👨🏭Getting rich slowly | 🌆 stonks {🧙♂️owner-operators🏯quality🥦 growth} 🎨Business & investing |🧘Happiness snob | #BillsMafia | 🐉Chaos is a ladder

2 subscribers

How to get URL link on X (Twitter) App

You can't overstate how impressive Couche-Tard's M&A program has been over the past decade and change

You can't overstate how impressive Couche-Tard's M&A program has been over the past decade and change

If a business uses shares to fund their investments, then that cost must be reflected as well.

If a business uses shares to fund their investments, then that cost must be reflected as well.

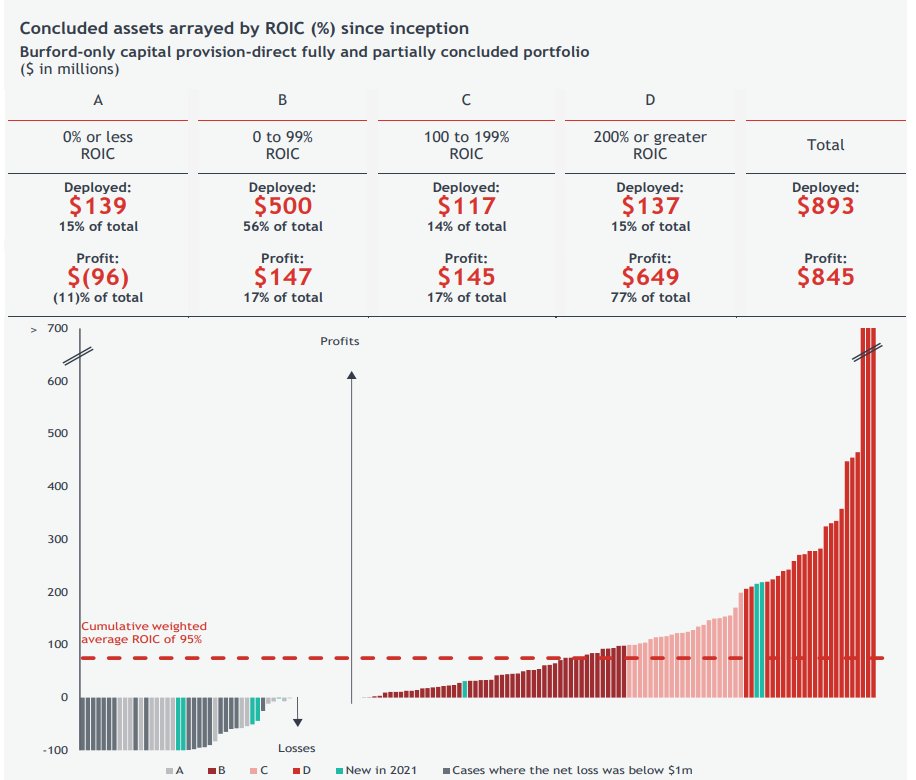

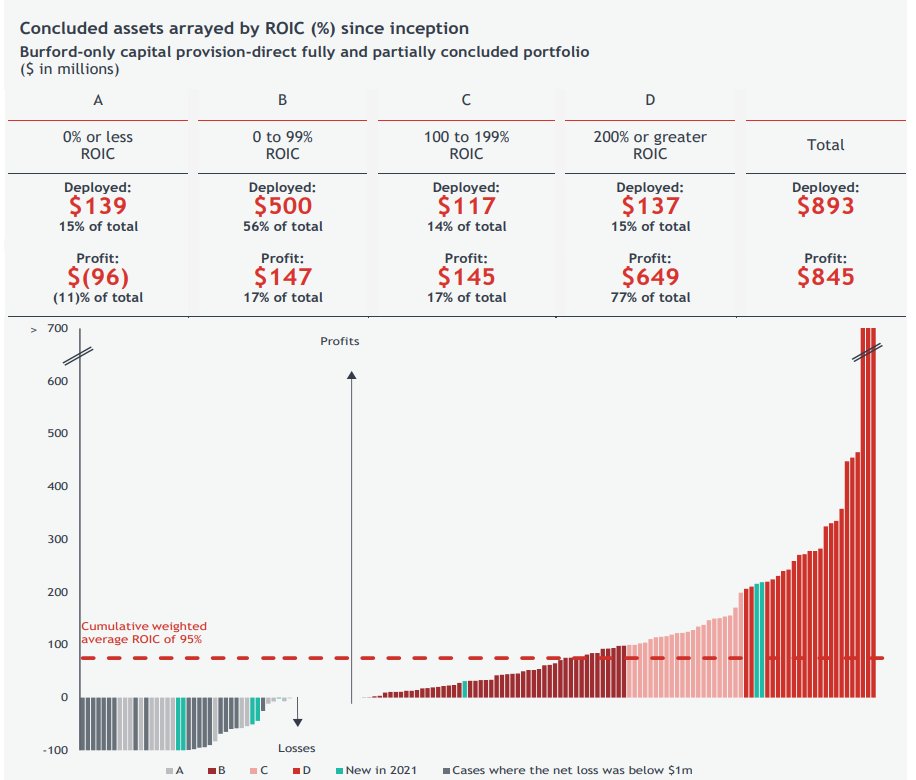

Some highlights from Burford's 11/2/2021 Investor Day:

Some highlights from Burford's 11/2/2021 Investor Day:

https://twitter.com/bizalmanac/status/1329455092219654146

It's simple but there is beauty in simplicity

It's simple but there is beauty in simplicity

https://twitter.com/bizalmanac/status/1303516456215343104?s=20

https://twitter.com/bizalmanac/status/1295391385672196097?s=202/TMO expects to generate $4.5B of Covid-19 related revenues in FY2020, 17.6% of their FY2019 revenues

2/ 2-9% of adults in the U.S. suffer from abnormal breathing during sleep, known as Obstructive Sleep Apnea (“OSA”). Heart attacks, strokes and other chronic conditions are highly correlated with OSA. Resmed, $RMD, is the leading provider of Sleep Apnea care products globally

2/ 2-9% of adults in the U.S. suffer from abnormal breathing during sleep, known as Obstructive Sleep Apnea (“OSA”). Heart attacks, strokes and other chronic conditions are highly correlated with OSA. Resmed, $RMD, is the leading provider of Sleep Apnea care products globally

2/ TMO uses cash generated from their resilient businesses, laboratory equipment, supplies and services as well as diagnostic instruments, and through a systemic M&A program, buys high optionality businesses serving the pharmaceutical industry

2/ TMO uses cash generated from their resilient businesses, laboratory equipment, supplies and services as well as diagnostic instruments, and through a systemic M&A program, buys high optionality businesses serving the pharmaceutical industry

