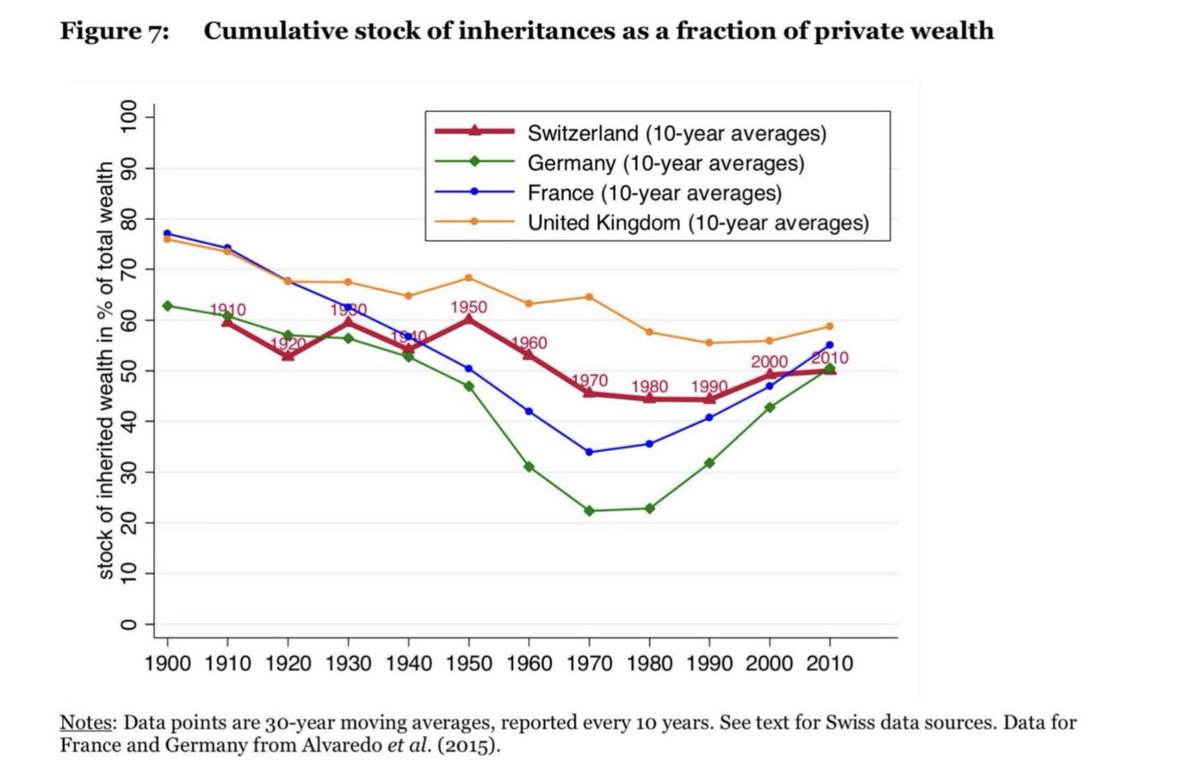

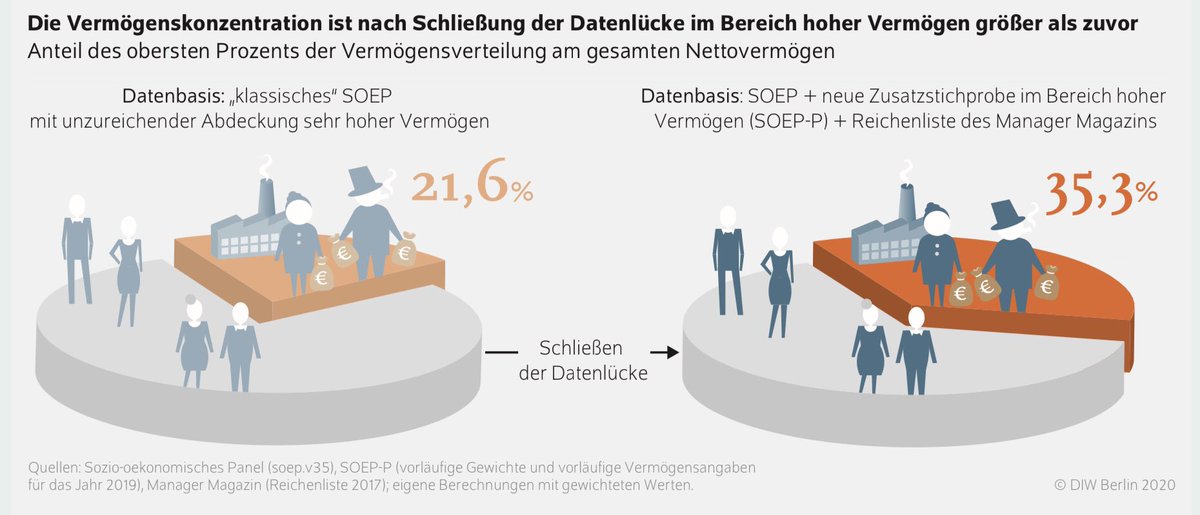

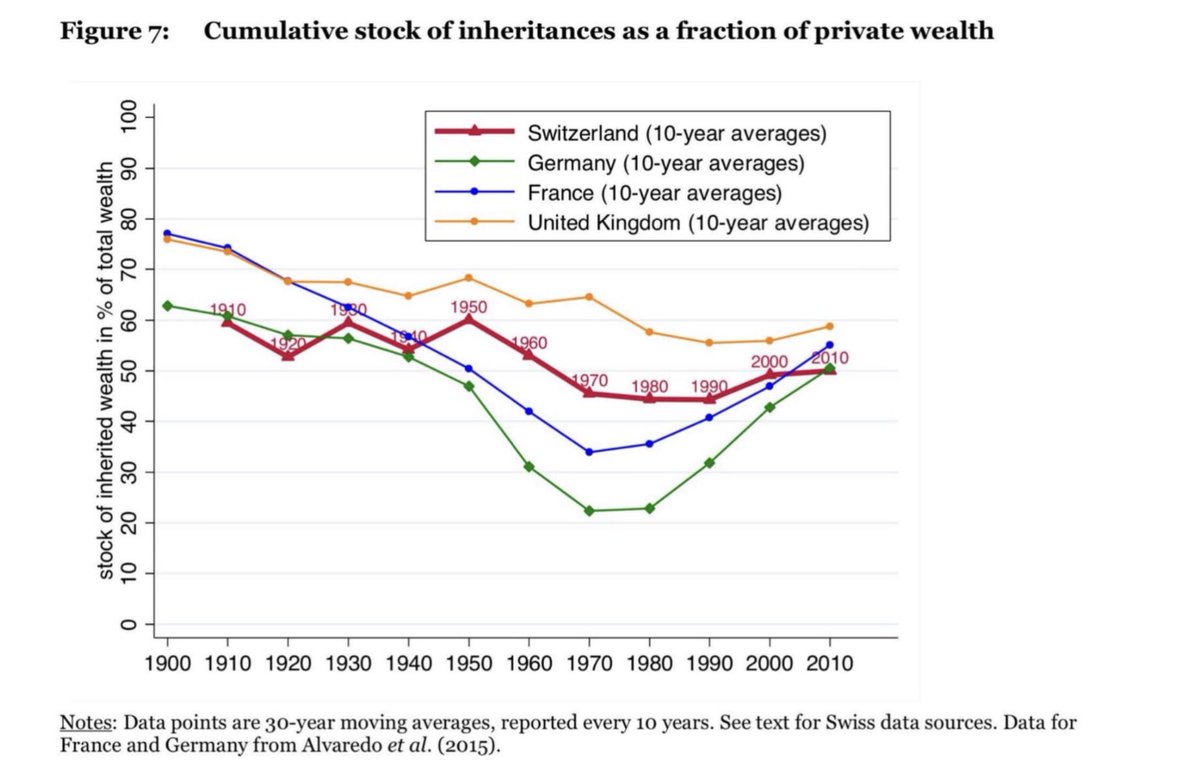

#1: More than half of all private wealth in Germany has been inherited and not be created through one’s own work and efforts.

