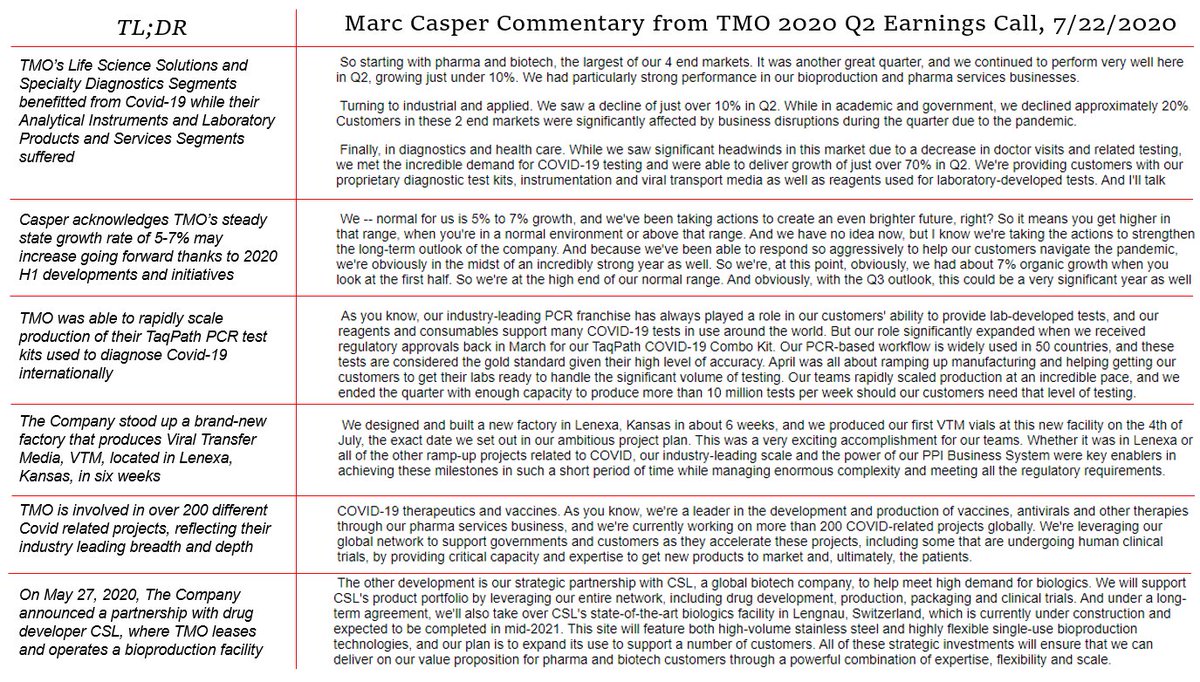

Thermo Fisher, $TMO, epitomizes this strategy

static1.squarespace.com/static/5ca38f3…

@bradsling

mckinsey.com/business-funct…

Casper joined Thermo as an SVP in 2006 following their acquisition of Kendro, a $200mm revenues / year business he lead as CEO

newtownbee.com/kendro-laborat…

The Company’s investments and response to the crisis evokes Andy Grove’s quote

venturebeat.com/2020/04/23/int…

Their failed Gatan and Qiagen bids evidence hurdles The Company will face due to their size

prnewswire.com/news-releases/…

reuters.com/article/us-qia…