The Economic Definitions ebooks:

https://t.co/hcJ6fw675b

https://t.co/Ac9kzrZ1Gv

https://t.co/EFWfG9cHxn

How to get URL link on X (Twitter) App

https://twitter.com/DesoGames/status/1998452885189767664

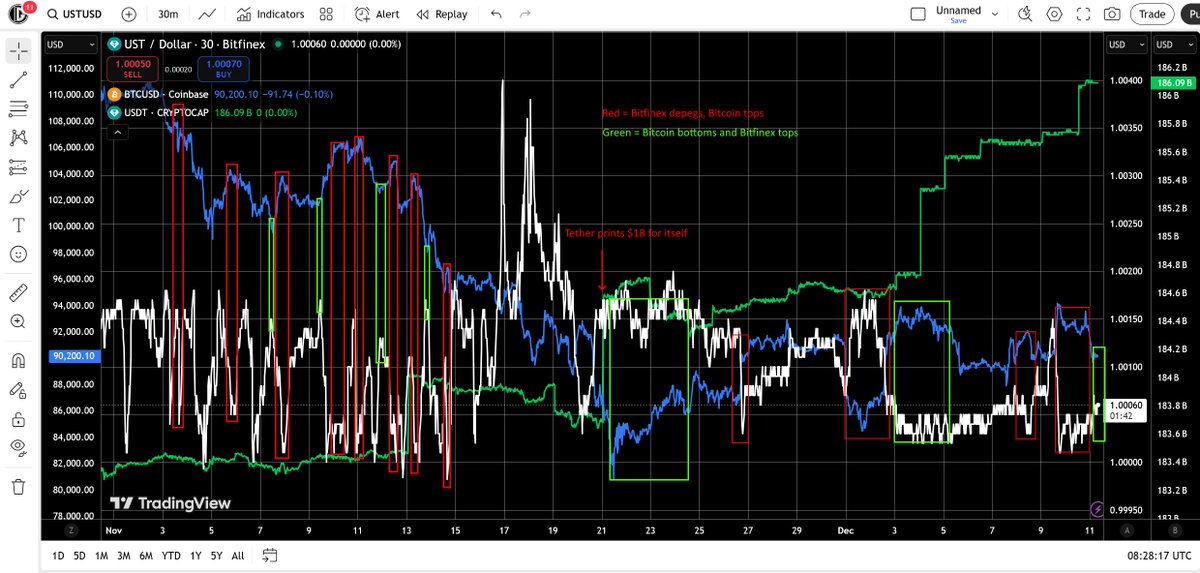

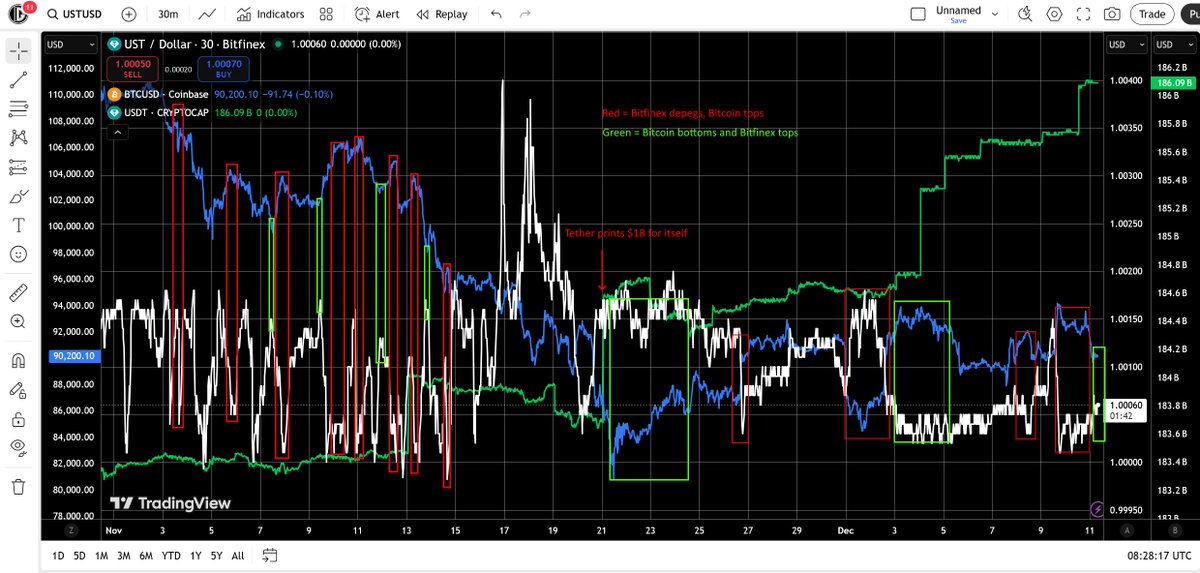

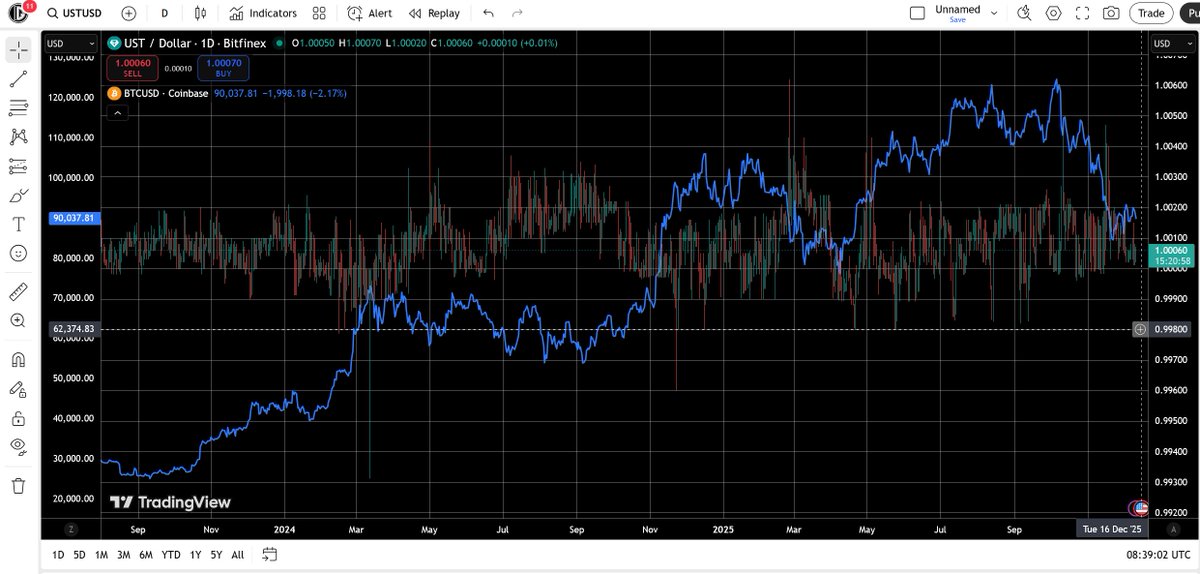

It's a simple relationship, the more BTC rises the more Bitfinex falls, and at the rate of rising and falling, at $100K Bitfinex will be around $0.998, which is the limit of this charade.

It's a simple relationship, the more BTC rises the more Bitfinex falls, and at the rate of rising and falling, at $100K Bitfinex will be around $0.998, which is the limit of this charade.

To clarify:

To clarify:

https://twitter.com/DesoGames/status/1871546414129644002

You know why the fucking Greek 10 year is trading 1.4% below the US 10 year? Why the market is *explicitly* saying the US is riskier to lend money to than Greece?

You know why the fucking Greek 10 year is trading 1.4% below the US 10 year? Why the market is *explicitly* saying the US is riskier to lend money to than Greece?

USDT:USD on Kraken can only spike if somebody throws a bunch of dollars at it, which means somebody is buying Tethers with dollars en masse. Not the behavior of somebody trying to rapidly get out of crypto, it'd be the other way around.

USDT:USD on Kraken can only spike if somebody throws a bunch of dollars at it, which means somebody is buying Tethers with dollars en masse. Not the behavior of somebody trying to rapidly get out of crypto, it'd be the other way around.

https://twitter.com/DesoGames/status/1862069977810862303

Below top 100 holders on TRON now hold 82.5% of supply, and that'll increase if Tether swaps more/burns what's in the treasury.

