ALRIGHT! FOLLOWER APPRECIATION TIME 🎉

Thank you all for listening/considering my words when i was still considered a nobody! The key to seeing what's coming is to be able to consider information on it's own merit. I learned this year how rare that ability is really is. 1/x

Thank you all for listening/considering my words when i was still considered a nobody! The key to seeing what's coming is to be able to consider information on it's own merit. I learned this year how rare that ability is really is. 1/x

So as a thank you, I'm gonna go through my entire stock portfolio! All of my current positions and my sisters, with the reasons why.

It's not Advice, don't blame me if you invest and ride down with me. But it exposes you to my logic thinking at the least, a good deal at best 2/x

It's not Advice, don't blame me if you invest and ride down with me. But it exposes you to my logic thinking at the least, a good deal at best 2/x

HOWEVER! Since i've run out of money (i know nobody with any kind of even decent money) i DO have an offer for anybody interested in riding a *really* good stock up with me. More about that later.

This'll be a LONG thread!(gimme time to build) Without tags just for you guys! 3/x

This'll be a LONG thread!(gimme time to build) Without tags just for you guys! 3/x

I'll Recap my sister's positions first. These are rock solid IMO; they WILL go up considerably within the next 3 years. Just not as much as the Pennies.

First up: Barrick, Ticker GOLD. Bought it because Buffett did.

Why? Safety. My sister means the world to me. 4/x

First up: Barrick, Ticker GOLD. Bought it because Buffett did.

Why? Safety. My sister means the world to me. 4/x

Say about Buffett what you want but his method does work for building ungodly wealth. The only question is, has he made a mistake on this?

That's simply fundamentals. The reason he fumbled on the airlines is because he bet on shitty fundamentals getting better. 5/x

That's simply fundamentals. The reason he fumbled on the airlines is because he bet on shitty fundamentals getting better. 5/x

