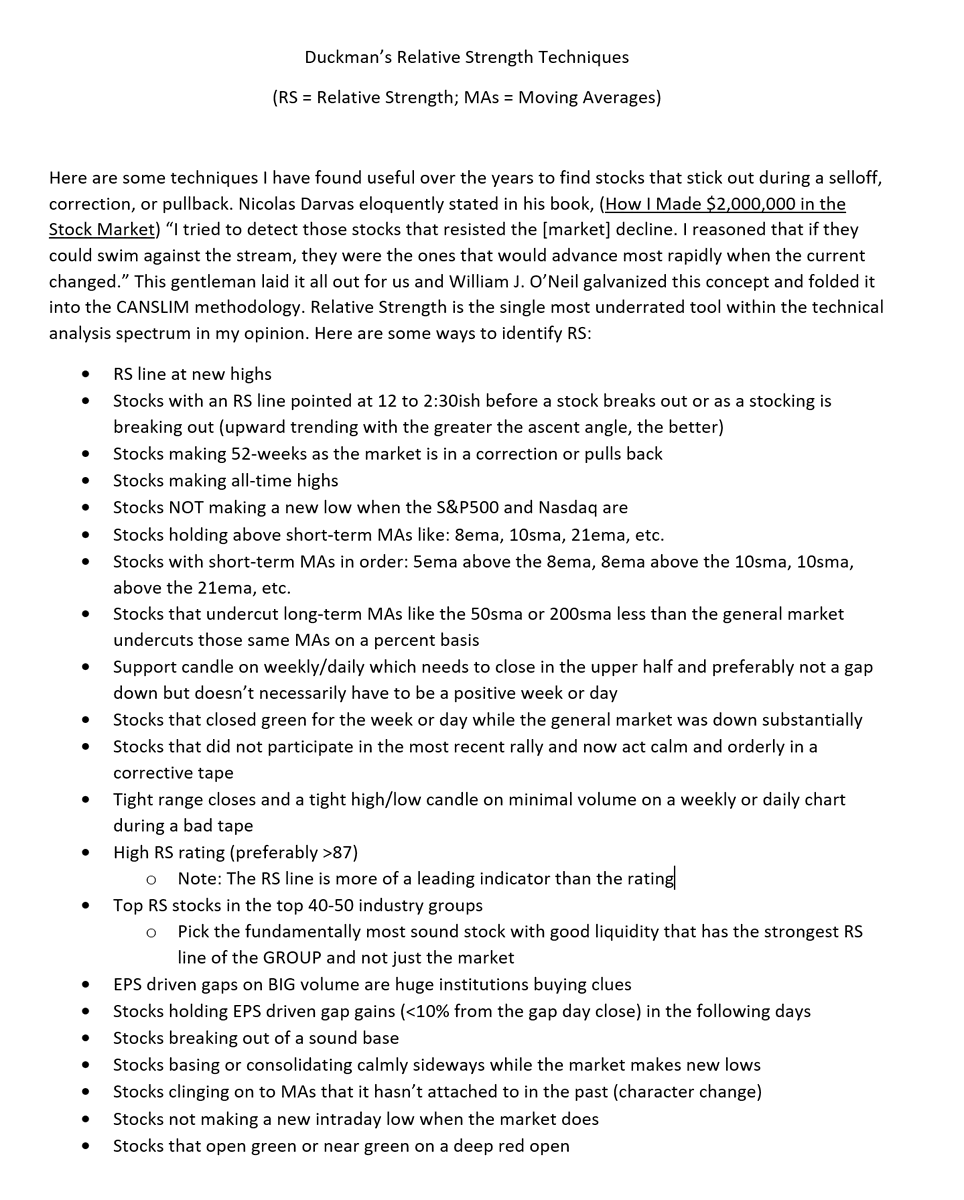

I tweeted my #RelativeStrength techniques out for new followers on 2/24/2020. I decided to update it a bit with new techniques that I have found studying this most recent Bear Market. I hope ya'll enjoy and can apply some of this in your careers/trading.

