👇

2/

4/

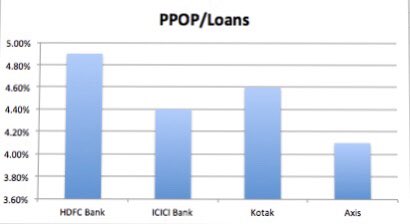

1. Ignore the current Covid provisioning

2. Assume 50% cut in PPOP

3. LGDs of 50% & Tax of 25%

Then this PPOP takes care of 10.6% to 13.3% of the book slipping over two years. (4% - 5% / 50% / 75%)

10% to 12% is lower than the total Morat book for many banks.

6/

7/

8/

9/

There are other issues as well.

10/

11/

Plus what if the stress is much bigger.

12/

13/

(All views are biased. Don’t be a moron and take investment advice from twitter).

14/14