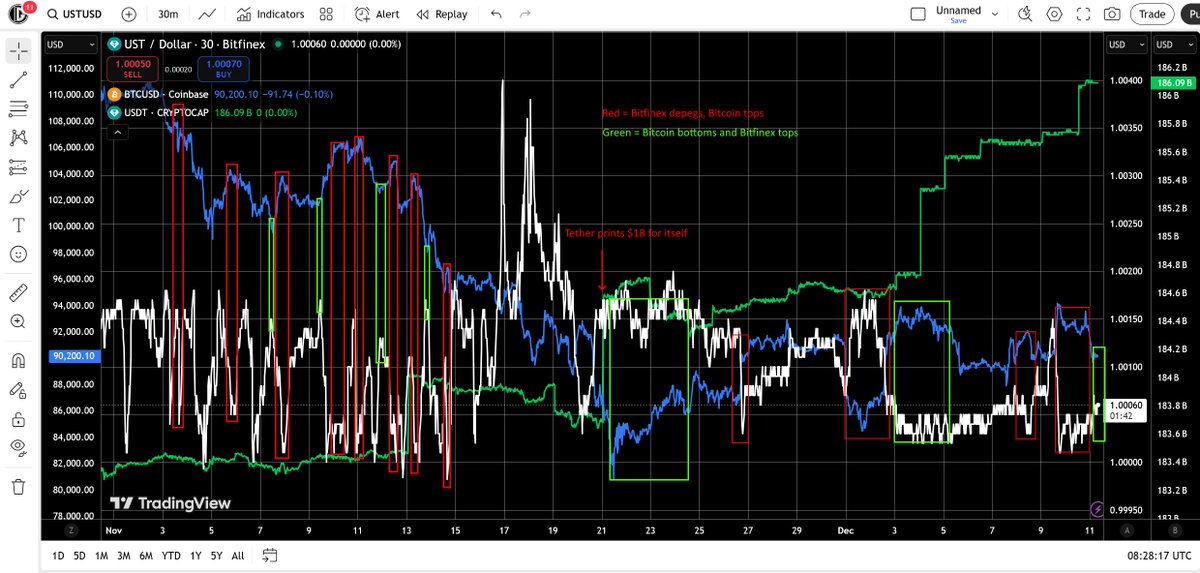

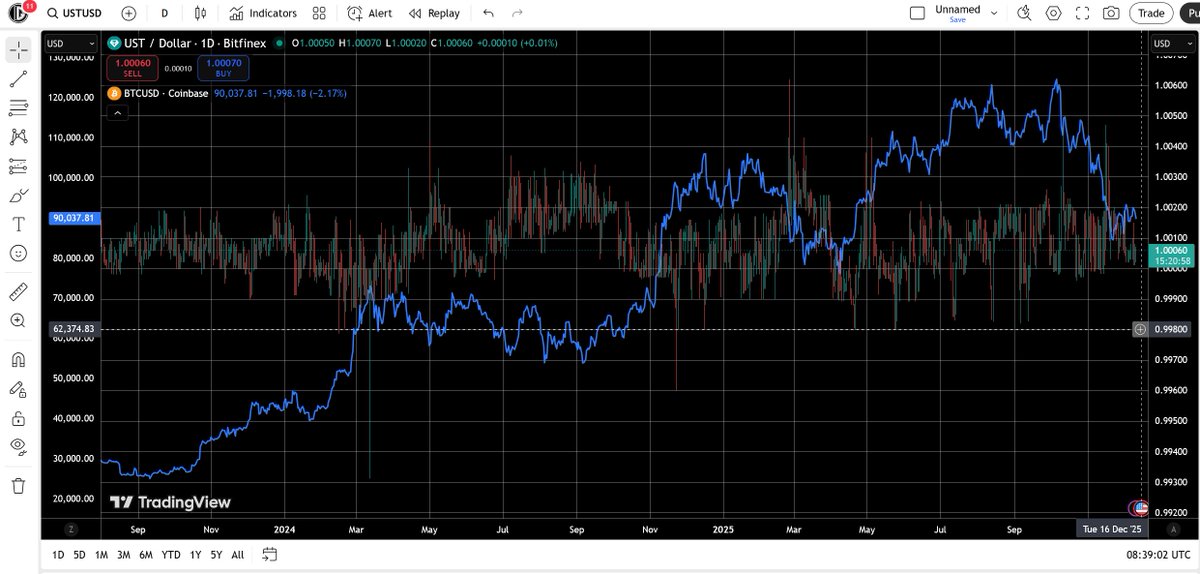

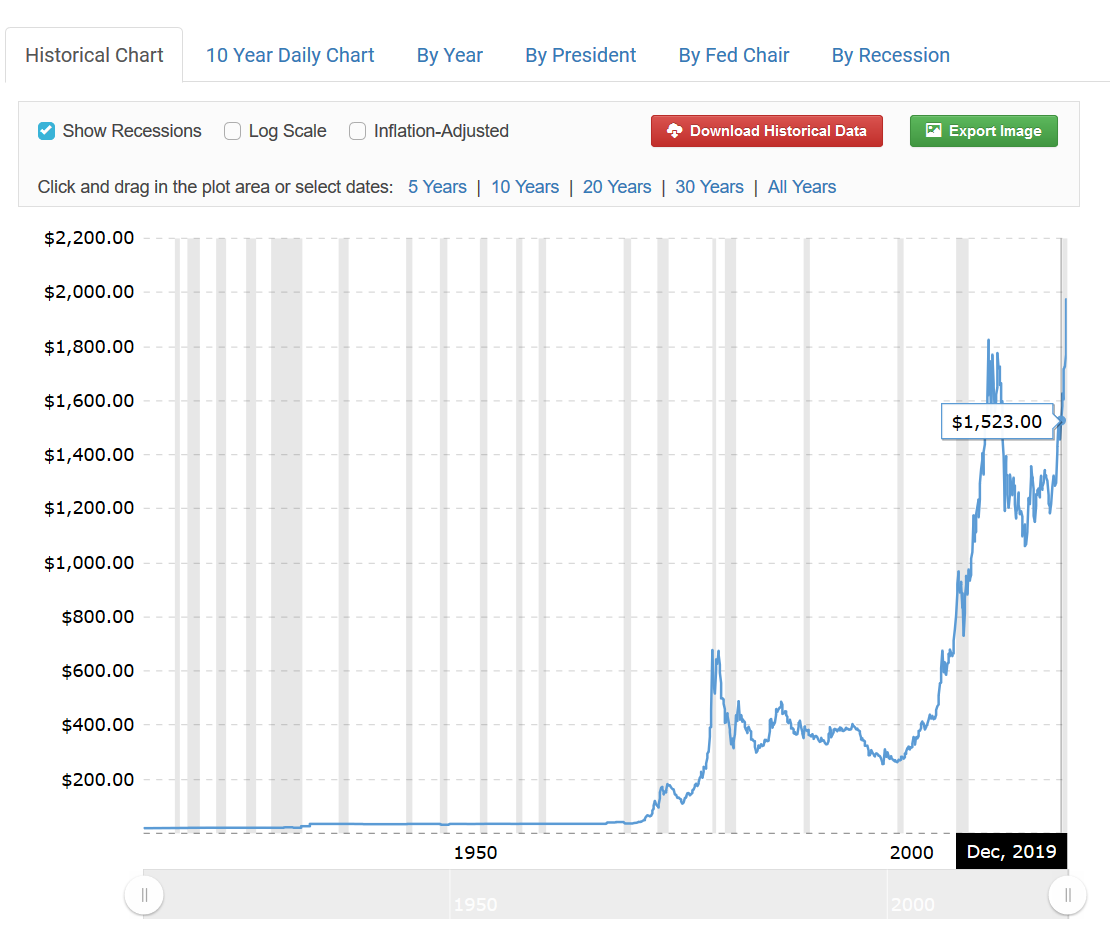

Gold's fundamentals for high prices in the future remain incredibly strong. Attached is gold over the past 100 years. Inflation corrected, Nominal, and my expectations for it.

Note my expectations are from the Inflation corrected chart. Nominally prices would be much higher. 6/x

Note my expectations are from the Inflation corrected chart. Nominally prices would be much higher. 6/x

The reasons for that pattern recurring are in place. Money will continue to be printed.

If more money is available, but spending power doesn't decrease, wealth flows against human nature and this simply cannot happen.

All assets in the world would be owned by 1 entity. 7/x

If more money is available, but spending power doesn't decrease, wealth flows against human nature and this simply cannot happen.

All assets in the world would be owned by 1 entity. 7/x

And it's human nature to desire wealth. Because it is directly correlated with survival; more wealth = easier survival. And it will continue to be so until the day Replicators are invented.

Buffett can lose BILLIONS, and still be O.K. Most people get into trouble at $1000. 8/x

Buffett can lose BILLIONS, and still be O.K. Most people get into trouble at $1000. 8/x

When people have nothing to lose, they have everything to gain. This places a floor under logical behavior

No matter how logical it is that a situation goes on, if too many people lose nothing by burning it down they will, because they stand everything to gain from the ashes 9/x

No matter how logical it is that a situation goes on, if too many people lose nothing by burning it down they will, because they stand everything to gain from the ashes 9/x