Below top 100 holders on TRON now hold 82.5% of supply, and that'll increase if Tether swaps more/burns what's in the treasury.

https://twitter.com/OccamiCrypto/status/1859225707852988697

DISGUSTANG

DISGUSTANG

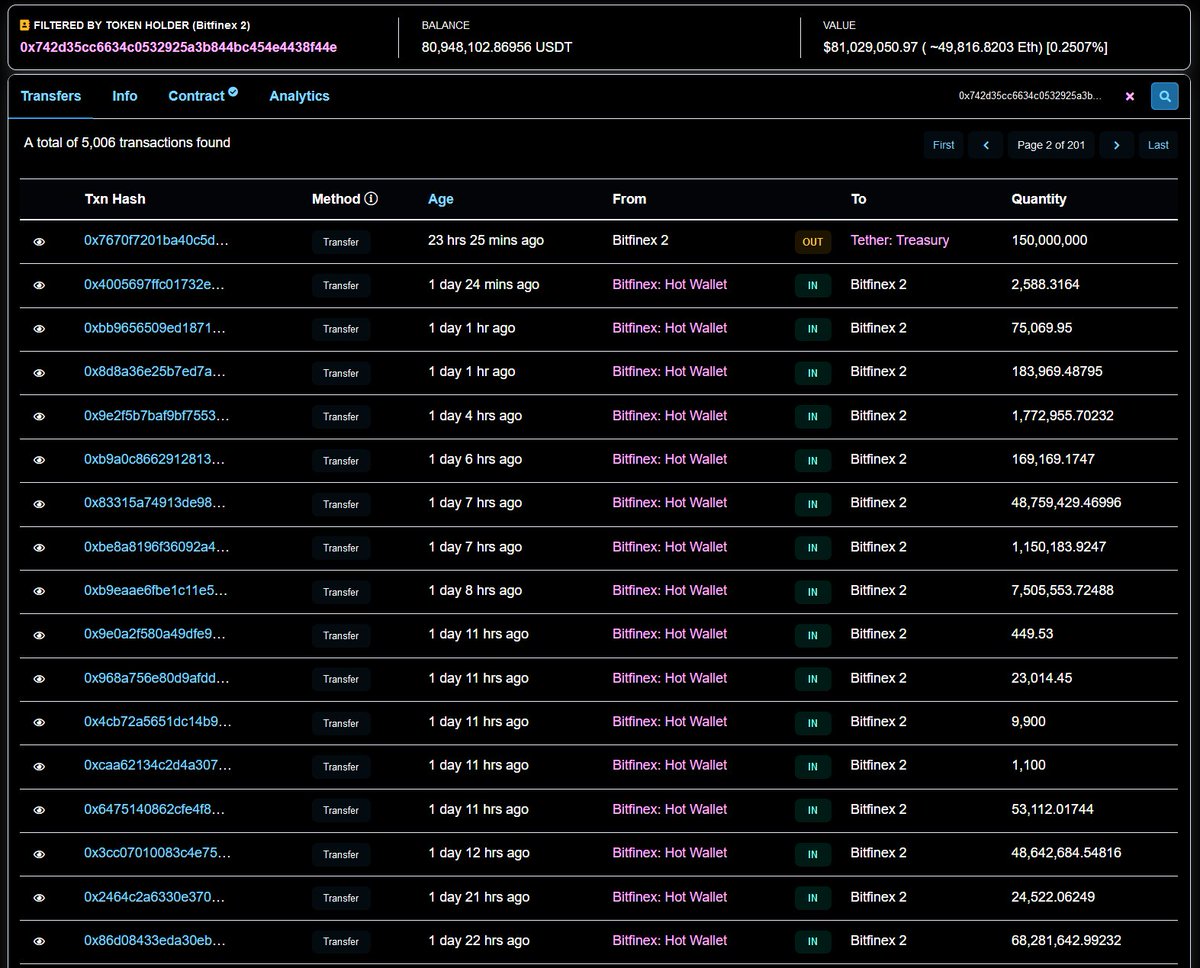

This happening while Binance does another $2B "chainswap" from TRON to ETH. To be fair, it was done a while after the runup started. Printer's started up on TRON again, including a Bitfinex TRON to ETH chainswap.

