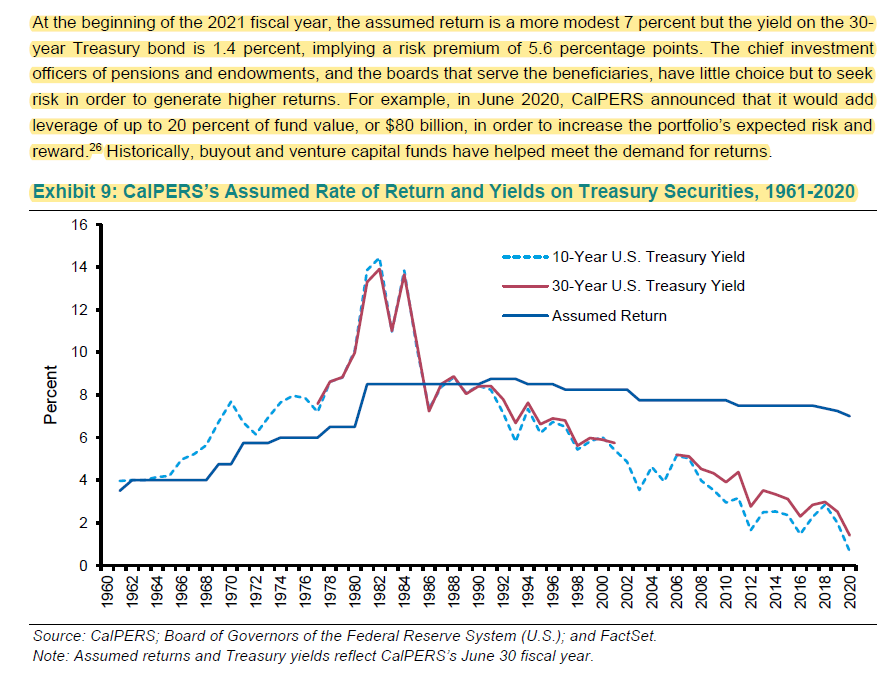

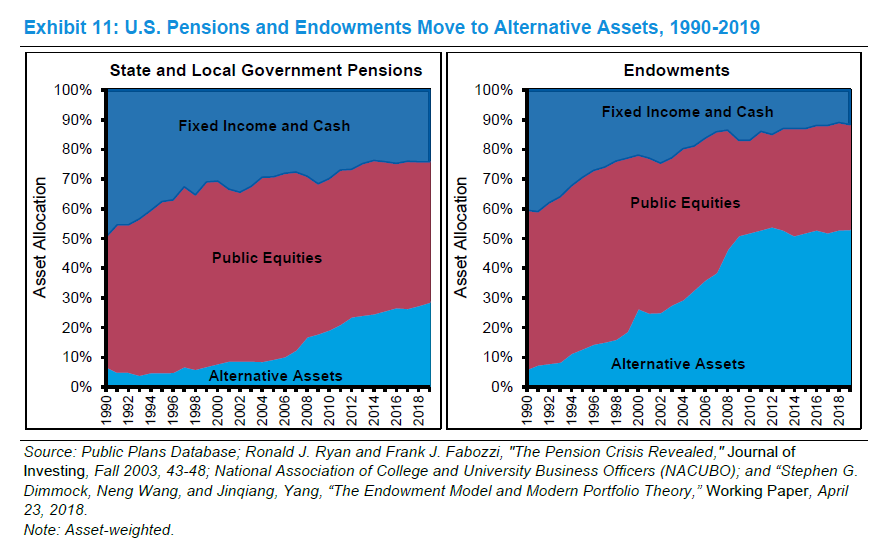

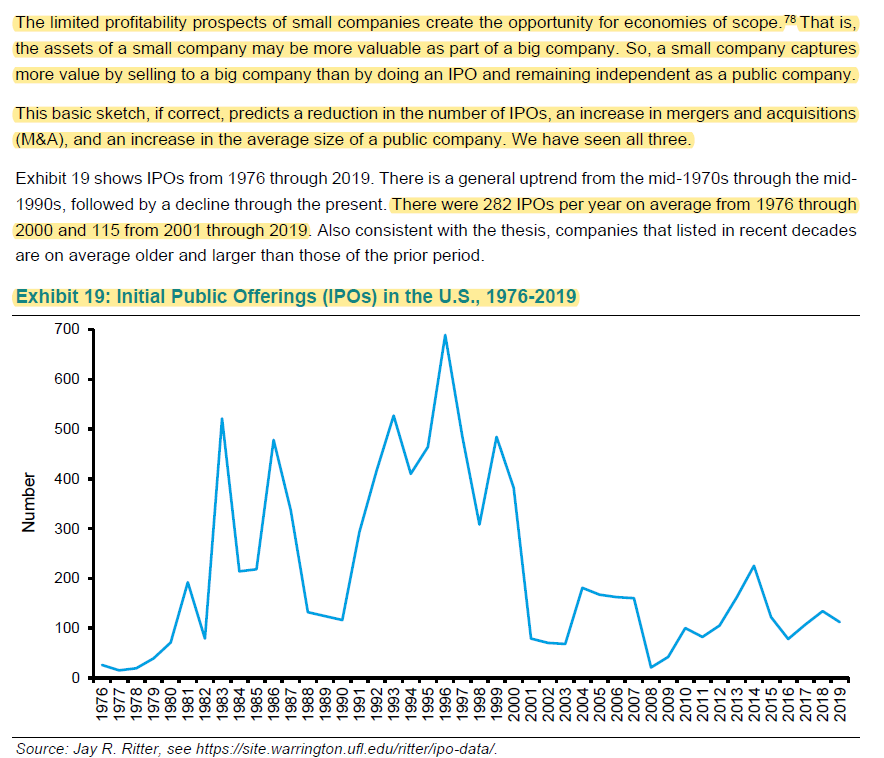

It's a 56-page document containing full of interesting data, charts, and insights. Here's a thread with some of those tidbits.