And the moment that happens, the people who Still have things to lose, seek safety. Historically, that safety has been Gold. And literally everybody benefits from gold being a ultimate "backup" to the machinations of value.

Burn it all; And gold will still be shiny. 10/x

Burn it all; And gold will still be shiny. 10/x

Therefor Buffett has not made a mistake. His bet on gold is correct. So the only question left is has he made a mistake in Barrick?

P/E of 11.51, P/B 2.32, Market cap of $51B/Enterprise value of $61B, and the share price is still 1/2 of the 2011 peak.

I think it'll be fine 11/x

P/E of 11.51, P/B 2.32, Market cap of $51B/Enterprise value of $61B, and the share price is still 1/2 of the 2011 peak.

I think it'll be fine 11/x

Don't worry i won't do a lengthy explanation for every commodity. Gold drags up all commodities regardless, because it's in effect the currency deprecation pushing them up. Follow the leader as they say.

Getting in gold now may not be early it is very sensible. 12/x

Getting in gold now may not be early it is very sensible. 12/x

2nd Stock! Yamana Gold. Same fundamentals as Barrick. However, dividend is higher while it hasn't run up as much yet. P/E of 21.62 (i'll get to that in a moment), but a P/B of 1.34!!! Enterprise value $6,5 billion, Market cap $5,65B.

Same stats as Barrick, just smaller. 13/x

Same stats as Barrick, just smaller. 13/x

Think Buffett can't deal with that cause he's spent more money then that when he's sneezed, but under the hood it's much better then Barrick, aside from the P/E.

So why the P/E and pricelag? Shut downs because of the Virus.

Explained here: seekingalpha.com/article/436068… 14/x

So why the P/E and pricelag? Shut downs because of the Virus.

Explained here: seekingalpha.com/article/436068… 14/x

"Production is already tracking ahead of guidance with Q4 expected to be an exceptionally strong quarter on both production and cost."