https://twitter.com/bizalmanac/status/1267543120910188544?s=20

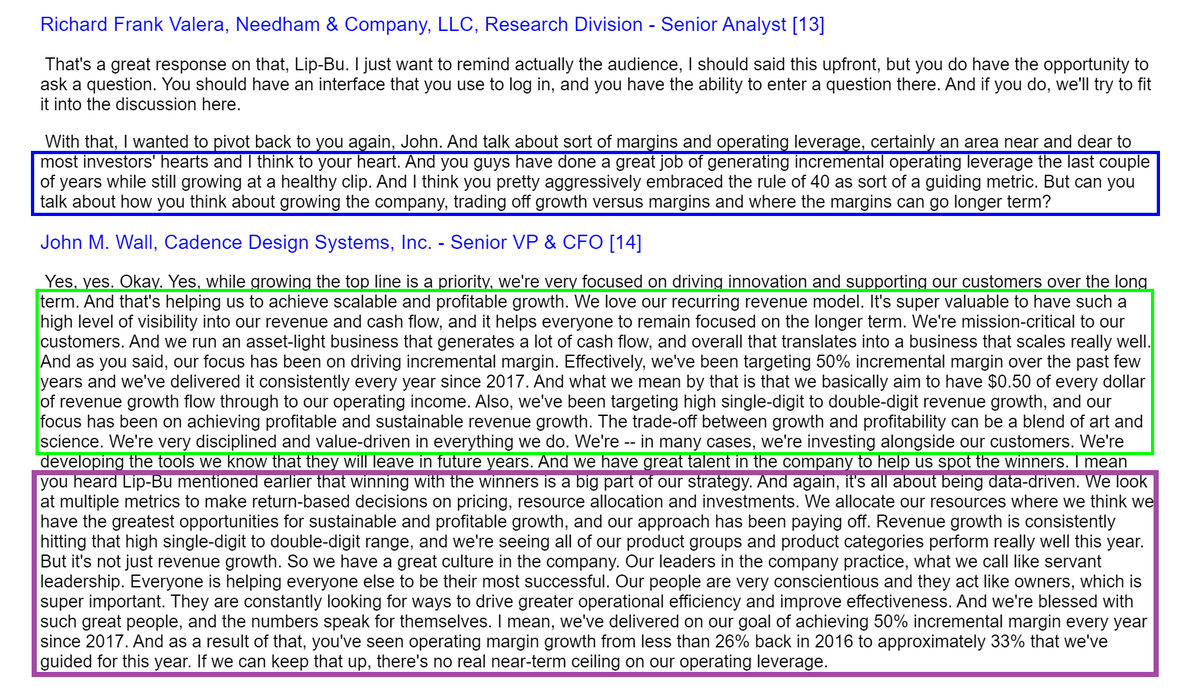

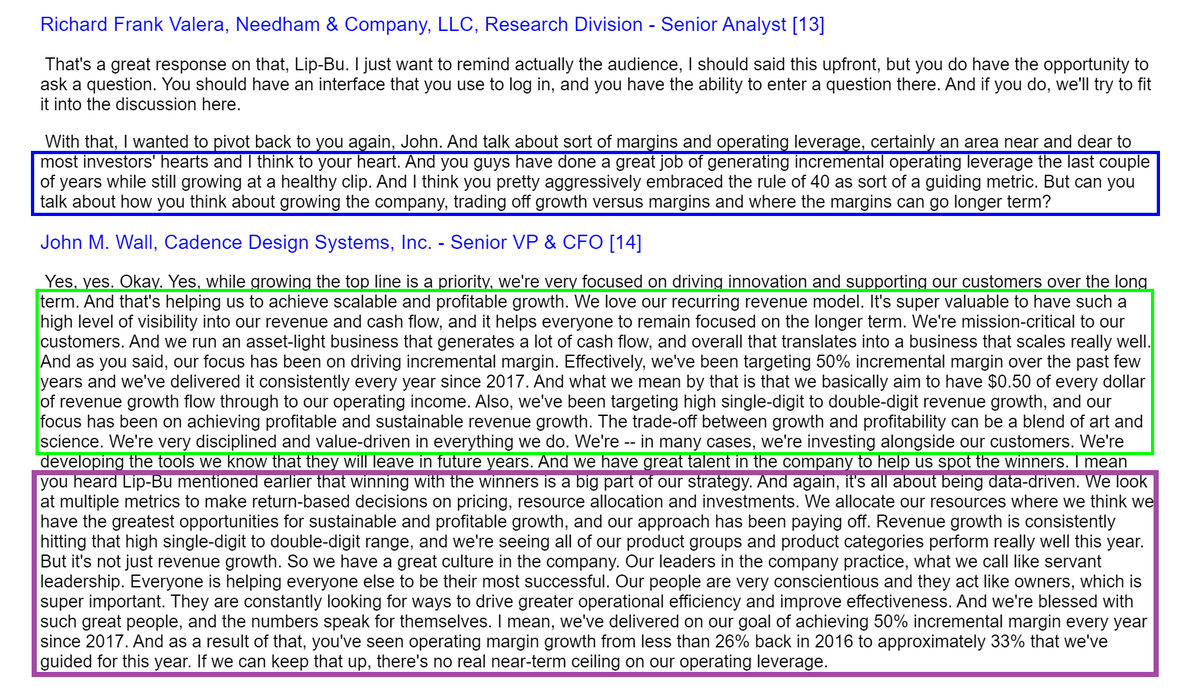

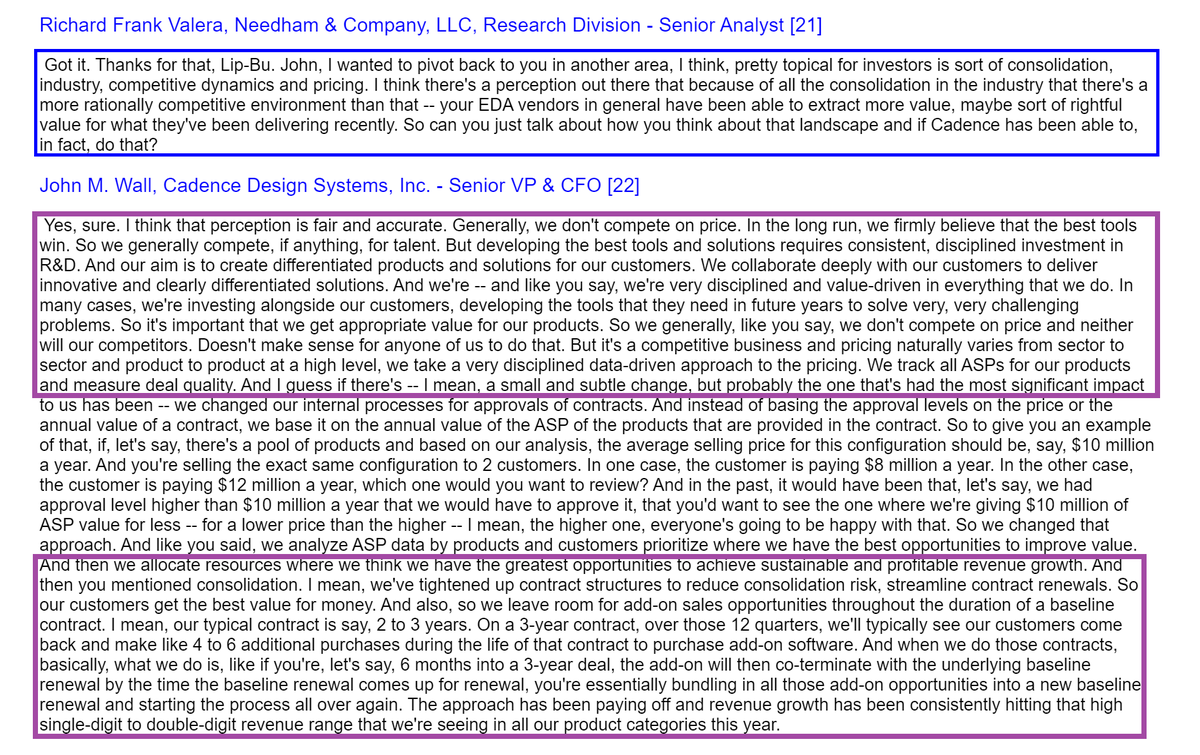

2/ Cadence is the second largest EDA business behind Synopsys with $2.4B and $3.3B of TTM sales respectively

2/ Cadence is the second largest EDA business behind Synopsys with $2.4B and $3.3B of TTM sales respectively

https://twitter.com/walshgb/status/1284198716686176257?s=20

2/ Roper reports across four segments, two that provide VMS and contribute ~65% of earnings power and the other two offering industrial and medical devices. Over the next four tweets, I pair a thumbnail of each segment’s financial profile, with its description from ROP’s 2019 10K

2/ Roper reports across four segments, two that provide VMS and contribute ~65% of earnings power and the other two offering industrial and medical devices. Over the next four tweets, I pair a thumbnail of each segment’s financial profile, with its description from ROP’s 2019 10K

https://twitter.com/InvestLikeBest/status/1286707971645480961?s=20

2/ SPSC is a cloud-hosted EDI software used by retailers, their suppliers and logistics providers. EDI, Electronic Data Interchange, is a set of common syntax that allow regular business transaction to be processed automatically, see details below

2/ SPSC is a cloud-hosted EDI software used by retailers, their suppliers and logistics providers. EDI, Electronic Data Interchange, is a set of common syntax that allow regular business transaction to be processed automatically, see details below

Since Andreesen’s prophetic essay, enterprise software sales have nearly doubled, growing from $245mm in 2010 to $456mm in 2019, a CAGR of 7.1% according to Gartner. In January 2020, Gartner projected increased growth of 10.5% for the industry through 2021 (2/14)

Since Andreesen’s prophetic essay, enterprise software sales have nearly doubled, growing from $245mm in 2010 to $456mm in 2019, a CAGR of 7.1% according to Gartner. In January 2020, Gartner projected increased growth of 10.5% for the industry through 2021 (2/14)