$FSLY

IR site has crashed

$FSLY

Fastly Q2 Adj. EPS $0.02 Beats $(0.01) Estimate

Sales $75.00M Beat $71.40M Estimate

$FSLY

Fastly Raises FY20 Guidance

$FSLY

FY20 Guidance:

Adj. EPS $(0.06)-$(0.01) vs $(0.13) Estimate

Sales: $290M-$300M vs $287M Est.

$FSLY

Quarter

--

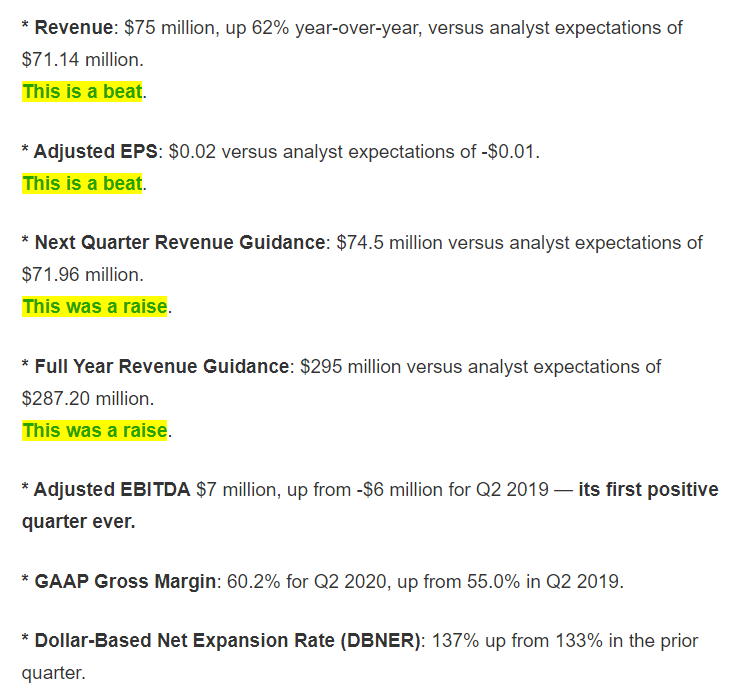

Fastly Q2 Adj. EPS $0.02 Beats $(0.01) Estimate

Sales $75.00M Beat $71.40M Estimate

FY20 Guidance:

--

Adj. EPS $(0.06)-$(0.01) vs $(0.13) Estimate

Sales: $290M-$300M vs $287M Est.

$FSLY

Q3 Guidance

Adj. EPS ~$(0.01) vs $(0.03) Estimate

Sales $73.5M-$75.5M vs $71.95M Est.

$FSLY

Beats Revenue and EPS

Beat quarterly guidance for revenue and EPS

Beats annual guidance for revenue and EPS

$FSLY

Jan 1 2020: Wall Street estimated 29% growth

Today: Company guided to 48% growth

$FSLY

Dollar-Based Net Expansion Rate (DBNER) of 137%, up from 133% in Q1 20201

$FSLY

Total customer count increased to 1,951 up from 1,837 in Q1 2020 — *the largest quarterly growth since IPO*

$FSLY

Average enterprise customer spend of approximately $716,000, up from $642,000 in Q1 20203

$FSLY

Non-GAAP gross margin, which excludes stock-based compensation, of 61.7% up from 55.6% in Q2 20194

$FSLY

Adjusted EBITDA of $7 million, up from ($6) million for Q2 20194 — *first positive quarter*

$FSLY $75M in revenue was 62% growth year over year.

$FSLY

$75M in revenue was 62% growth year over year.

$FSLY

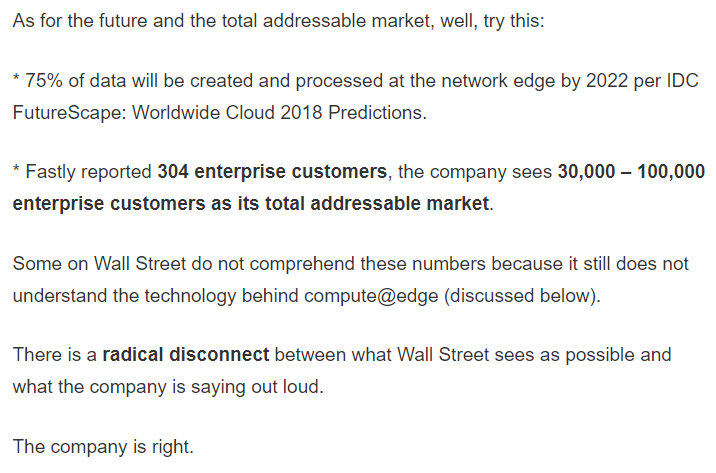

TAM!!!

* 75% of data will be created and processed at the network edge by 2022 per IDC.

* Fastly reported 304 enterprise customers, the company sees 30,000 - 100,000 enterprise customers as its total addressable market.

$FSLY

Image 1: TAM

Image 2: Large Customer (TikTok)

Image 3: Some results

Image 4: Why Fastly is different from a CDN

Learn more about CML Pro

bit.ly/CMLPro