Founder - Scientific Investing | SEBI Registered Investment Advisor (RIA) | Stock Market | Data Science - Top 40 under 40 DS | Guest Faculty | Ex- EY, HP, ICRA

18 subscribers

How to get URL link on X (Twitter) App

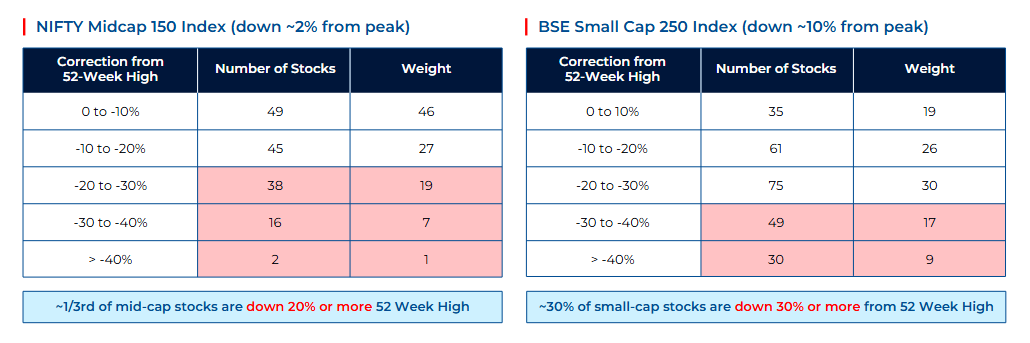

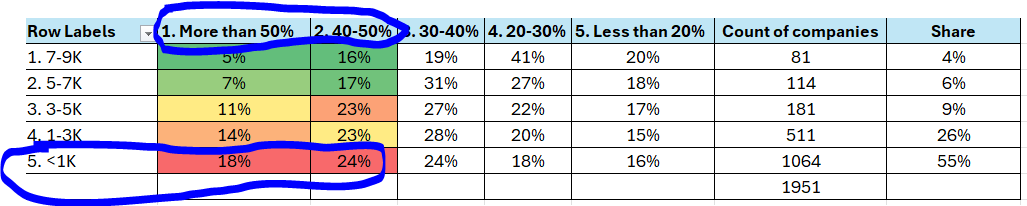

I have taken a universe of companies between Rs 200-9000 Cr. There are 1951 companies

I have taken a universe of companies between Rs 200-9000 Cr. There are 1951 companies

It does not stop here. When one looks at the balance sheet of the company, there is something interesting. It has a non-current investment of Rs 498 Cr

It does not stop here. When one looks at the balance sheet of the company, there is something interesting. It has a non-current investment of Rs 498 Cr

To start with market, how much the EPS needs to grow to justify the existing valuation against historic multiple.

To start with market, how much the EPS needs to grow to justify the existing valuation against historic multiple.

% of companies > 20D EMA has hit 80% where short term market becomes overheated if we are not in a clear bull market

% of companies > 20D EMA has hit 80% where short term market becomes overheated if we are not in a clear bull market

💡 Companies delivering > 15% Sales growth

💡 Companies delivering > 15% Sales growth

💡 Companies delivering > 15% Sales growth

💡 Companies delivering > 15% Sales growth

2/15

2/15

2/13

2/13

💡 Companies delivering > 15% Sales growth

💡 Companies delivering > 15% Sales growth

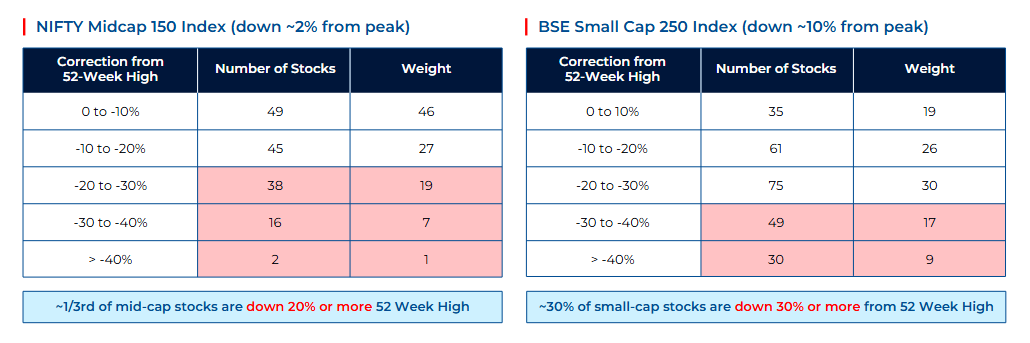

Was curious to check which institutions are selling because if I blindly look at charts - then all we see is stoploss. Something very interesting came out. First thing, looking at screener, looks like FIIs and DIIs are buying and retail is selling. Also, evident in falling count of retail investors. So, who is moving the prices down?