This happening while Binance does another $2B "chainswap" from TRON to ETH. To be fair, it was done a while after the runup started. Printer's started up on TRON again, including a Bitfinex TRON to ETH chainswap.https://x.com/DesoGames/status/1854261786658107527

How come the transfer accounts and counts stay the same at the same time that number of accounts have nearly doubled; with only a 50% increase at best in transfer amounts?

How come the transfer accounts and counts stay the same at the same time that number of accounts have nearly doubled; with only a 50% increase at best in transfer amounts?

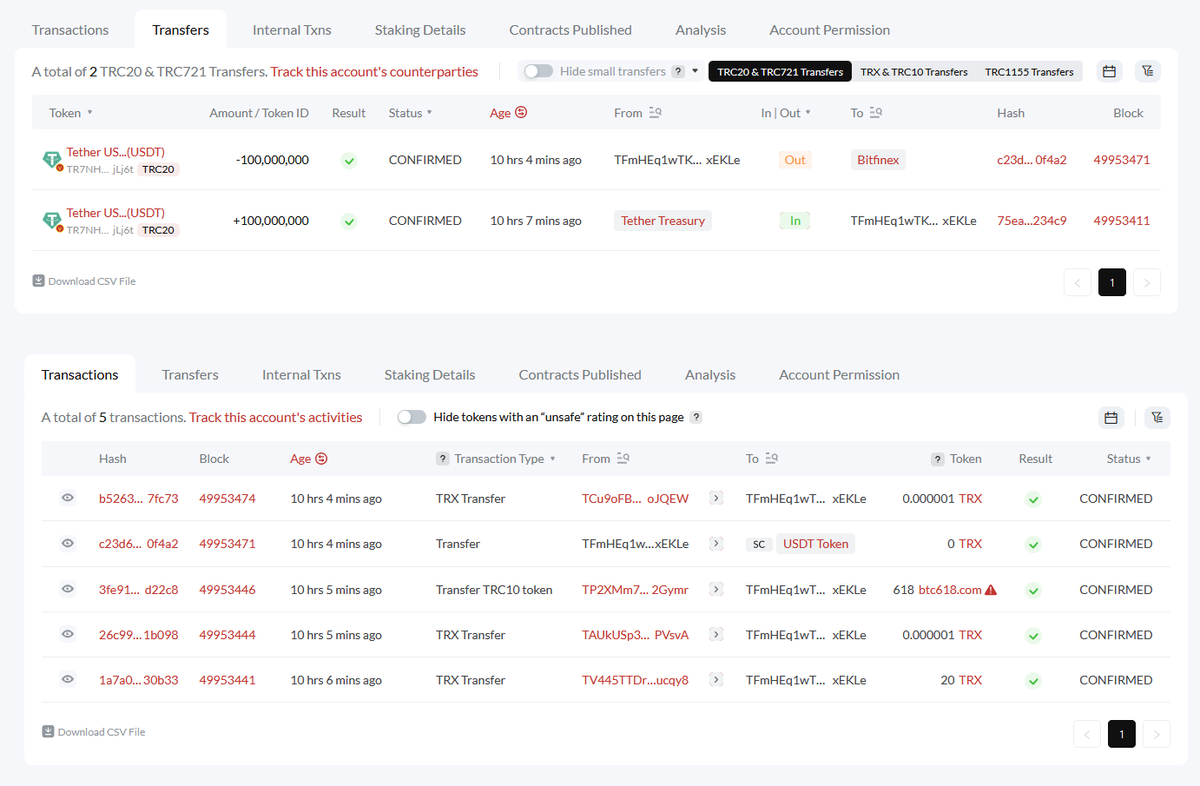

$60M (rounded) freshly redeemed Tethers, because ETH's quiet so it's not a chainswap.

$60M (rounded) freshly redeemed Tethers, because ETH's quiet so it's not a chainswap.

Luna/Terra had the EXACT same setup. If reducing Luna supply leads to increasing UST supply, then increasing Luna supply should reduce UST supply, because arbitrage works two ways! With UST it only worked one way; until all supply came to market at once.

Luna/Terra had the EXACT same setup. If reducing Luna supply leads to increasing UST supply, then increasing Luna supply should reduce UST supply, because arbitrage works two ways! With UST it only worked one way; until all supply came to market at once.