Link to full report: morganstanley.com/im/publication…

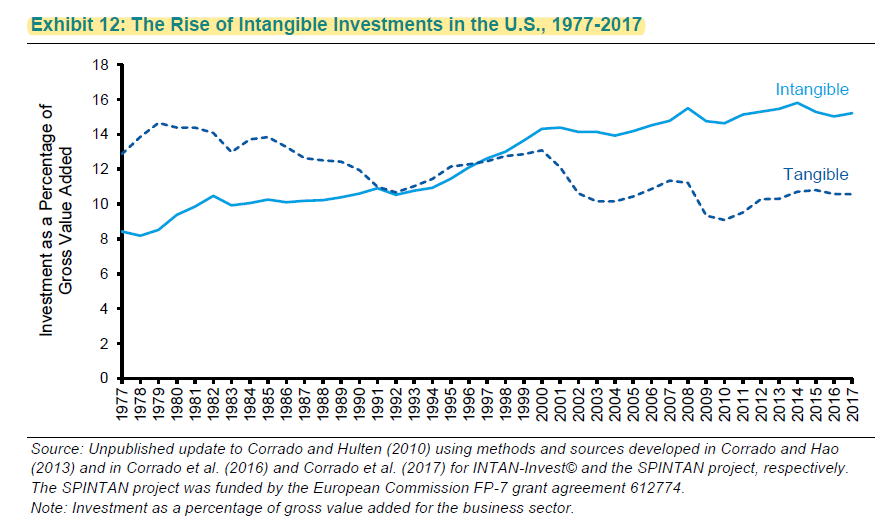

A physical book is a rival good. It requires more capital/labor to produce more of it. A digital book is non-rival. We can all read simultaneously.

$FB sales/employee is 2x $F's. Today, companies don't need much capital, plus access to capital is cheaper than ever.

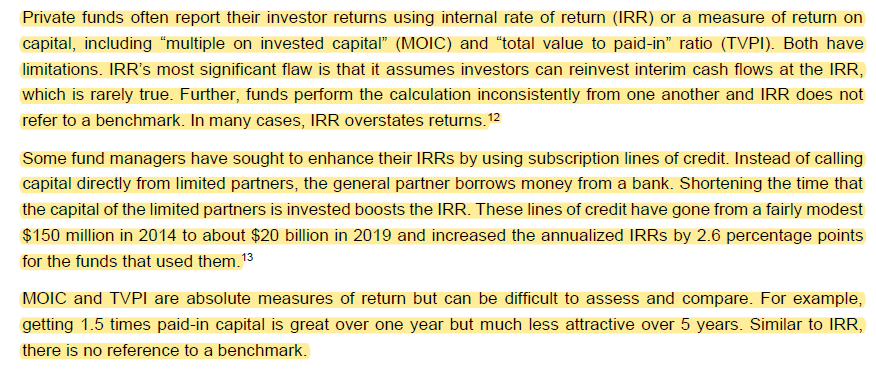

A co listed in 1970s had 92% probability of survival for next 5 years. In 2000s, it was 63%.

CLOs have gone from 0.1% of leveraged loan market in 1994 to ~60% today.

Cov lite loans increased from 60% in 2015 to 80% in 2019.

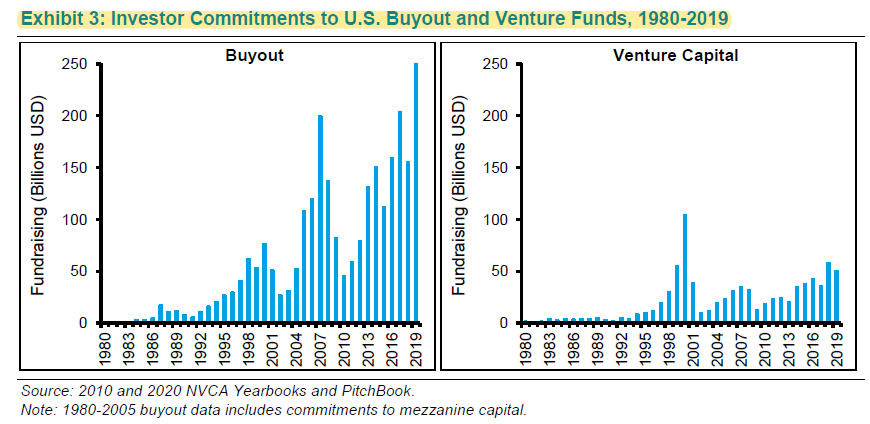

In early days, bankruptcy meant liquidation. Following 1978 inclusion of Chapter 11, reorganization of the cap structure became possible which was a huge boon for buyout funds.