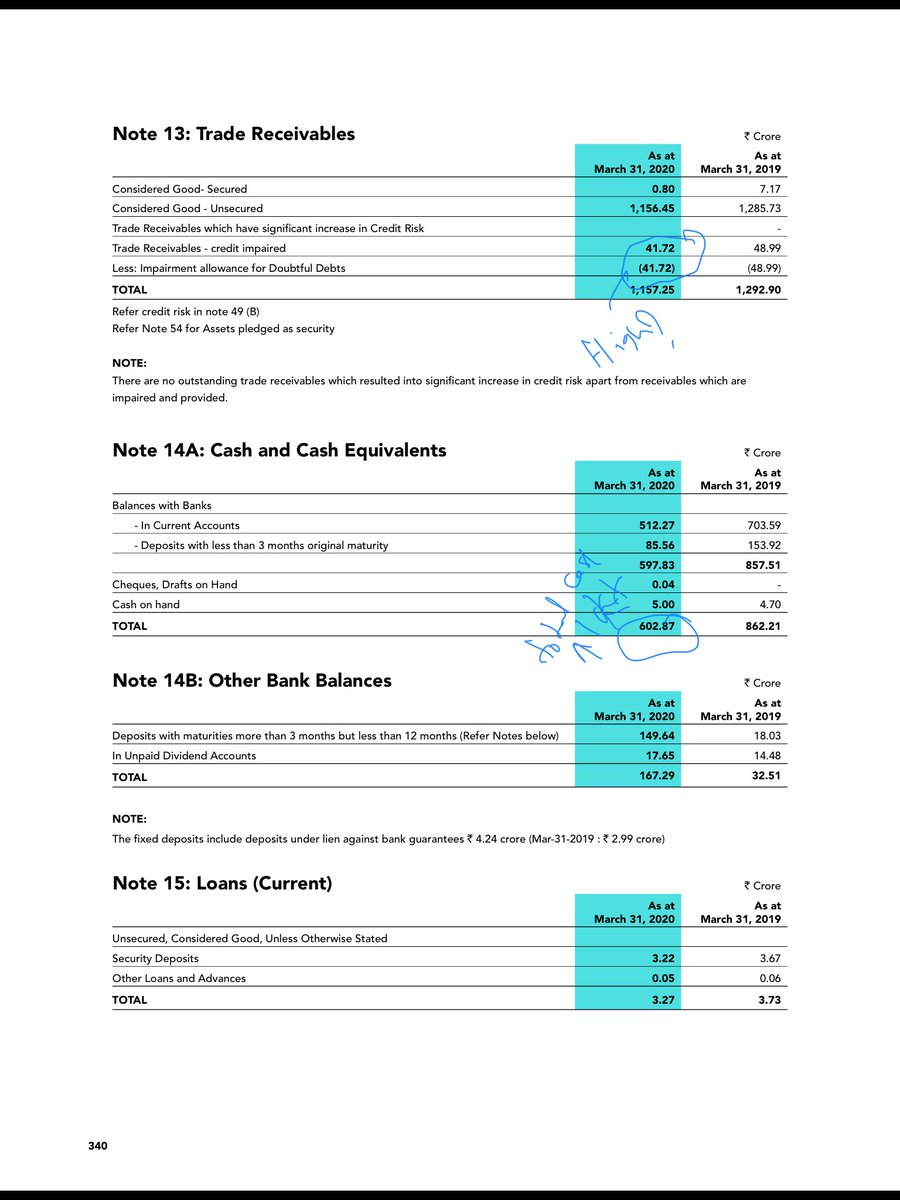

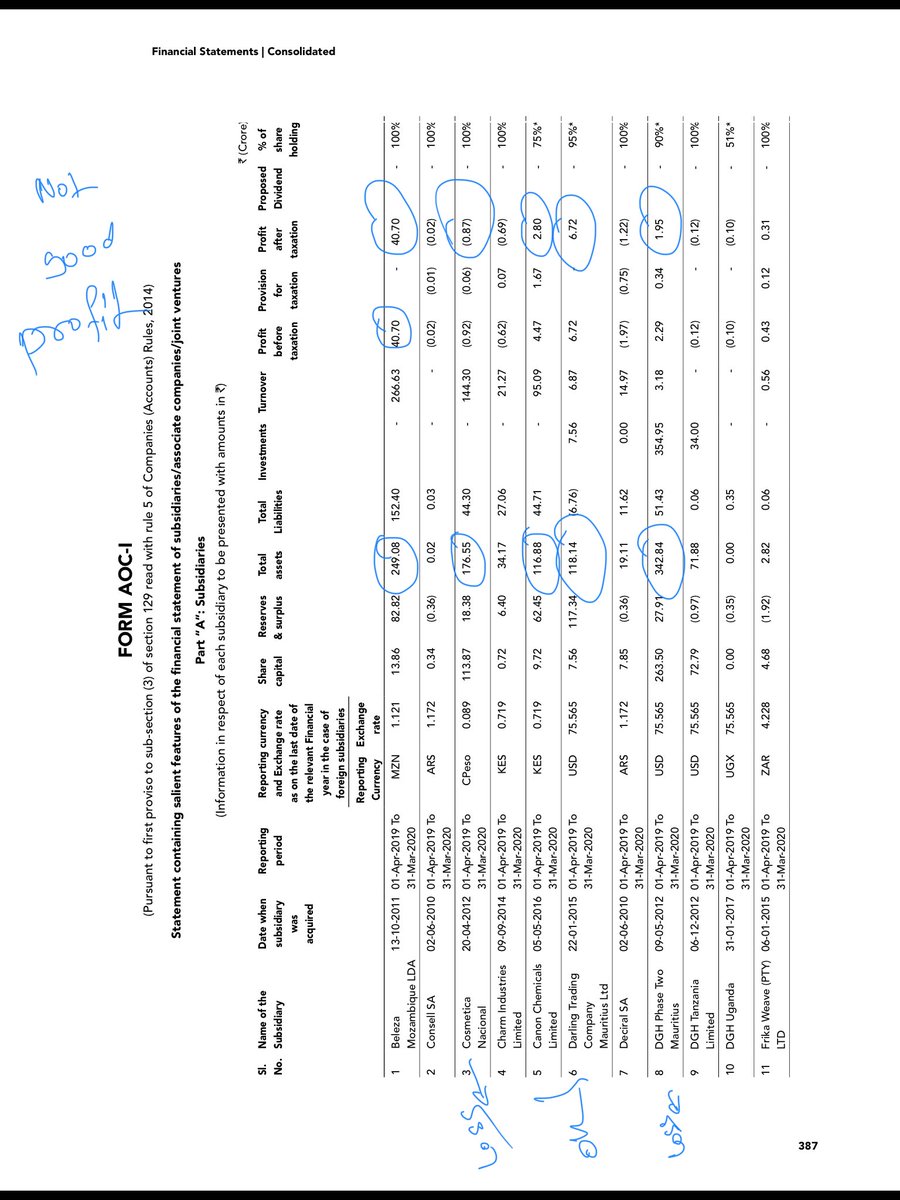

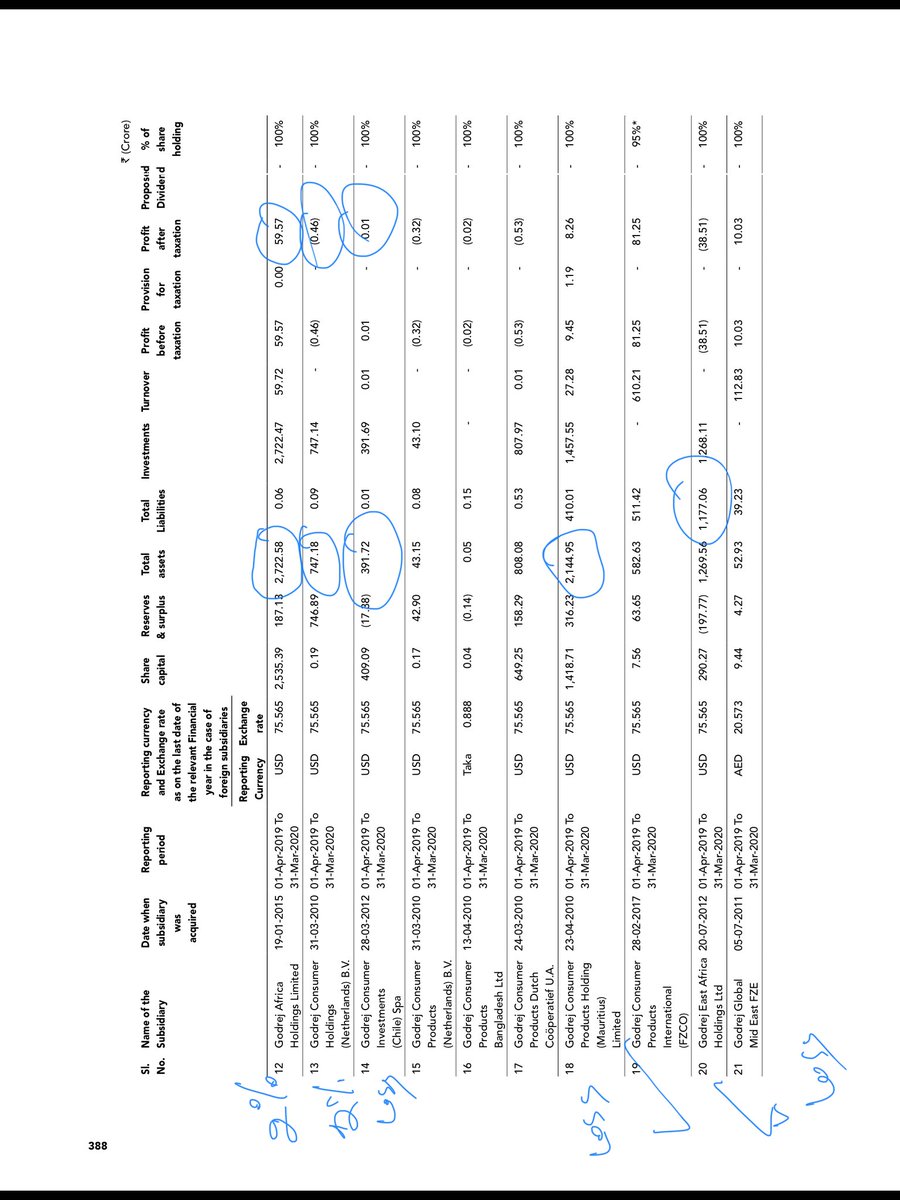

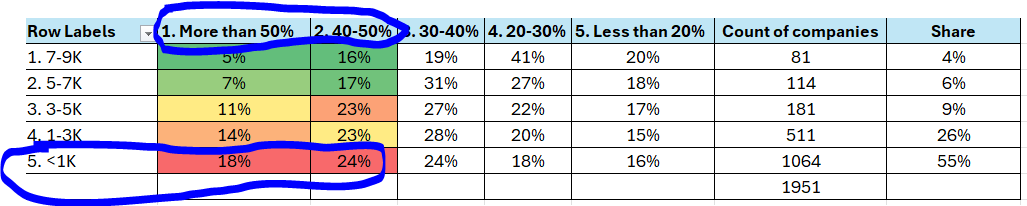

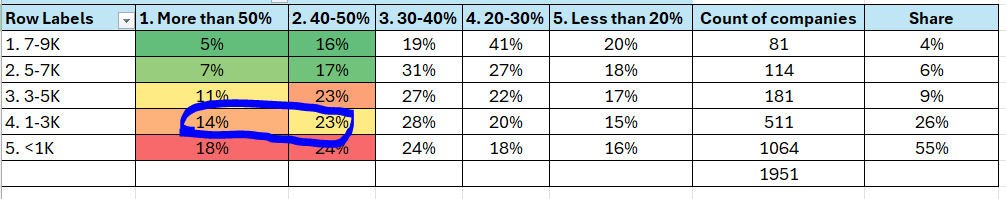

#ARNotes #Godrejconsumer Pretty long 1. One of Indian FMCG gone international but the acquired foreign business, specially Africa n LA are pain. Just look at some of subsidiary losses. Sorry for cartoon caricatures in between. Need to entertain my little one while reading 😁

• • •

Missing some Tweet in this thread? You can try to

force a refresh