Cheers. 🦆🇺🇸🐕🍻

Cheers. 🦆🇺🇸🐕🍻

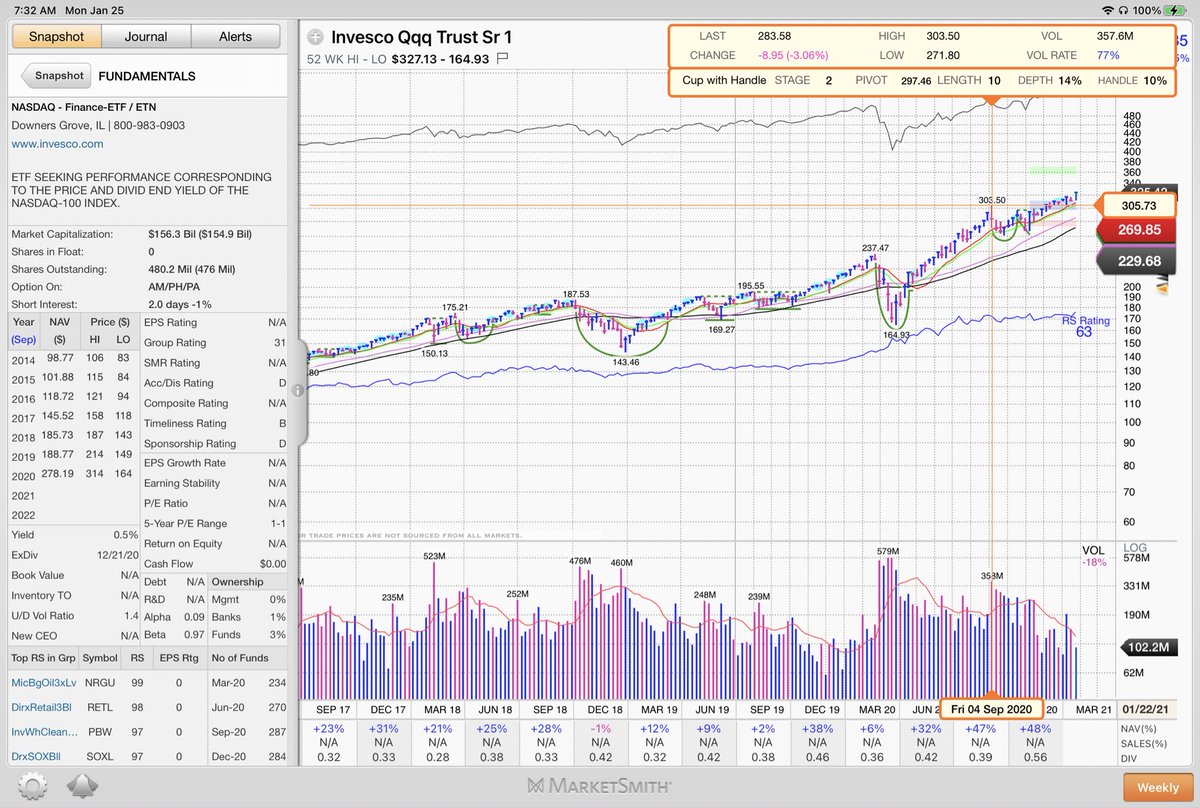

During any harsh corrective periods or bear markets when the market is below the 50sma/200sma, pay attention to the % of stocks above their 50sma and 200sma. Notice how it got to 7% (% above 200sma) at the March lows? That was our queue to find those 7%. .

You did this by starting with the fundamentals and liquidity first to weed out the crap. Here are some select growth stocks that either didn't undercut the 200sma as much as the general market or didn't even touch it in March 2020:

$ZM, $DOCU, $DXCM, $TSLA, $TDOC, $AMD, $QDEL

$ZM, $DOCU, $DXCM, $TSLA, $TDOC, $AMD, $QDEL

• • •

Missing some Tweet in this thread? You can try to

force a refresh