Here's part 1 of the thread if you haven't read that yet (not necessary though):

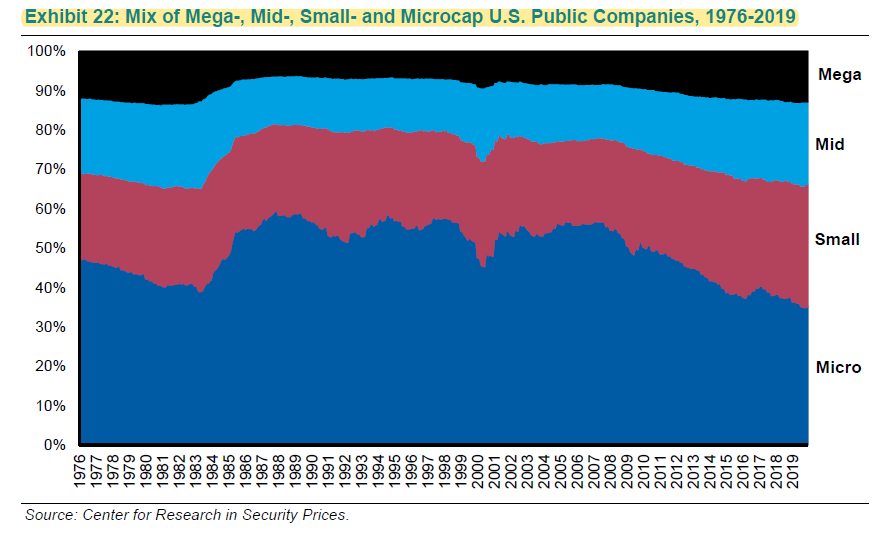

In the 90s, 15-20% small cap cos became medium/large cos every year. Today, it's half of that.

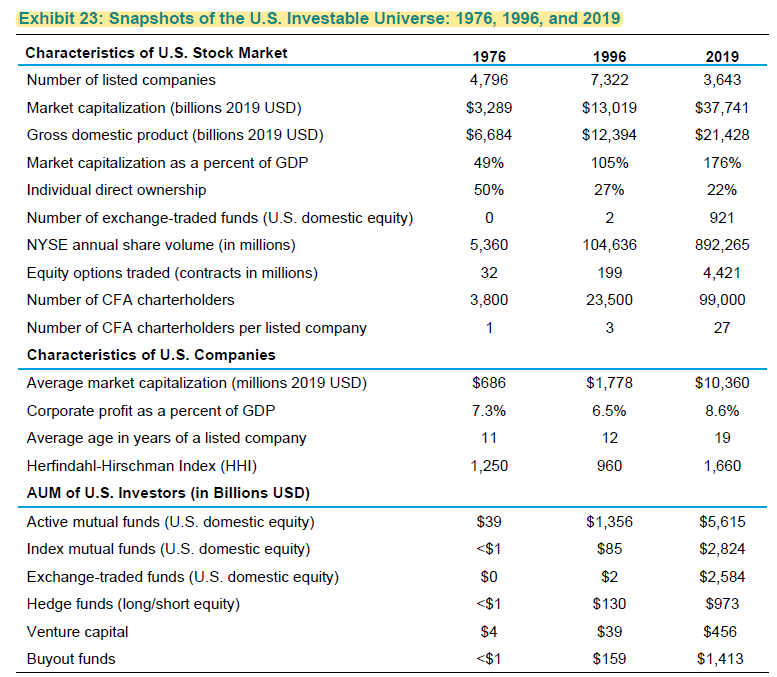

Median ROA gap between large and small cos was 15% in the 90s while today it has become 30-35%!