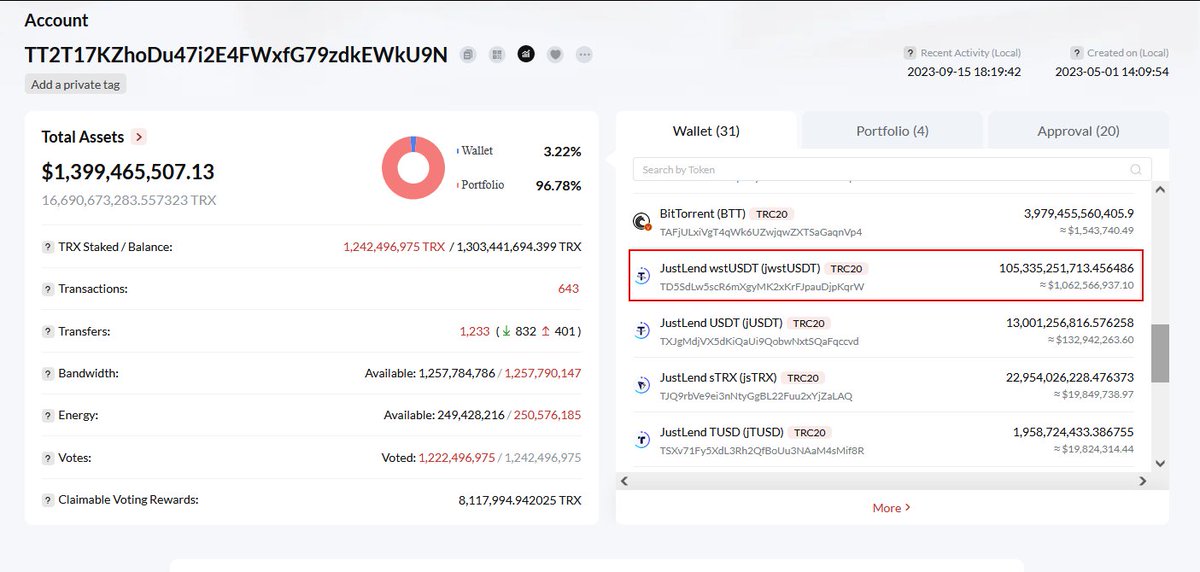

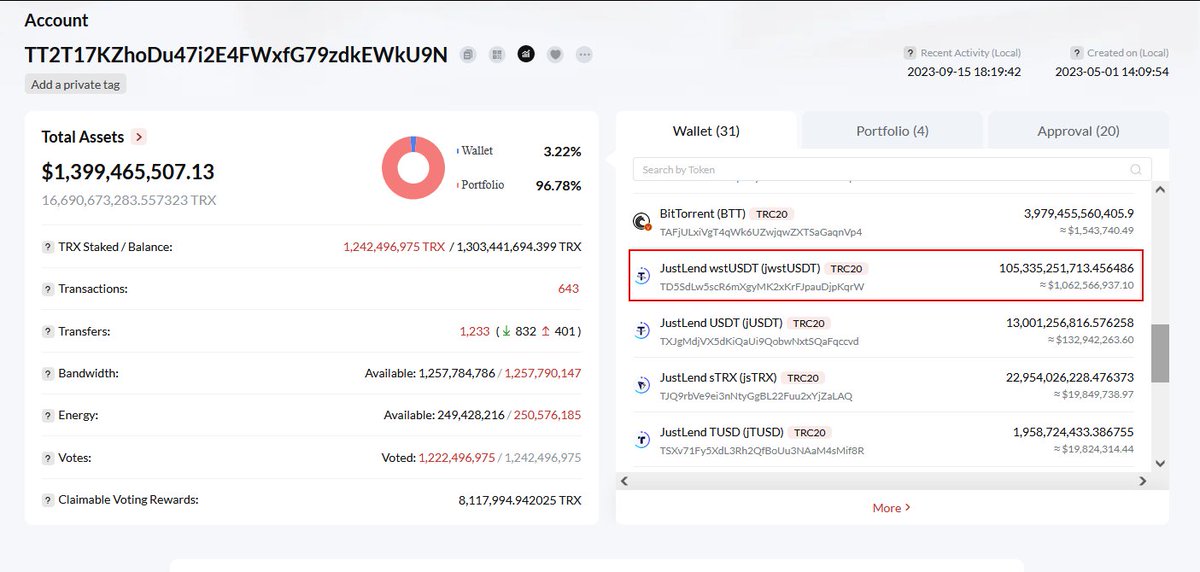

This could also indicate stUSDT is infact (or atleast partially) backed by TUSD, which itself is naturally fraudulently printed.

