Today, I’d like to tell you a little story about a farmer named Bill.

If you’re not into farming, it just so happens that Bill discovers one of the most important principles in investing and decision-making in this story, so there’s also that.

Bill grows crops. In a good season, Bill harvests 150 seeds for every 100 seeds that he plants.

That’s a 50% growth rate!

For Bill, good and bad seasons are equally likely and unpredictable.

But, it’s possible to get “lucky” and have a streak of good years or “unlucky” and have a streak of bad years.

It’s a positive expected value bet: half the time you make 50% and the other half the time, you lose 30%. On “average,” Bill makes 10%.

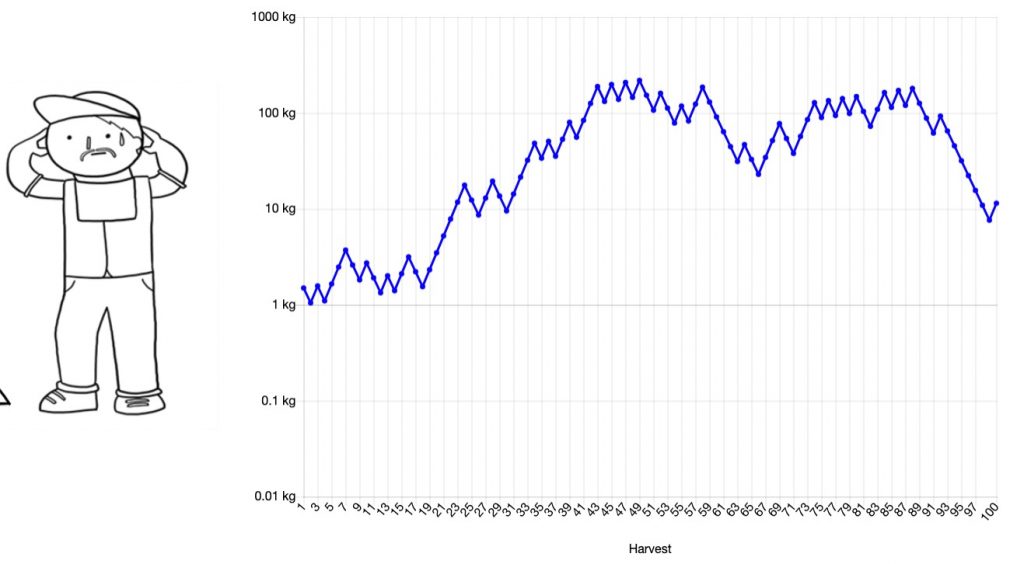

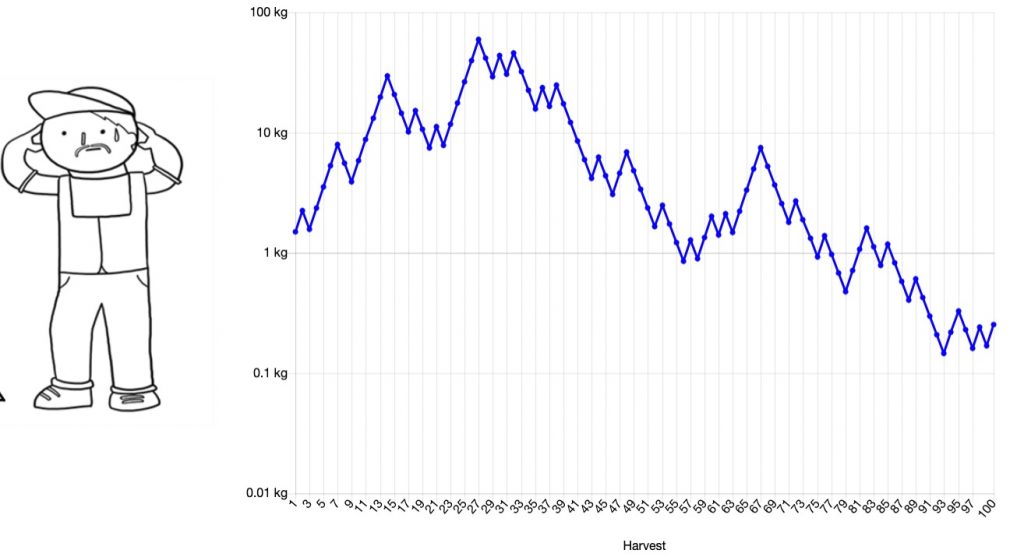

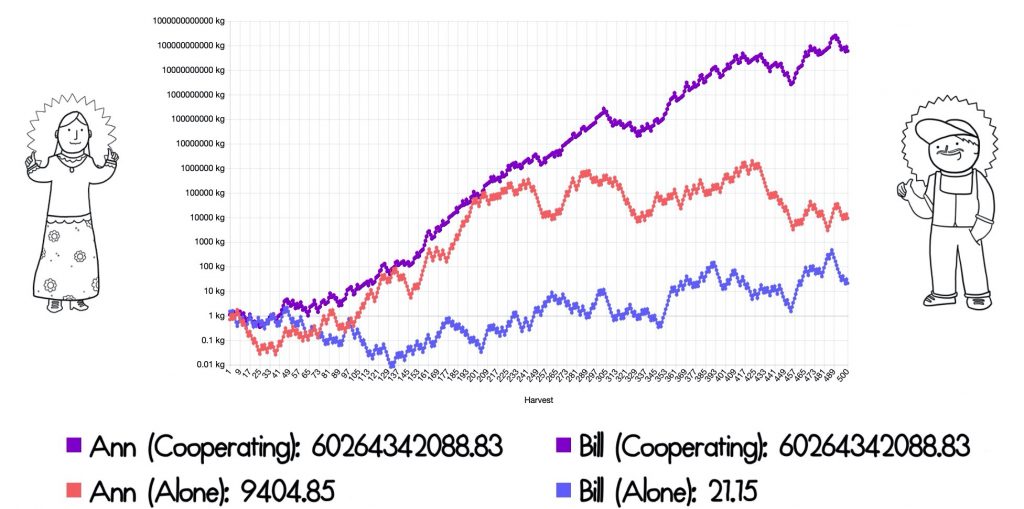