Was curious to check which institutions are selling because if I blindly look at charts - then all we see is stoploss. Something very interesting came out. First thing, looking at screener, looks like FIIs and DIIs are buying and retail is selling. Also, evident in falling count of retail investors. So, who is moving the prices down?

Are things turning around?

Are things turning around?

💡 Companies delivering > 15% Sales growth

💡 Companies delivering > 15% Sales growth

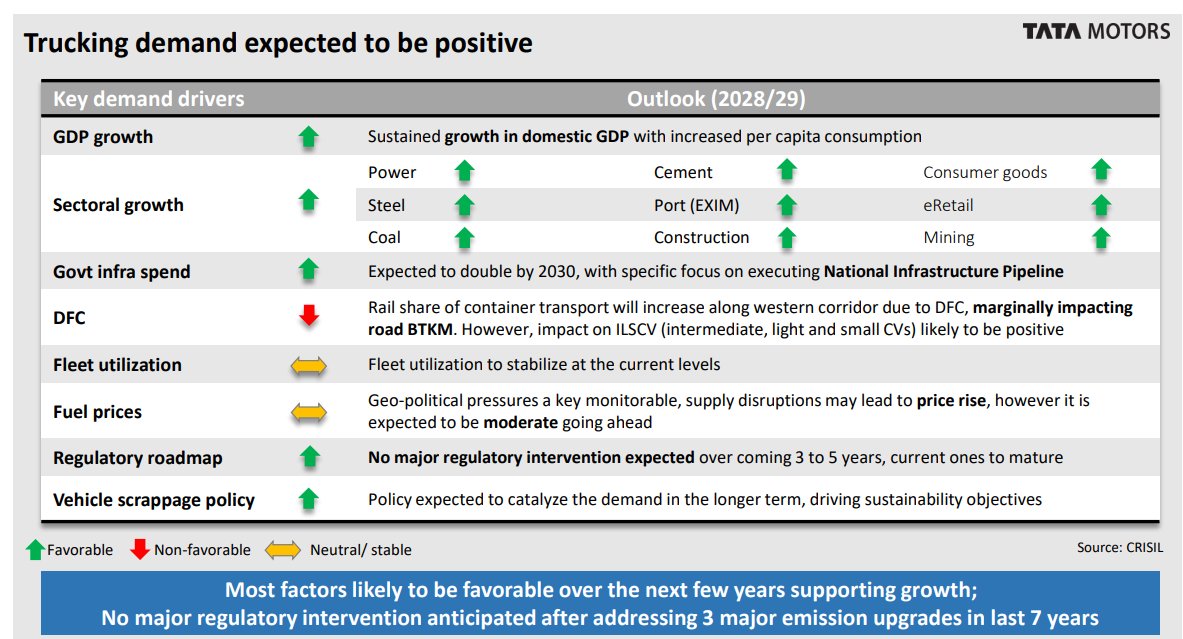

➡️What drives CV industry: DFC and fuel prices should be tracked from risk perspective for CV industry

➡️What drives CV industry: DFC and fuel prices should be tracked from risk perspective for CV industry

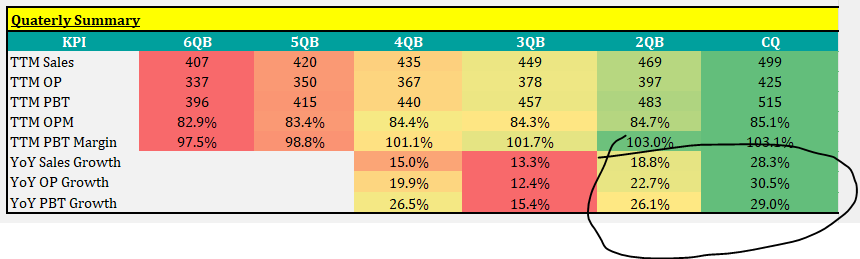

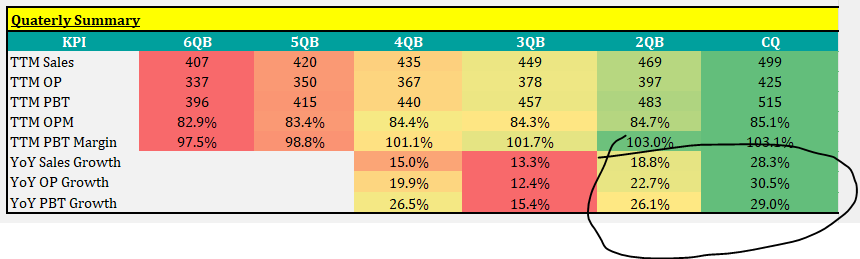

Given stock has not given good returns, it is important to understand if stock performed badly earnings wise in last 5 years. Nothing changed in last 5, 3, 1 year.

Given stock has not given good returns, it is important to understand if stock performed badly earnings wise in last 5 years. Nothing changed in last 5, 3, 1 year.