This could also indicate stUSDT is infact (or atleast partially) backed by TUSD, which itself is naturally fraudulently printed.

Gonna be another screenshot heavy thread i'm afraid, since i've gotta prove ownership when that's hard to do. So.

Gonna be another screenshot heavy thread i'm afraid, since i've gotta prove ownership when that's hard to do. So.

So Tether printed $100 million to an account 10 hours ago on TRON.

So Tether printed $100 million to an account 10 hours ago on TRON.

See that red line? I figured, maybe the bot network is stupid enough to transfer all the funds in at once, because there's pages of IN at 6H22M - but the amounts are *ASCENDING* in order! Sorted almost!

See that red line? I figured, maybe the bot network is stupid enough to transfer all the funds in at once, because there's pages of IN at 6H22M - but the amounts are *ASCENDING* in order! Sorted almost!

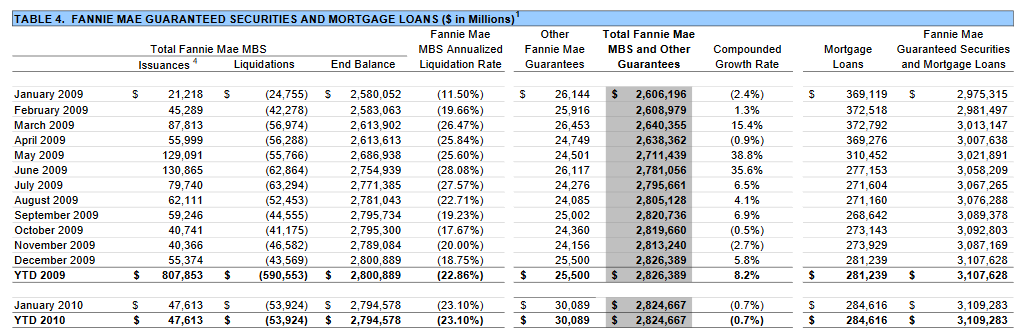

Dug out an old summary from December 2008, and the liquidation rate's looking like it's having the same "blow off bottom" as it had in 2008.

Dug out an old summary from December 2008, and the liquidation rate's looking like it's having the same "blow off bottom" as it had in 2008.

I really wonder what the function of Bitfinex 2 on Ethereum is as well. Since these chainswaps keep originating from there, and the INs before the chainswap are a total mystery to me.

I really wonder what the function of Bitfinex 2 on Ethereum is as well. Since these chainswaps keep originating from there, and the INs before the chainswap are a total mystery to me.

https://twitter.com/DesoGames/status/1602529359180533761

So, in a nutshell, Coinmarketcap and Coingecko circulating supply have become completely unreliable. I've squared the numbers before as has @Cryptadamist, so it's notable that there's a change.

So, in a nutshell, Coinmarketcap and Coingecko circulating supply have become completely unreliable. I've squared the numbers before as has @Cryptadamist, so it's notable that there's a change.

So what you're looking at is the moment of transfer out of Binance Cold 2, as well as 2 other Binance Hot wallets at that time which aren't the main one. Page 500 was already below 2 hours when i thought of tracking this transaction.

So what you're looking at is the moment of transfer out of Binance Cold 2, as well as 2 other Binance Hot wallets at that time which aren't the main one. Page 500 was already below 2 hours when i thought of tracking this transaction.

https://twitter.com/tier10k/status/1602622142188867585

Shoulda kept ya mouth shut buddy.

Shoulda kept ya mouth shut buddy.

If you still think that's a glitch with THAT much convenient timing, there's nothing i can do for you, sorry. For the rest; the big spikes simply mean alot of quick transactions at scale, which CMC aggregates with an algo causing these big spikes.

If you still think that's a glitch with THAT much convenient timing, there's nothing i can do for you, sorry. For the rest; the big spikes simply mean alot of quick transactions at scale, which CMC aggregates with an algo causing these big spikes.