How it works:

It makes 30% of our cashflow tax free.

Very powerful but there is much more to it...

We'll have a cost segregation study done to split up the depreciable lifespan of different parts of the building. The raw land can't be depreciated so you have to give that a value.

The IRS has a depreciation schedule for each type. Some parts are 5 yrs. Others 15 years...

Now you can get 5 or 6% of the value as a deduction in the early years...

But wait... theres more.

So the doors, sidewalks, HVAC, walls, latches, curbs, security, gates, etc.

A % of this stuff goes in Yr 1

But then Trump got elected and he enacted the Tax Cuts and Jobs act. Moving this percentage to 100% from 2017 to 2023

So now 30% of your asset cost can be DEPRECIATED IN THE FIRST YEAR.

The cost segregation study came back. 30% of the asset cost can be depreciated on a 15 yr or faster timeframe. This is 100% deductible THIS YEAR...

A $900k tax deduction. In year 1.

The facility will produce about $260k in NOI and $200k in free cashflow after interest expense.

So while $200k goes into the bank account the tax LOSS is $700k.

But wait there is more...

You can also carry these losses forward into eternity.

On these new properties we won't have a tax liability for 4+ years because of Bonus Depreciation...

INSANITY.

This is how real estate owners, operators, developers make millions a year and pay 0 taxes.

But if you've owned it longer than 12 months its taxed at capital gains...

And you can do whats called a "like-kind exchange" (1031 exchange) which allows you to use the proceeds to buy a new asset and shield the taxes and push them further down the line.

Powerful stuff.

How that works...

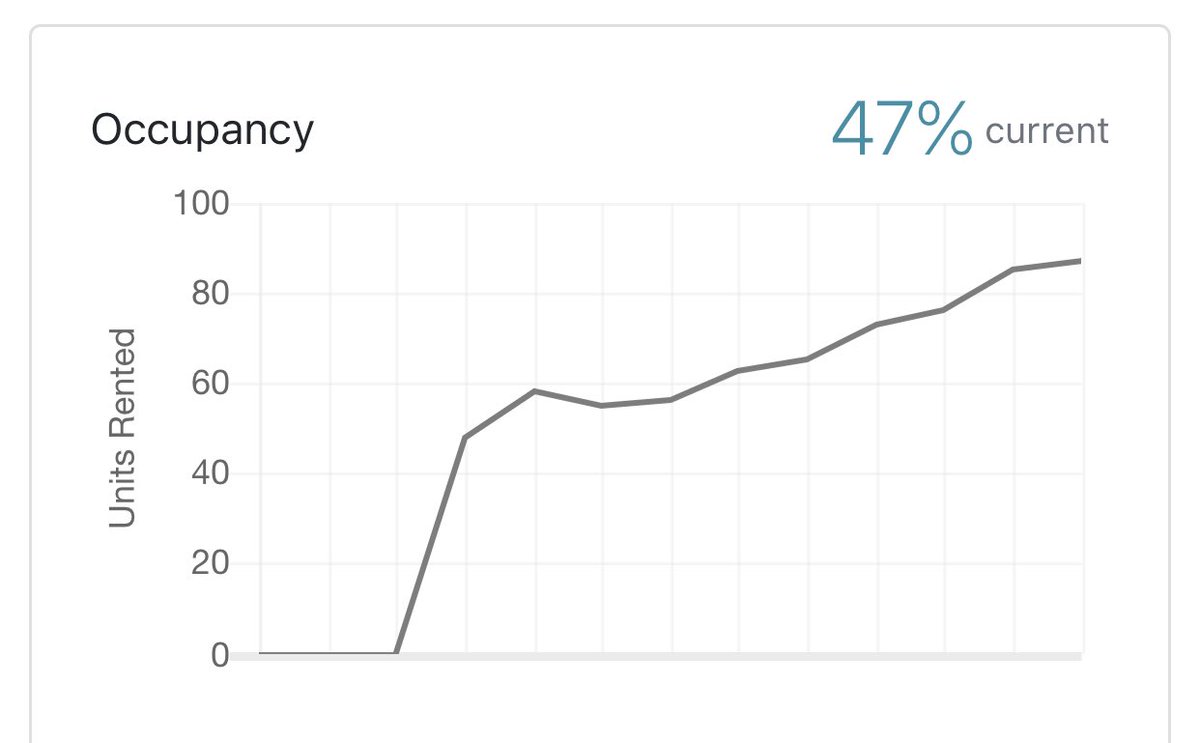

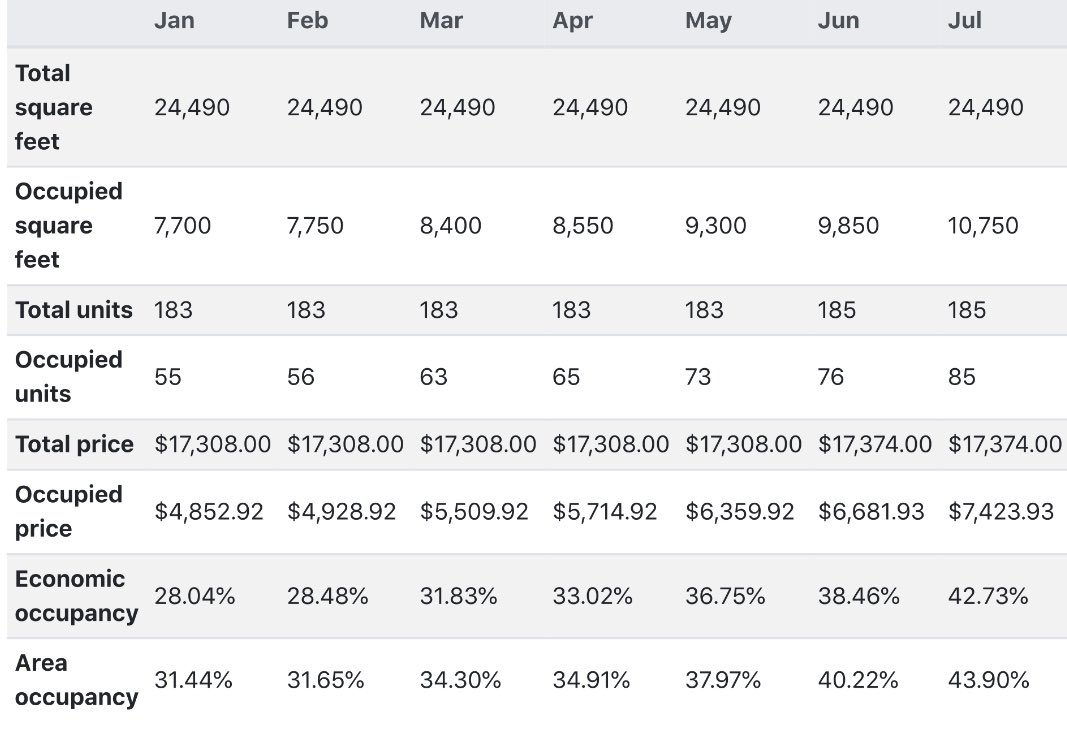

Then we operated it and filled it up with customers.

So we went to a bank and said hey - this property can support more debt - lets refinance and restructure the debt we have on it.

Now the bank will lend on that new amount. In our case it was ~75% of that new value, or $4MM.

This amount isn't taxed. There is no taxable event here so the $2MM went straight to our checking accounts.

This strategy, accompanied with the aggressive depreciation, is a deadly combination to build and preserve wealth.