Thanks to the virus shutdowns, Q1 production was crap, which depressed the price. This is sure to go up. Just read that one page. 15/x.

Thanks to the virus shutdowns, Q1 production was crap, which depressed the price. This is sure to go up. Just read that one page. 15/x.

3rd stock! Gazprom. Dropped in price recently now even more ridiculously attractive. P/E 8.07, P/B 0.32, MC (market cap) $58,44B. EV (Enterprise value): $110.53B!!!

RIP US investors, but i'm not an US investor ^_^ Nord Stream 2 *will* be finished. Natgas is a commodity too. 16/x

RIP US investors, but i'm not an US investor ^_^ Nord Stream 2 *will* be finished. Natgas is a commodity too. 16/x

Not just that, but they increased their dividend recently, are on track to pay out more in the future (8% dividend already vs 1% in the gold sector) and EVEN WITH a -15% revenue growth, their NET income was +$7 billion.

I have BOTH my sisters and my money in it. 17/x.

I have BOTH my sisters and my money in it. 17/x.

I'm taking a lil sidepath here to talk about 2 of my own stocks before my sister's final one, to stick with the same commodities.

The single gold stock i have is Karora Resources, which was the Royal Nickel Corporation until May. This is the least "penny" of my stocks :D 18/x

The single gold stock i have is Karora Resources, which was the Royal Nickel Corporation until May. This is the least "penny" of my stocks :D 18/x

By that it's the most mature company i have, and a "hedge" against the more extreme speculations.

Now, when it comes to my (penny) stocks, i look for different "markers" of cheapness then i do for "rocksolid" stocks. This because metals are a very capital intensive business 19/x

Now, when it comes to my (penny) stocks, i look for different "markers" of cheapness then i do for "rocksolid" stocks. This because metals are a very capital intensive business 19/x

Because they'll usually spend themselves into a hole getting things started; so when fundamentals LOOK the most shit is ironically when you want to buy.

In Karora's case, P/E of 24.5, equal MC to EV, 4.54 P/B. Certainly no Barrick or Yamana. So why was this the one? 20/x

In Karora's case, P/E of 24.5, equal MC to EV, 4.54 P/B. Certainly no Barrick or Yamana. So why was this the one? 20/x

This page in their earnings report. As well as the recent sale of their nickel cobalt project. Their revenue has increased by staggering amounts.

They've pivoted to a full blown medium Gold Producer. They changed names, and did a reverse 4-to-1 stock split recently. 21/x

They've pivoted to a full blown medium Gold Producer. They changed names, and did a reverse 4-to-1 stock split recently. 21/x

Revenue growth is 103%! WITH the pandemic! They've had 2 quarters now where shares where no longer diluted and they turned a profit.

They recently bought another high grade gold project. Their production is in Western Australia, so a safe district. Only a matter of time. 22/x

They recently bought another high grade gold project. Their production is in Western Australia, so a safe district. Only a matter of time. 22/x

Now i have 1 more precious metal stock, in Silver. Just as a reminder i also have 305 ounces of Silver (and 2 gold) in a vault, which is why i'm light on miners. Physical > all.

Despite that, i wanted a little more exposure. And, i found this miner based on a story :D 23/x

Despite that, i wanted a little more exposure. And, i found this miner based on a story :D 23/x

Klondike Silver Corp. MC $7,23M, EV $8,45M, 0.89 P/B (MC and P/B have doubled since i found them). Why these guys?

Cause i grew up reading the Donald Duck Weekly and ol' McScrooge made his fortunes in the mines of the Klondike :D So i looked for "Klondike" on seeking alpha 24/x

Cause i grew up reading the Donald Duck Weekly and ol' McScrooge made his fortunes in the mines of the Klondike :D So i looked for "Klondike" on seeking alpha 24/x

I just thought it would be cool if i could make my fortunes in the Klondike too. And lo! there are 2 companies with that name.

Turns out, these guys are re-exploring the old Klondike mines with modern tech to find missed ounces. And they've already found some in 2019! 25/x

Turns out, these guys are re-exploring the old Klondike mines with modern tech to find missed ounces. And they've already found some in 2019! 25/x

Twitter messed up linking the threads together! Continuation:

https://twitter.com/DesoGames/status/1298639504811724803

• • •

Missing some Tweet in this thread? You can try to

force a refresh