Valuations Matter/Nobody Knows/Structure Beats Activity. At the end of every road, you meet yourself. Views are mine. Reposts & Likes Are Not Endorsements.

8 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/abhishec_s/status/1543117855889113088Q: What are you proudest of?

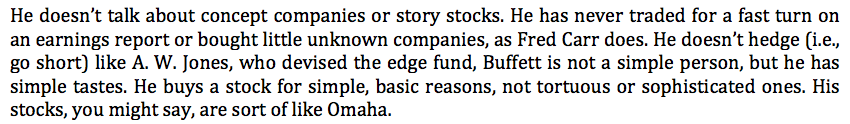

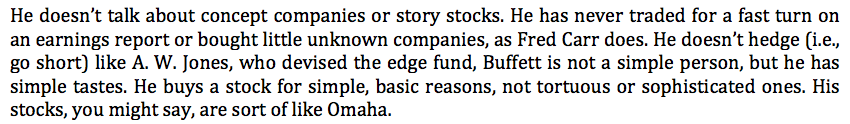

https://twitter.com/RamBhupatiraju/status/1335055560723603458"Buy stocks for simple reasons, not torturous & sophisticated ones".

Coffee was introduced to Italy by Arabic travellers in 15th/16th century.

Coffee was introduced to Italy by Arabic travellers in 15th/16th century.

MARS paid $11 BN itself. $ 5.7 BN debt was raised from Goldman.

MARS paid $11 BN itself. $ 5.7 BN debt was raised from Goldman.