hec.unil.ch/mbrulhar/paper…

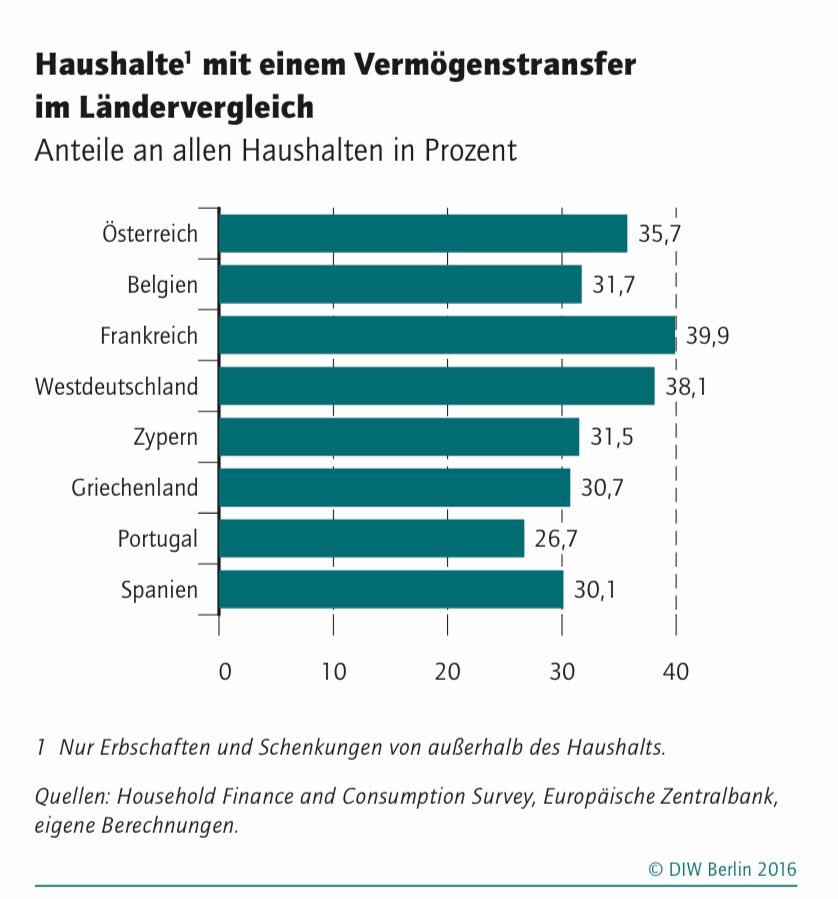

38% of Germans have received an inheritance. Most are well educated and have a good income, so that inheritances raise inequality of wealth and income.

Our study @DIW_Berlin_en (in German):

