Imperfect Catholic, hunter, fisherman, dog lover, and PM. Disclaimer: Trade at your own risk. All opinions not investment advice. Investing/trading since 2004.

5 subscribers

How to get URL link on X (Twitter) App

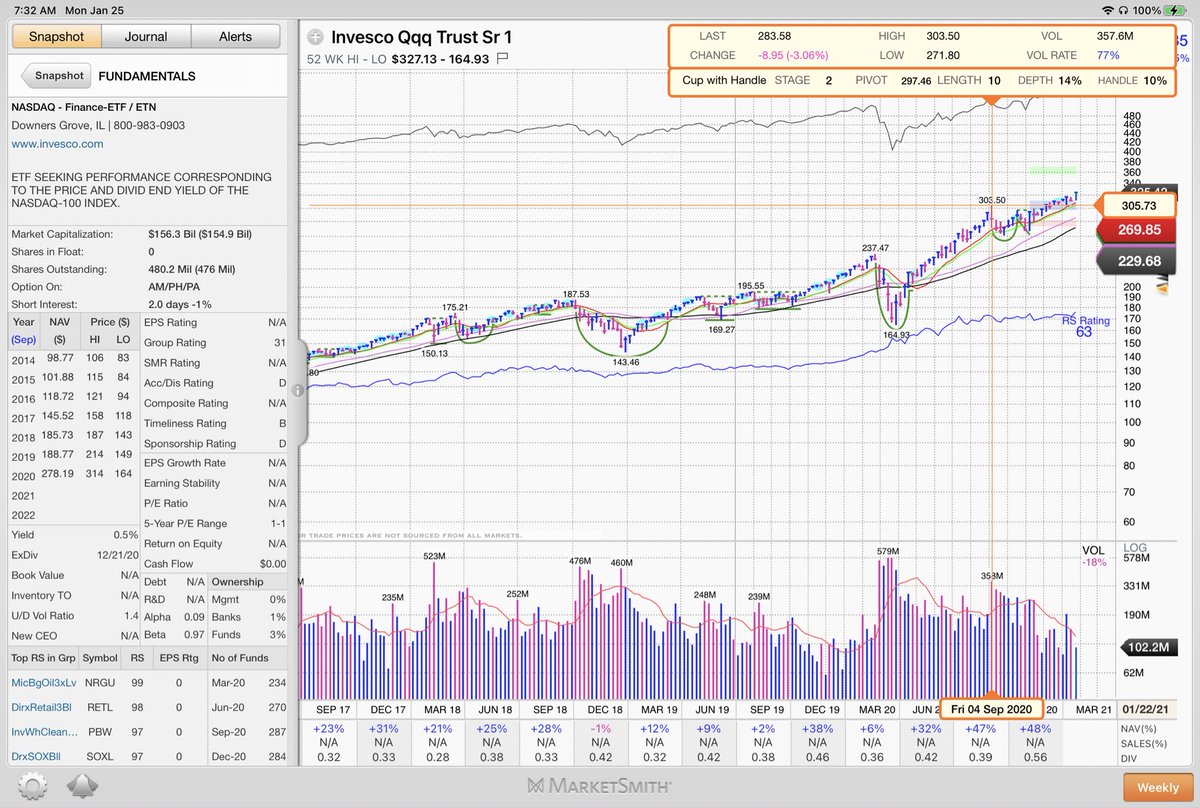

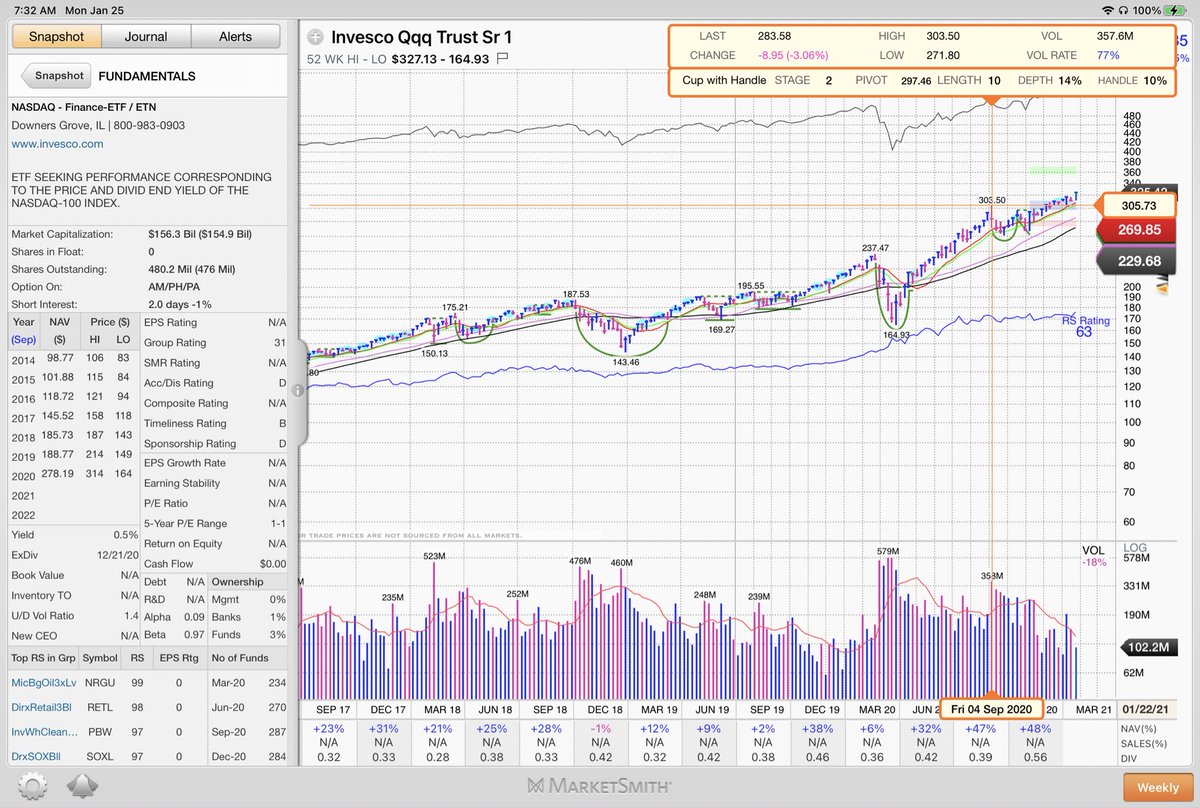

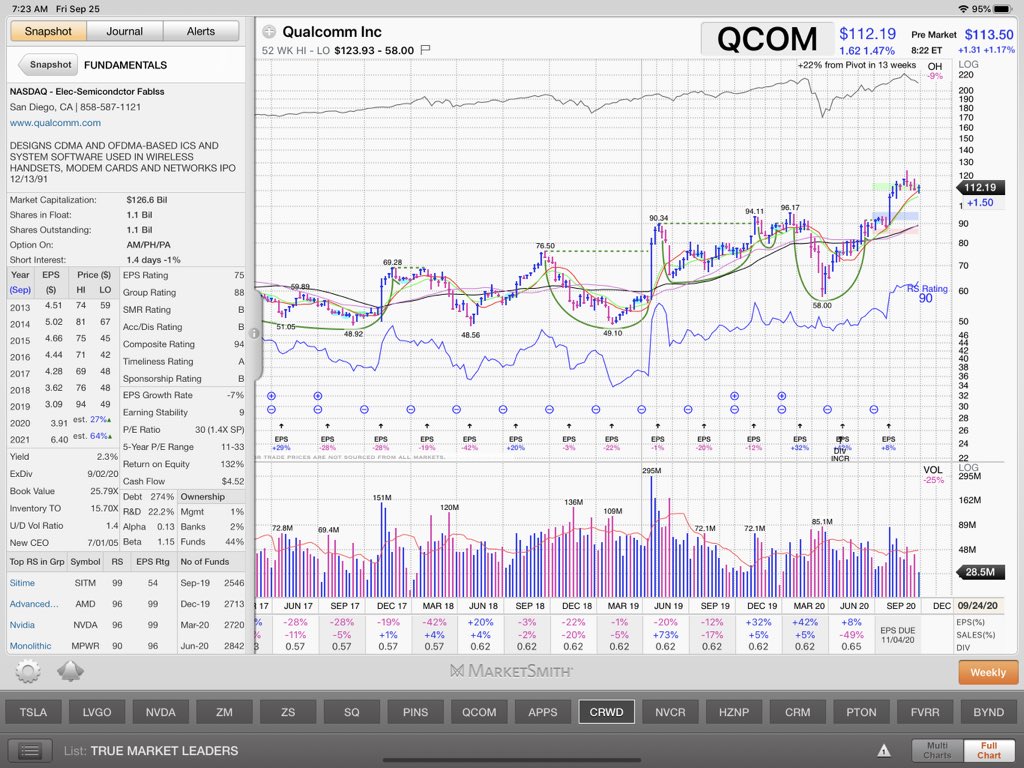

Short-term, the market is certainly well within its right to pullback 5% from highs and be totally normal which will put us at or below the 21ema on the $QQQ. I evaluate my portfolio for stocks lagging or gains that are mediocre in gap up mornings like this to sell into.

Short-term, the market is certainly well within its right to pullback 5% from highs and be totally normal which will put us at or below the 21ema on the $QQQ. I evaluate my portfolio for stocks lagging or gains that are mediocre in gap up mornings like this to sell into.