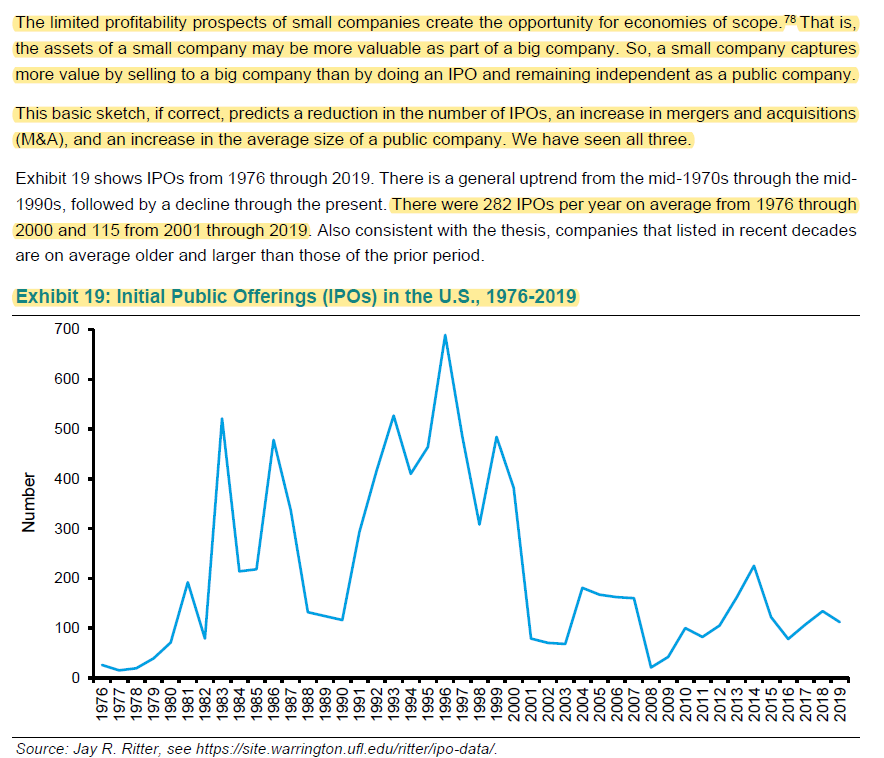

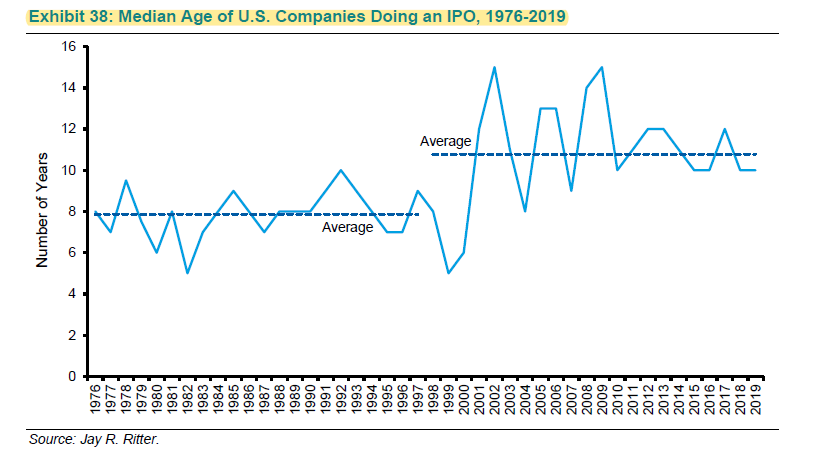

# of IPO in 1969 = ~20% of total public companies today

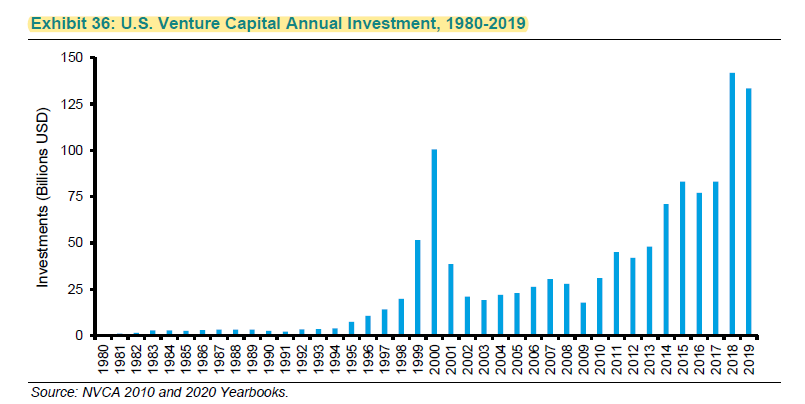

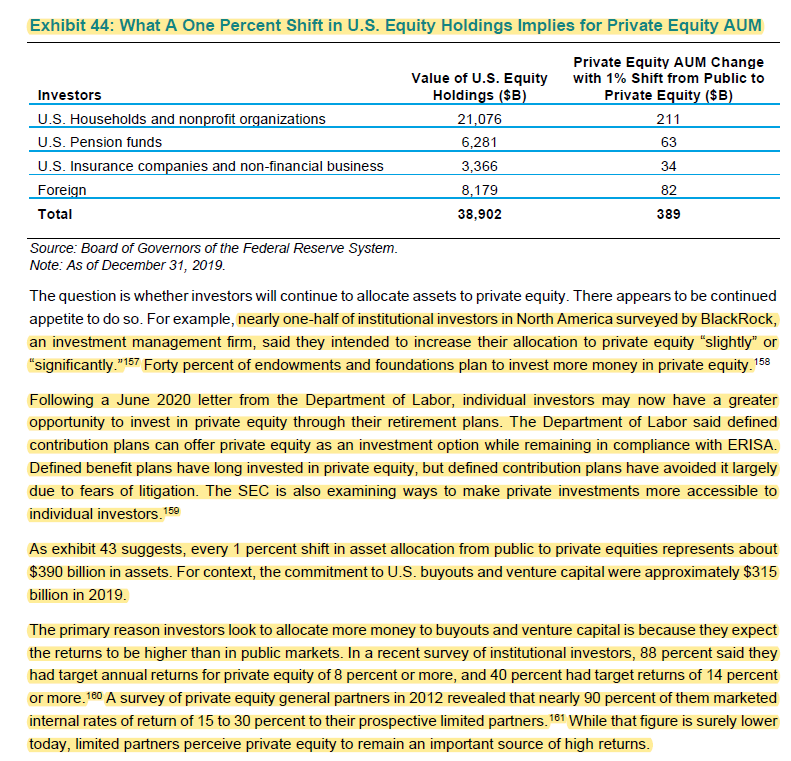

~50% US VC AUM is in the Bay Area, 75% after including NYC and Boston i.e. VC AUM is very, very geographically concentrated. Total US VC AUM is $455 Bn with $120 Bn dry powder.

Have a great weekend, everyone!