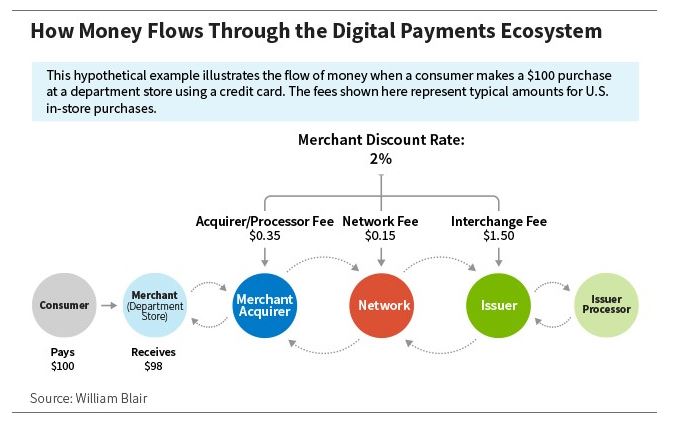

Excellent 7 part series on Digital Payments by @WilliamBlair (Pt 6/7 not out yet). 👏

Reminded me again why I love this space & will for a long time to come.

@TMFJMo @Matt_Cochrane7 @IntrinsicInv @FromValue @saxena_puru @dannyvena @BluegrassCap

1. blog.williamblairfunds.com/daniel-hill/wh…

Reminded me again why I love this space & will for a long time to come.

@TMFJMo @Matt_Cochrane7 @IntrinsicInv @FromValue @saxena_puru @dannyvena @BluegrassCap

1. blog.williamblairfunds.com/daniel-hill/wh…

The many drivers for sustained long-term growth in Digital Payments.

✅A shift away from cash

✅Growth of e-commerce

✅Usage by small and midsize businesses (SMBs)

✅Under-penetration in international markets

✅Government support

✅A shift away from cash

✅Growth of e-commerce

✅Usage by small and midsize businesses (SMBs)

✅Under-penetration in international markets

✅Government support

How Merchant Acquirers add Value

✅Enhanced fraud prevention

✅Increased acceptance rates

✅More sophisticated targeted marketing

✅Improved Omni-channel experiences.

Attractiveness scale of Clients for Merchant Acquirers (for growth).

✅Enhanced fraud prevention

✅Increased acceptance rates

✅More sophisticated targeted marketing

✅Improved Omni-channel experiences.

Attractiveness scale of Clients for Merchant Acquirers (for growth).

• • •

Missing some Tweet in this thread? You can try to

force a refresh