diw.de/de/diw_01.c.60…

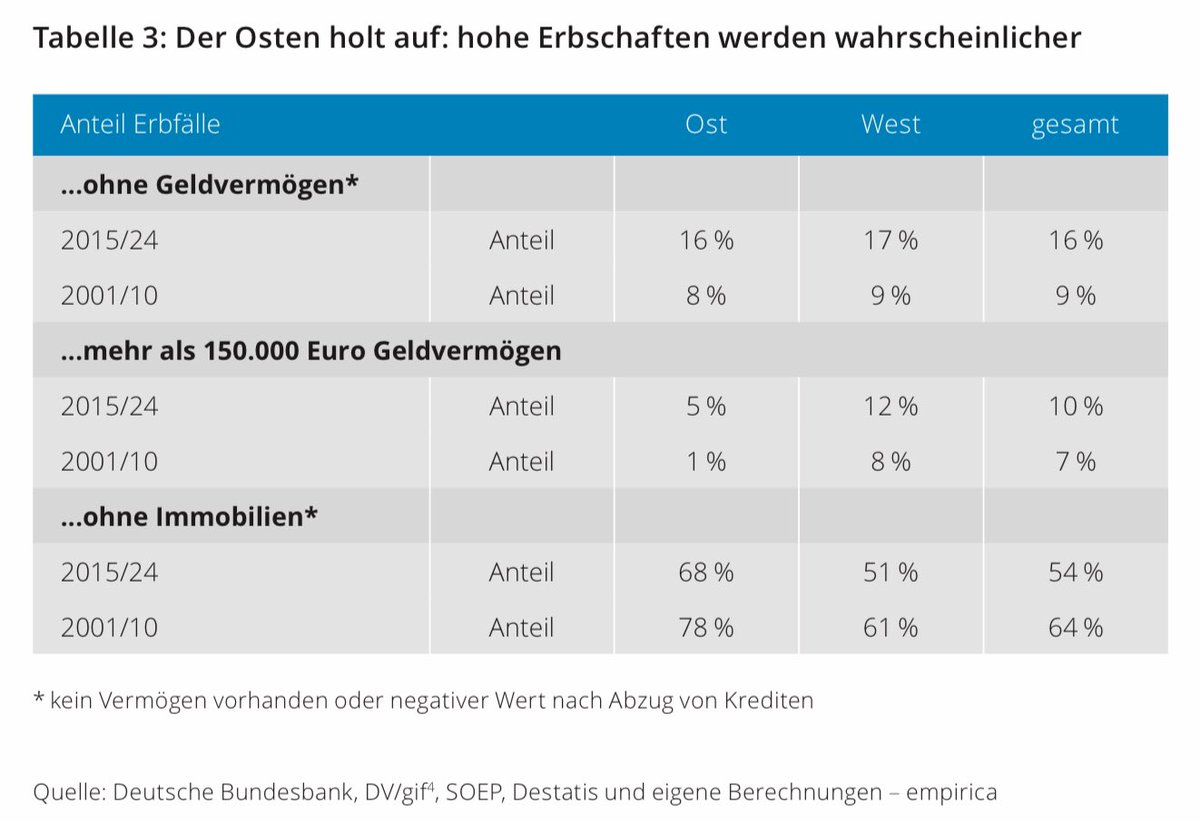

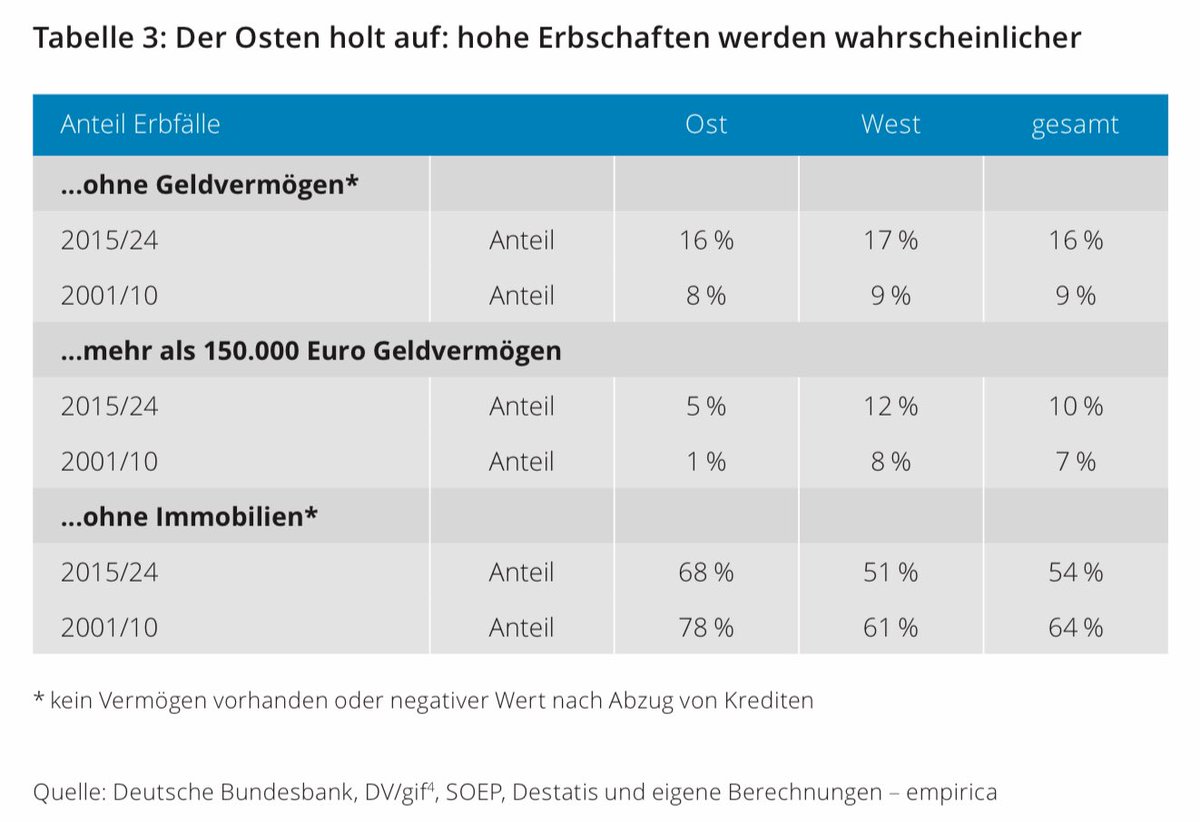

Inheritances are distributed highly unequally across regions in Germany, which are very low in East Germany, also as private ownership was limited before reunification.

empirica-institut.de/fileadmin/Reda…

€300 to 400 billion (~10% of GDP) are inherited in Germany every year.

