But also touches on why other Brazilian stocks, e.g. $MELI, $PAGS, $STNE, might be affected from same factors.

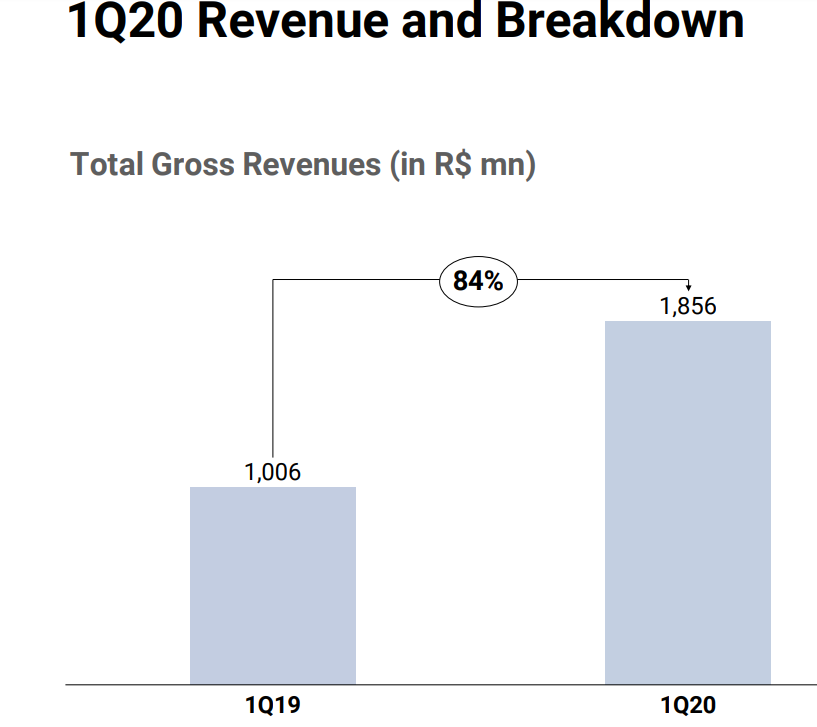

Why was a 20-yr old brokerage now growing 80% YOY?

Why were Brazilians suddenly pouring money into brokerages and investing?

Brokerages are largely commoditized, so what was $XPs long-term moat, besides possibly gaining scale?

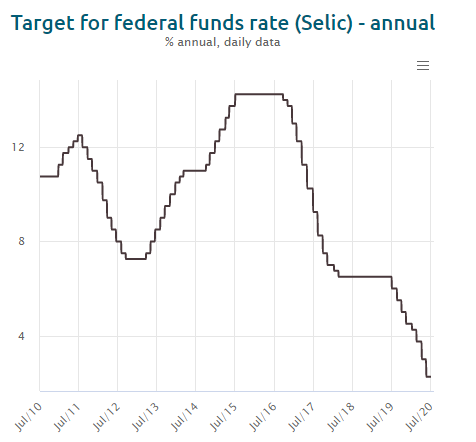

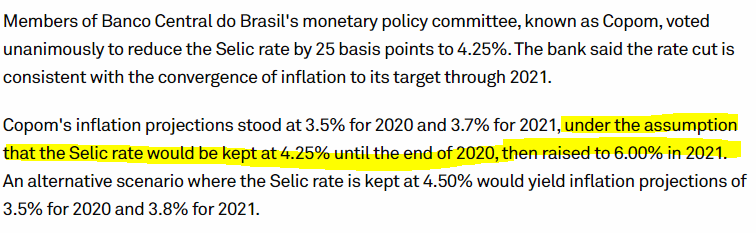

Brokerages normally earn money from the interest earned on cash balances held in client accounts, so the higher the better. See #1:

investopedia.com/articles/inves…

bcb.gov.br/en/monetarypol…

bcb.gov.br/en/legacy?url=…

spglobal.com/marketintellig…

I have more thoughts on $XP, but will get back to them at the end. For now, let's quickly turn back attn to $MELI $STNE $PAGs etc

alphaarchitect.com/2019/12/05/glo…

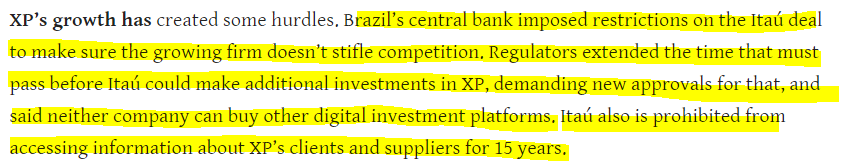

From: bloombergquint.com/business/guilh…

bloomberg.com/news/articles/…

@saxena_puru @JoeySolitro @andrescardenal @LuisMiguelValue