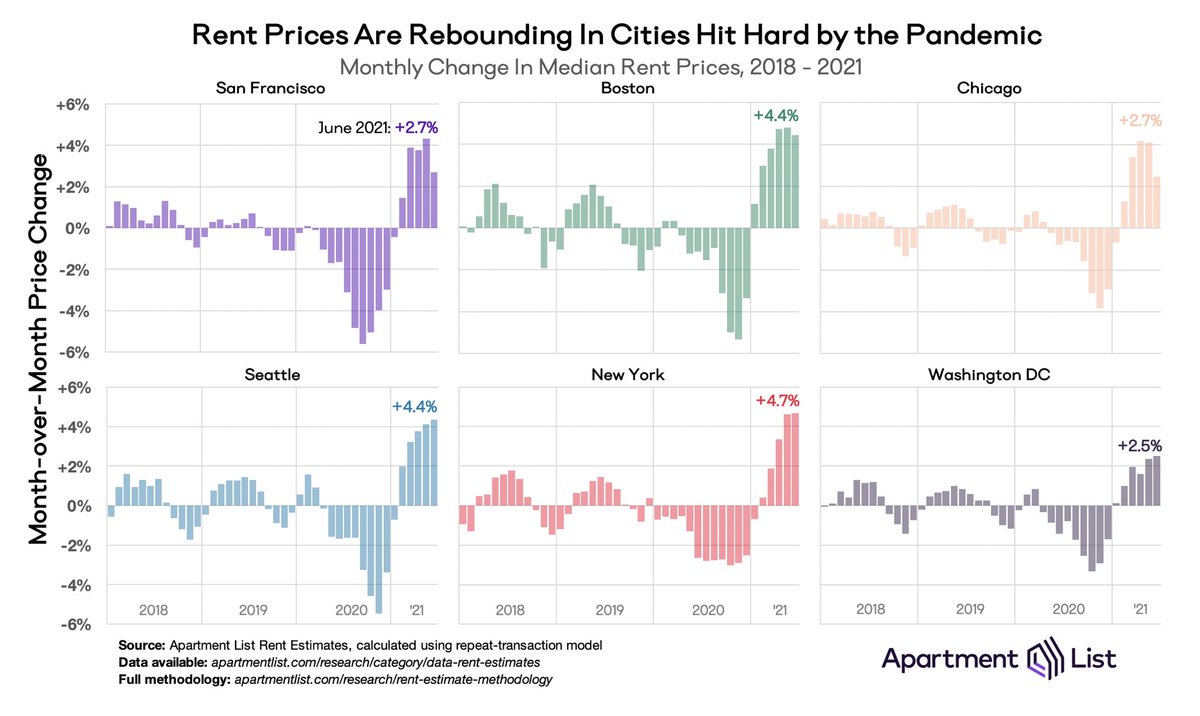

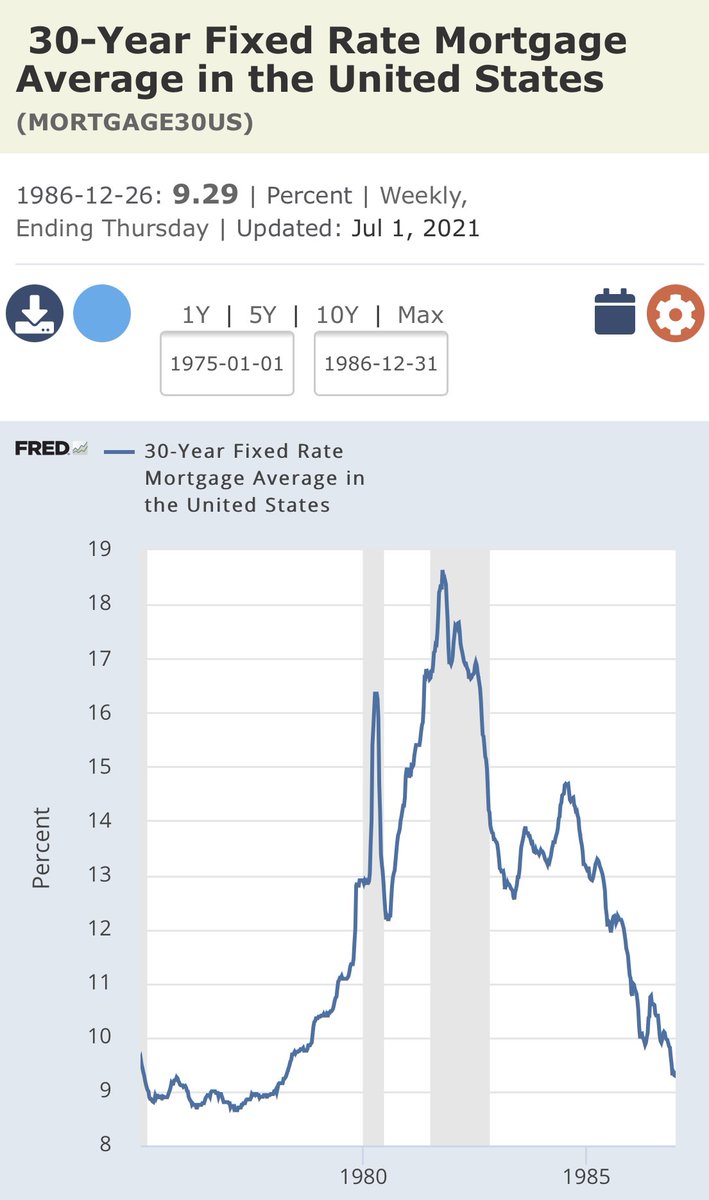

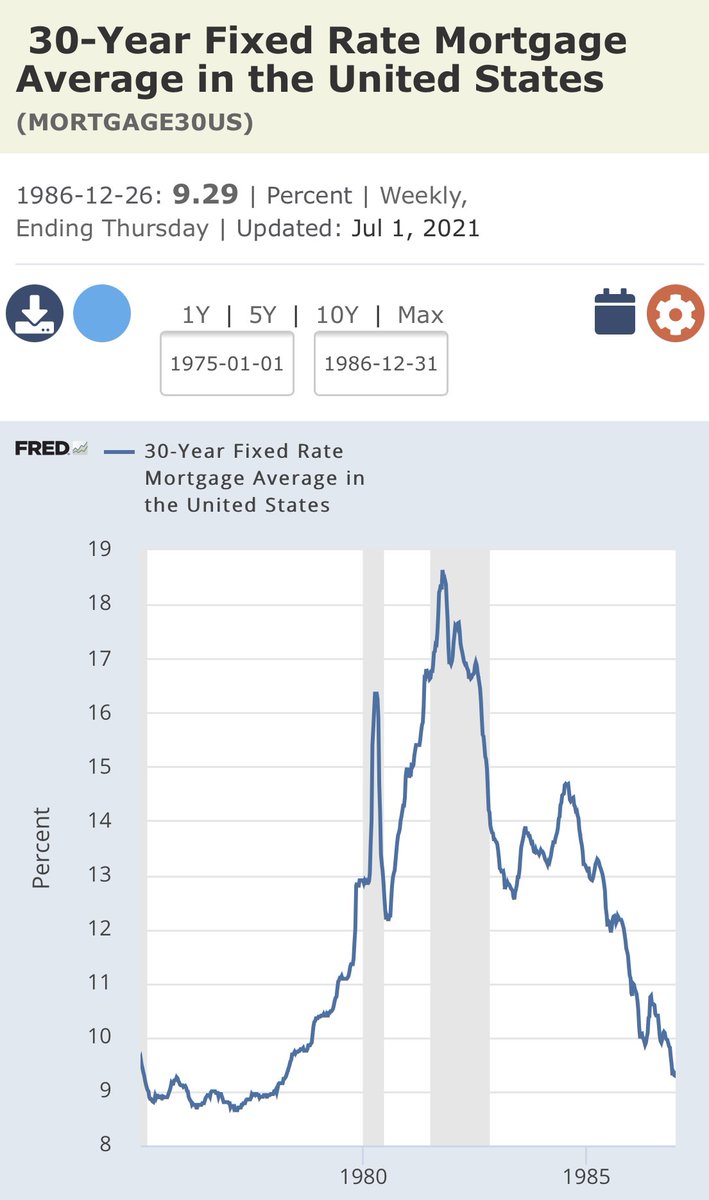

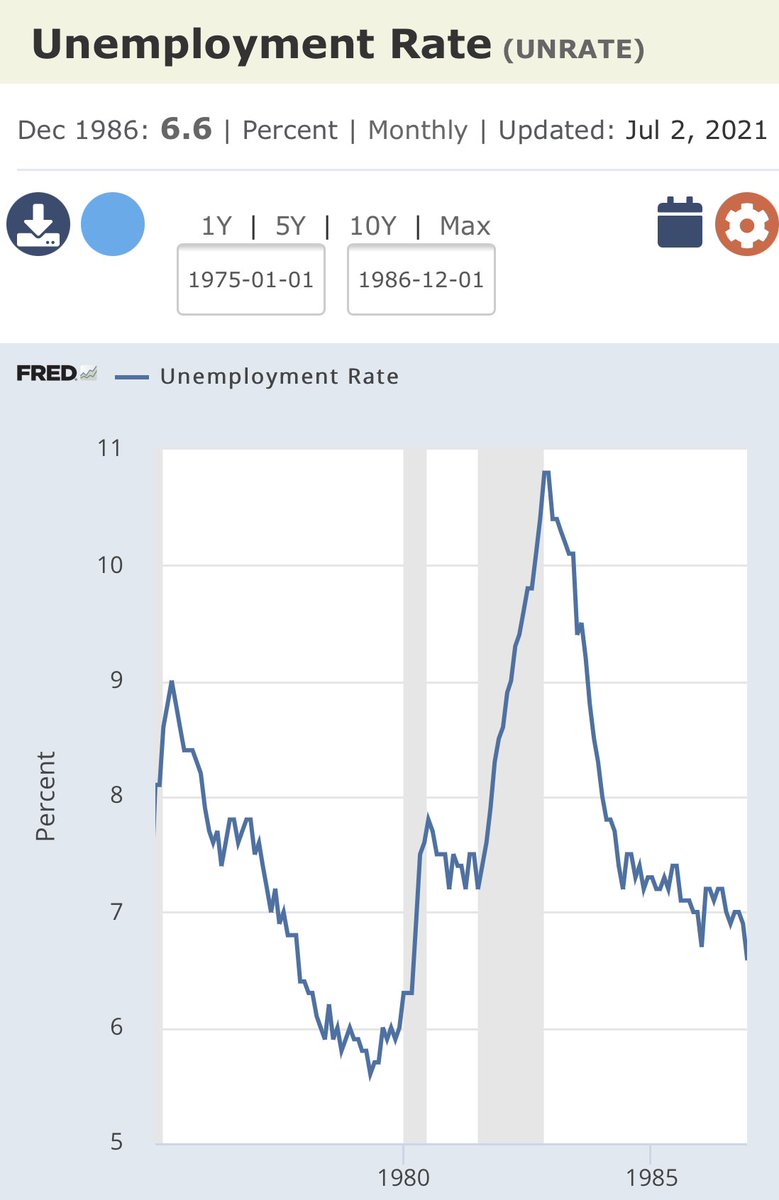

Boomers in their 30’s: lots of crime and pollution, expensive oil, high inflation and interest rates, fear of nuclear annihilation

Boomers in their 30’s: lots of crime and pollution, expensive oil, high inflation and interest rates, fear of nuclear annihilationhttps://twitter.com/bluestein/status/1377282067076108292