Based on a 1994 Forbes profile and this interview from 2000

d2wsh2n0xua73e.cloudfront.net/wp-content/upl…

-Cost discipline

-Invest in key revenue drivers

-Hire great people, leave them alone (autonomy), incentivize with equity (but review expenses in detail against the annual budget)

-Disciplined capital allocation: acquisitions or buybacks

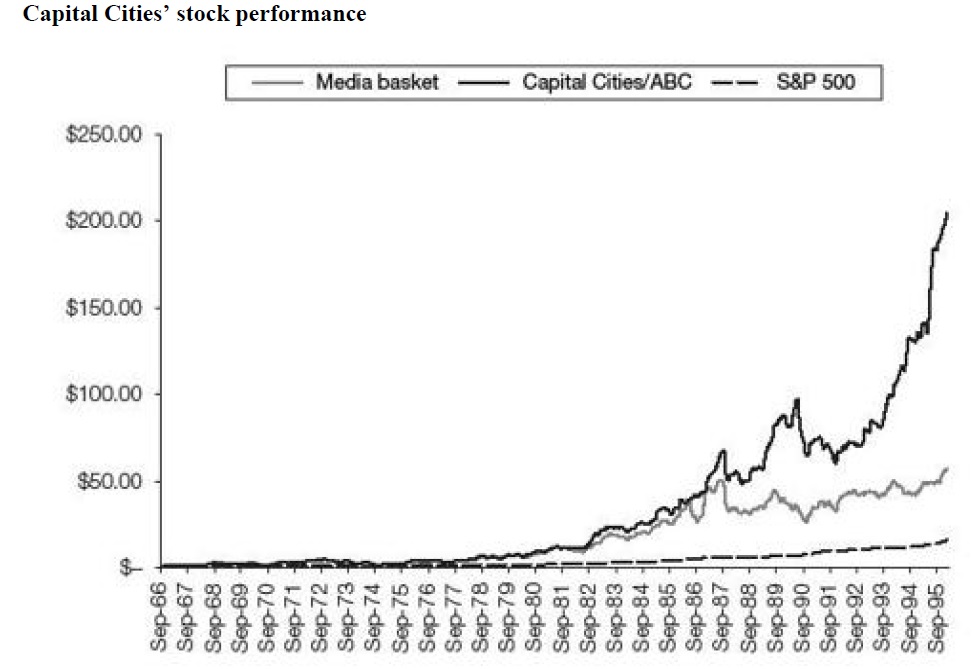

"We just kept buying assets, intelligently leveraging the company, improving operations, and then we'd go on and take a bite out of something else."

Burke explained: "my job was to create the free cash flow and Murphy's was to spend it."

"Decentralization is the cornerstone of our philosophy. Our goal is to hire the best people we can and give them the responsibility and authority. We expect our managers to be forever cost conscious and to recognize sales potential."

"The reason you're scared to leave is because the system we have corrupts you with autonomy and authority. After you live that way, you're very fearful that someplace else wouldn't be the same."

How do you proactively defend yourself against a hostile takeover?

"I love the action. Every day you get a scorecard on how you did the day before. You're winning and losing every day! I like competition. I like winning.

I don't like losing, but the only thing that would be worse is not being in the game."