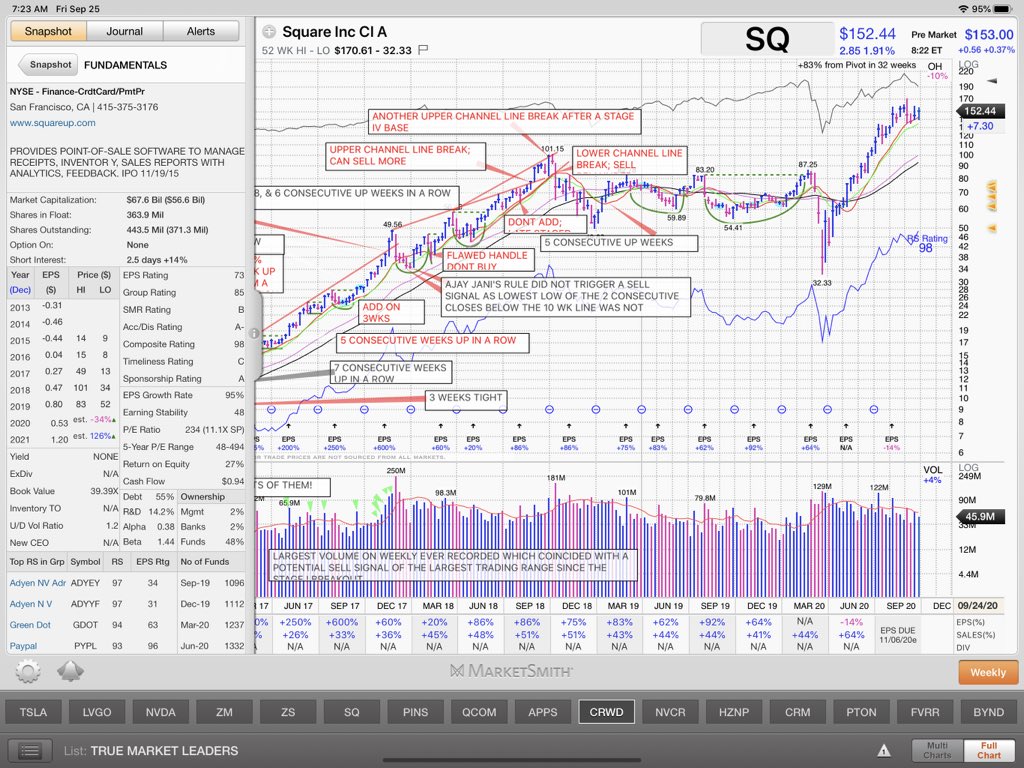

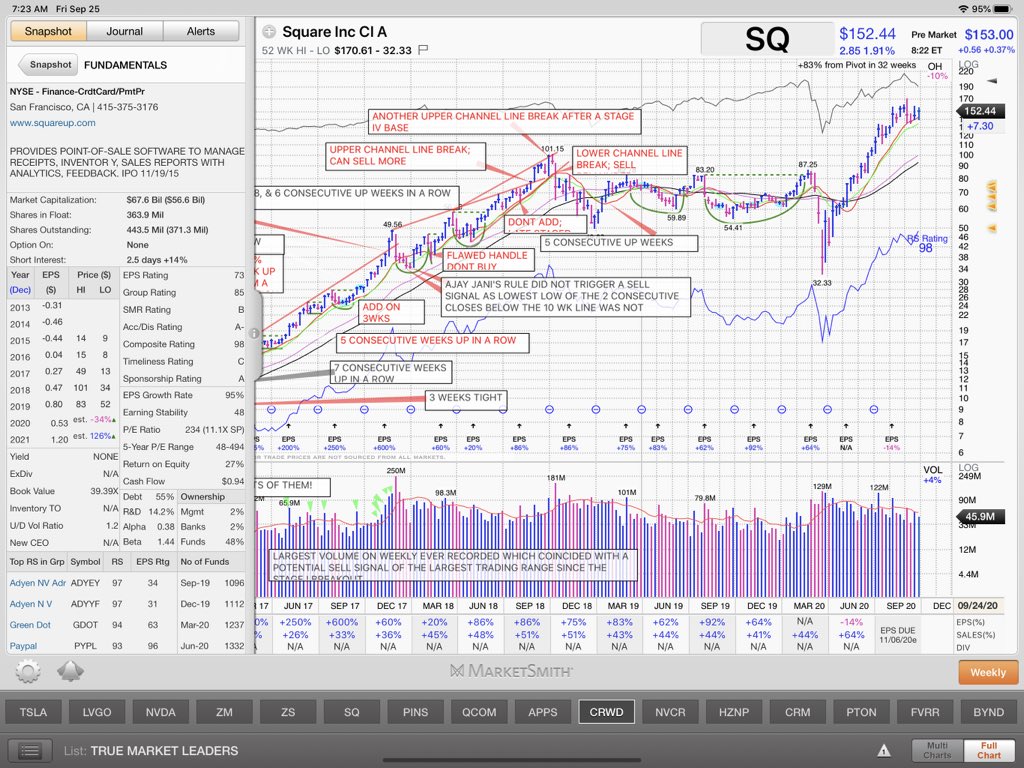

When a liquid name is gapping up, it’s more difficult for institutions and algos to shake out on the gap day. Here’s a 15 minute of . To get the price to come in, they have to sell blocks of shares. Hence, the intraday pullbacks are more orderly.

When a liquid name is gapping up, it’s more difficult for institutions and algos to shake out on the gap day. Here’s a 15 minute of . To get the price to come in, they have to sell blocks of shares. Hence, the intraday pullbacks are more orderly.