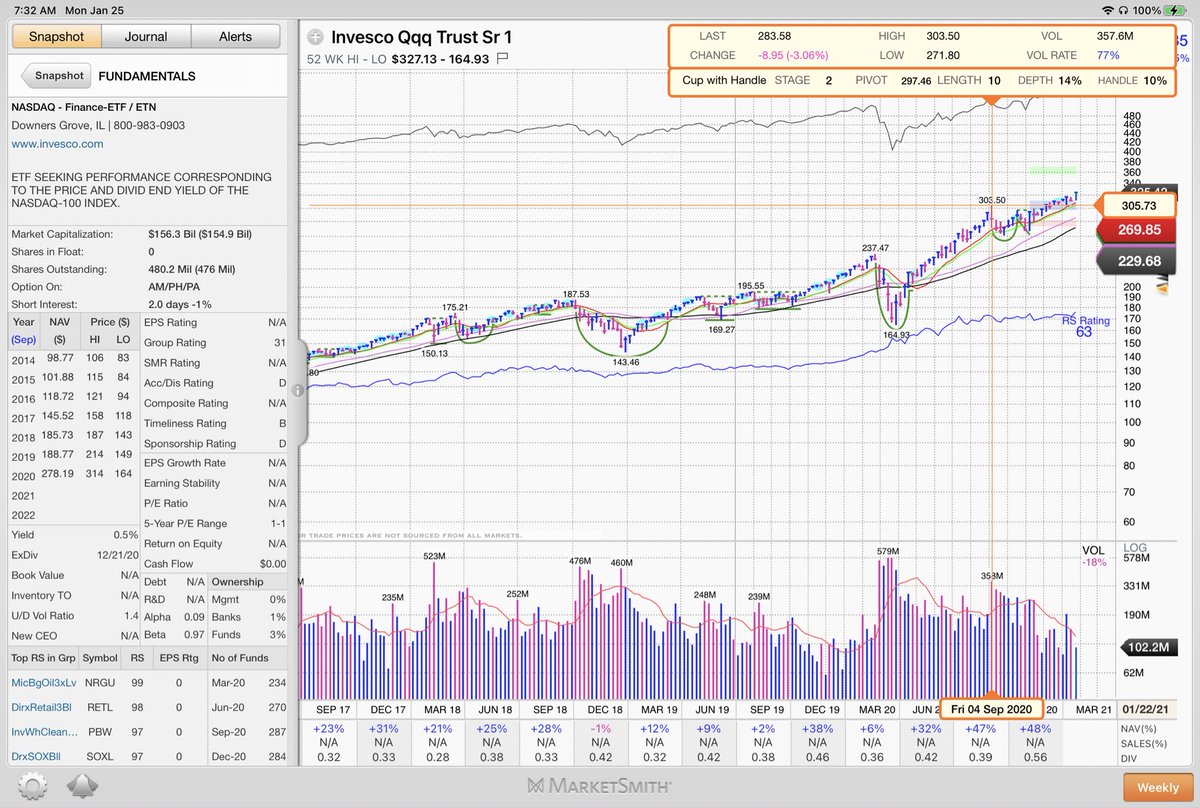

Market Thoughts: We’ve had an unbelievable run since the FTD but I can’t ever ignore or get complacent with how well things have been. This is a pretty classic lockout rally IMO. Constant shake outs to the 21ema on the has frustrated many. (1/...)

But when I see the indices not shaking much anymore, it tells me there might be a big boy pullback coming. Over the years I’ve noticed this phenomena. That very tight tight action on the daily. (2/...)

Couple this with leaders still working on Stage 2 bases as well as EXTREMELY euphoric sentiment readings, the case for it is very possible. Also, now the has a mini cluster of D-Days (4), albeit low. (3/...)

But remember that we are now an outstanding 20 weeks from the FTD with some quasi railroad tracks last week on the NAZ. That has been the leading index this entire rally so my attention is there. Job Number 1 for me is to manage risk and I will be flexible to anything. (4/...)

However, I also want to keep my expectations realistic with any adds or new buys. I taught @thelagunapadre years back to always put the wind at your back with new buys. Leaders, indices, sentiment, etc. (5/...)

When putting on exposure (as a position trader), I want as many things going for me as possible and right now I see valid setups on TMLs but a disparity on the . It and the NAZ are in thin air as well as the overly bullishness. (6/...)

Long winded but I see a million tweets on and just want folks to stay grounded and humble. Week 4 of >85 readings on the NAAIM and a low Equity Put Call. At some point, the institutions will correct the excesses. (7/...)

The ideal situation for me is for the indices to correct while the TMLs show strength and we begin to see those RS lines begin to perk back up. (8/...)

But at the end of the day, I’m a trend follower and will take action on a stock by stock basis. I play each of my positions against my cost and support levels and not against the indices.

Just some thoughts. Blame Ripley if my speculation is wrong. 🦆 🐕 😎

Just some thoughts. Blame Ripley if my speculation is wrong. 🦆 🐕 😎

• • •

Missing some Tweet in this thread? You can try to

force a refresh