-Adi Finechem Ltd. Founded in 1985 by Shri R.Harivallabhdas and Shri Nahoosh J Jariwala.

-It is engaged in mfg of Oleochemicals & Neutraceuticals.

-They operate through only one plant in SANAND,AHMEDAAHMEDABAD,GUJARAT.

-The plant has one of the largest processing capacities for natural soft oil-based fatty acids in India.

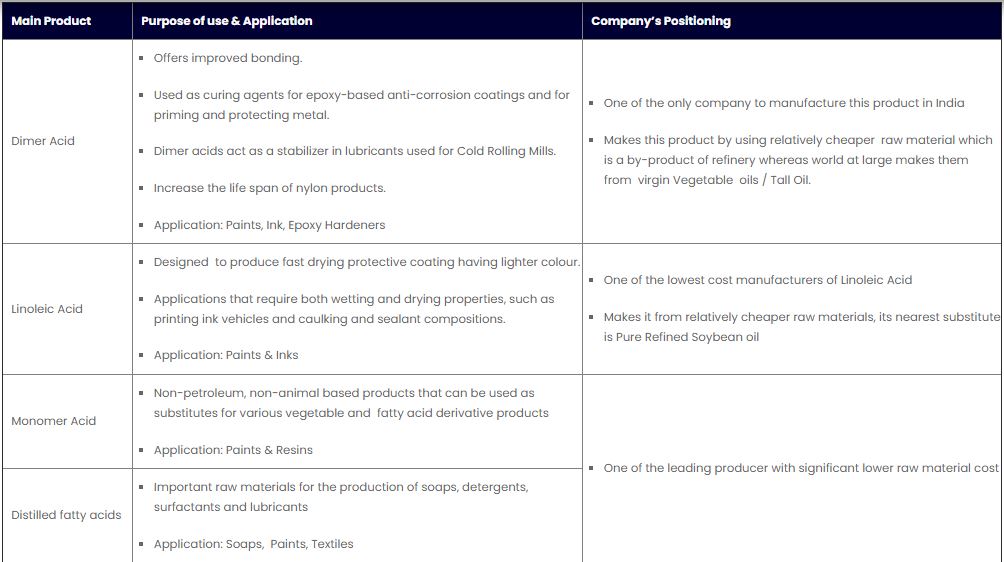

-Their main products are

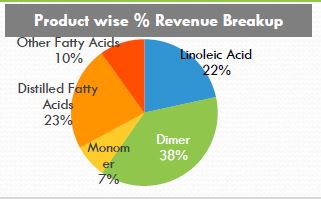

i) OLEOCHEMS-dimer, monomer, linoleic acid etc.

They r further undergoing expansion:

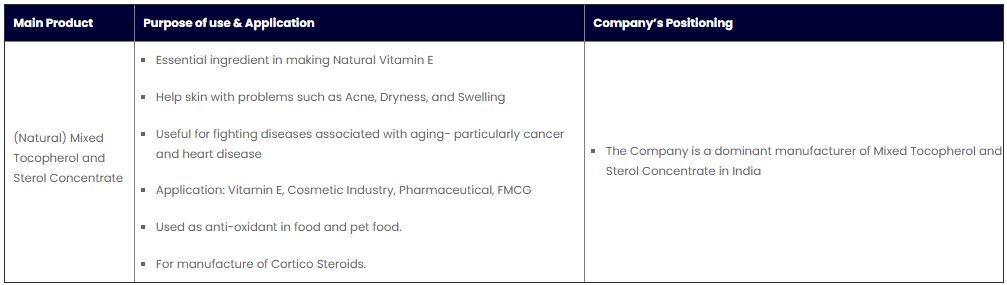

-Neutraceuticals - to manufacture sterols and higher concentration tocopherols.

-to manufacture bio-diesel using three by-products of its manufacturing process:

-They hv developed and mastered the process of manufacturing its entire product range from waste/by product streams of natural vegetable oils.

Their buss segments can be divided into oleochems & Neutraceuticals

-They r India's largest manufacturer of Dimer acid used in many consumer products including paints and enjoys a market share of ~70%.

Their Oleochems r mainly used in production of soaps, detergents, personal care products and paints.

Raw material - Deodorizer Distillate a waste prod. Generated from processing of Oils like Soya,Sunflower,Corn,Cotton etc.

-Majority of sales from this segment is from exports.

-Even In FY15 after it ASP declined the revs. remained flat.

-they hv been constantly expanding recently they inc. their capacity to 72K MT in FY18.

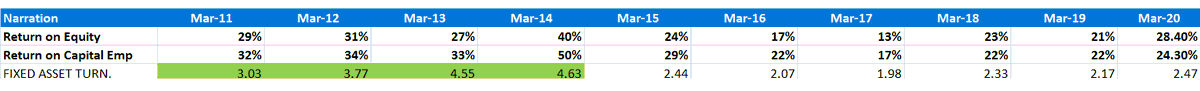

-EBITDA & PAT MARGINS seems to be bottomed out in FY17 n moving up consistently after that.

Short Term:44crs

Interest cost seems to be on a lil higher side at 10.9% for Fy20.

Though it is only 2% of d overall revenue.

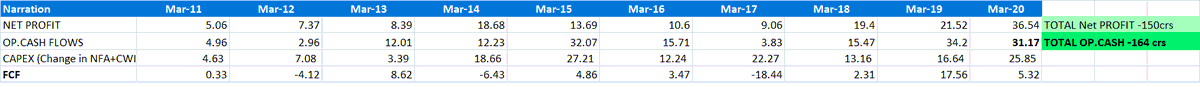

N.p for last 10 yrs - 150crs.

FCF hv been low but they hv been on expansion most of the time.

-This business unlike that of aroma chemicals faces challenge from Chinese imports.

Infact in 2019 they faced shortage for its key raw materials, due to inc. demand from China, where customers r able to pay higher prices bcoz their products hv better margins.

-Impact of COVID on realizations.

MITIGATION OF RAW MAT. RISK -

In order to mitigate raw material risk they are now working on 3 potential substitute of their existing raw material

Could not collect latest data for FY20 as co. doesnt conduct concalls nor even presentations.

Hope they wil communicate effectively after demeger.

Disclosure - Invested