In just four simulations, Bill ended up anywhere between +1000x where he’s watching over his farmland from his ski chalet to down 80% where he’s barely able to survive.

He could do exceptionally well or exceptionally bad, depending on how the chips fall.

Even though it works out “on average,” would you want to start a business or make an investment for your whole lifetime with that much variability?

What can Bill do?

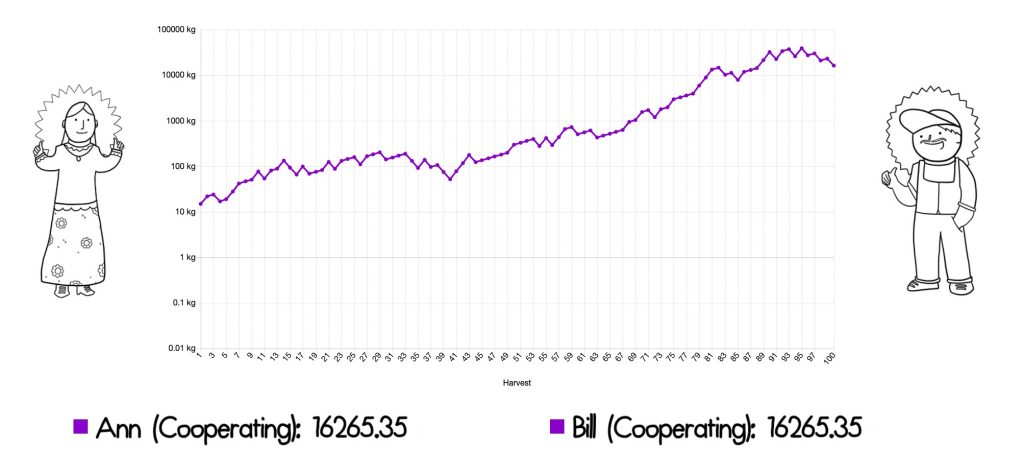

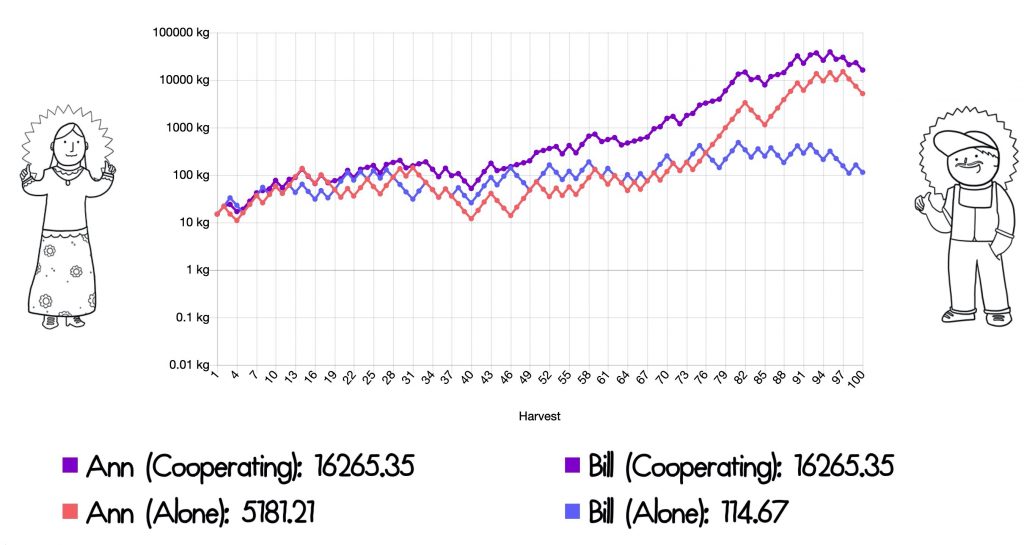

Bill having a bad year doesn’t make it any more or less likely for Ann to have a bad year and vice versa.

Let’s run a simulation with both Bill and Ann.

In investing terms, they are agreeing to “rebalance” their profits and losses. If Ann does well and Bill does poorly, she’ll share with him and vice versa.

For a delightful playable simulation of this, check out farmersfable.org to whom all credit is owed!