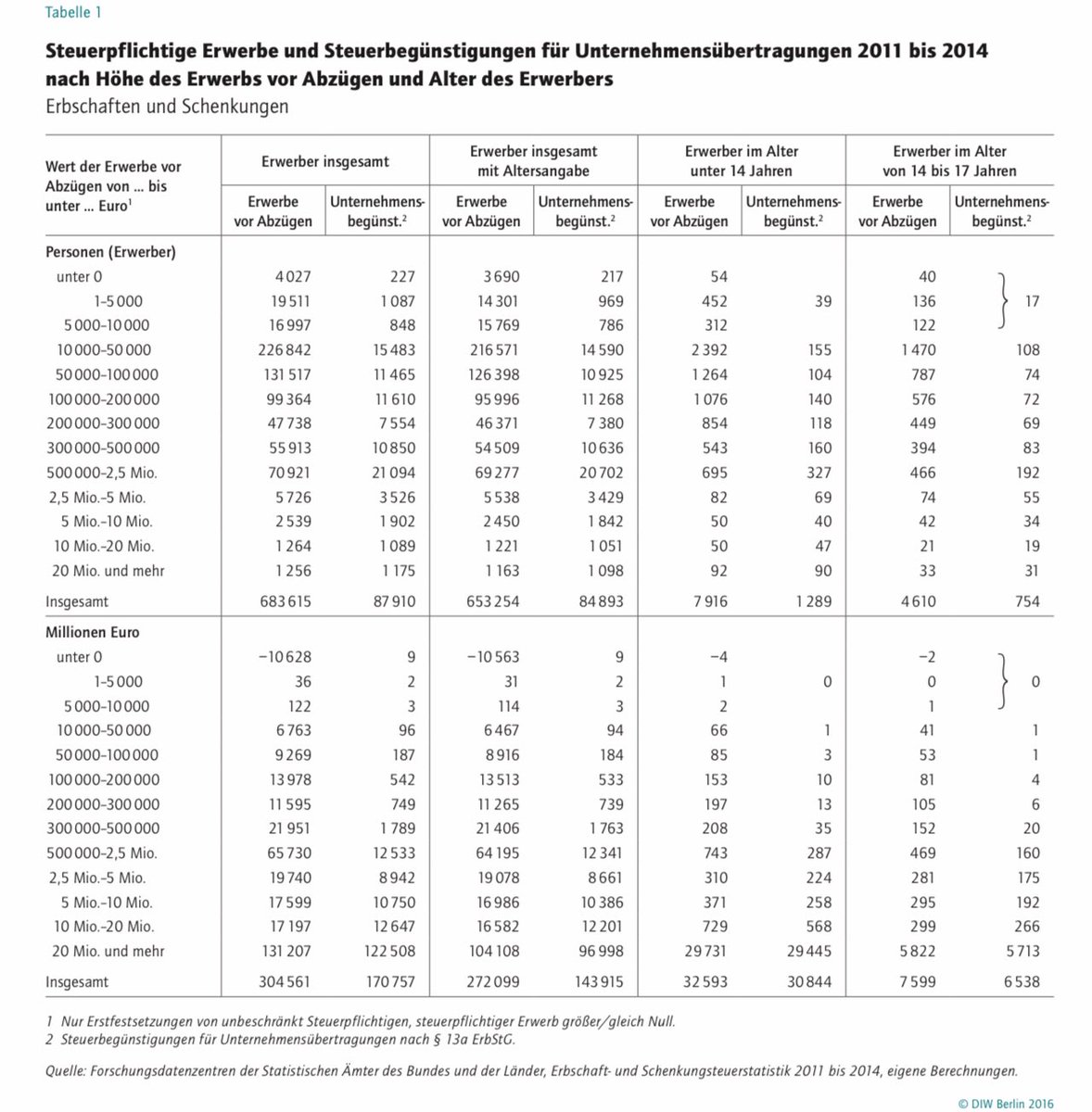

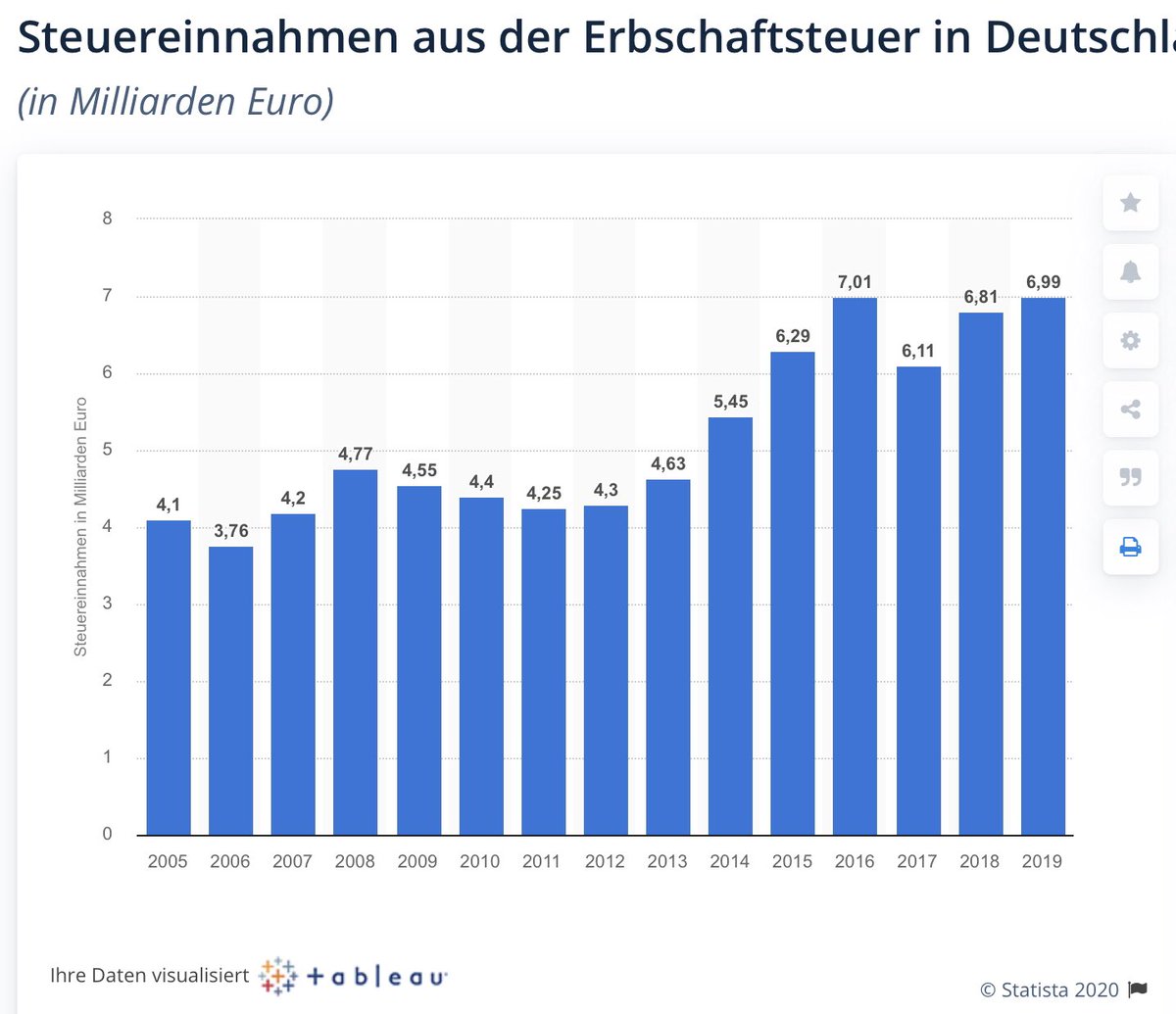

Inheritance tax revenues were €7 billion in 2019 — the low effective tax rate is mainly due to exemptions of the inheritance of companies.

diw.de/documents/publ…

Most heirs in Germany are men: they inherit two thirds of companies. Women generally inherit substantially less when it comes to large inheritances.

diw.de/documents/publ…

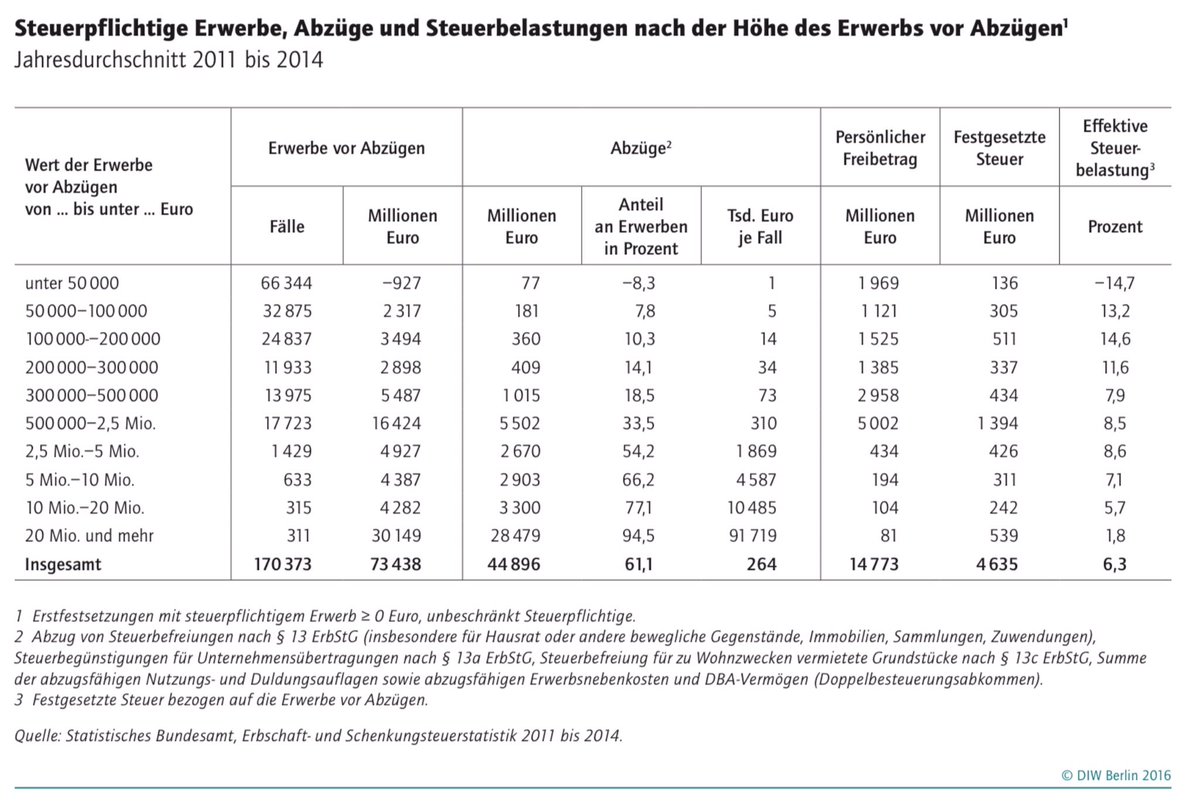

Germans inheriting more than €20 million pay on average 1.8% in inheritance taxes.

Germans inheriting less than €500,000 pay on average 12% in inheritance taxes.

diw.de/documents/publ…

1. Leave everything as is, i.e. very low and very unequal/regressive inheritance taxes -- this could (yet again) be challenged by the Constitutional Court, requiring changes sooner or later.