They will invest a dollar amount (say $1M) and buy shares at a certain Price Per Share (PPS) which is the value of one unit of equity (a share).

So far so trivial :-)

Post Money = Pre-Money + New Cash coming in

= the agreed value of your company + the cash that sits in your bank account immediately after the round.

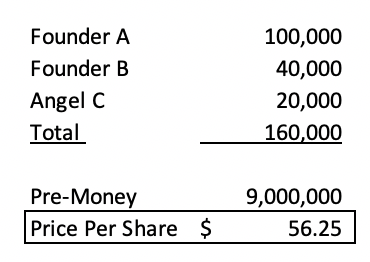

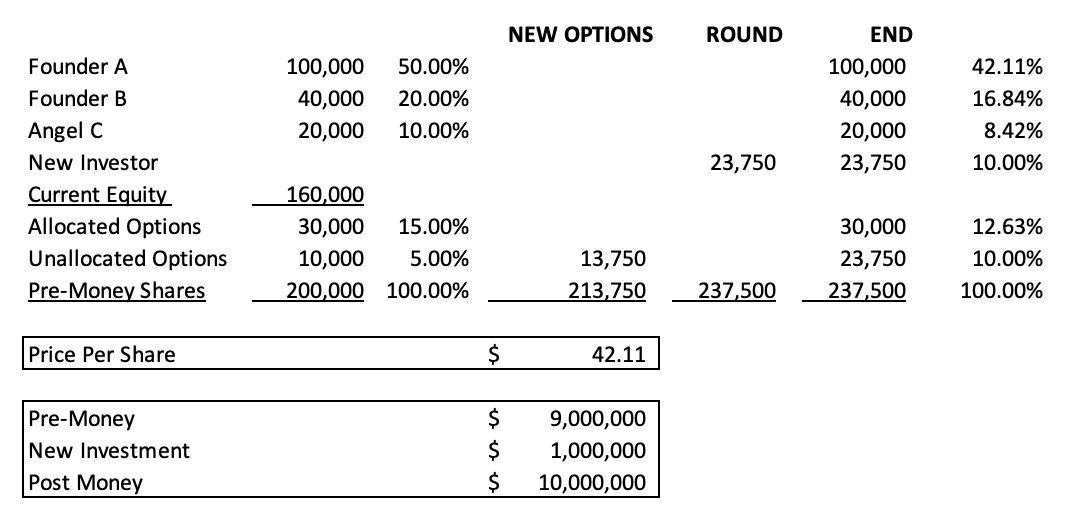

Price Per Share = Pre-Money Valuation / # Pre-Money Shares

(a) In it for sure: existing shares + options that have been allocated.

(b) To be agreed: a number of options that have not yet allocated or even authorised yet.

VCs calculate their return profiles based on ownership, and like to know how much they will own by the time you get to the next round.

Think of unallocated Options as “unseen dilution” or “yet to happen” dilution.

There’s nothing wrong with this, but some VCs might conveniently fail to explain that math to you and hope you focus only on the pre-money number.

THE PRICE PER SHARE NEVER LIES.

It captures everything.

venturehacks.com/option-pool-sh…

And here is a simple cap table you can use. Everything is a variation on this - keep it simple.

docs.google.com/spreadsheets/d…

In a Pre-Money Note, the PRE-money is fixed (and the Post-Money increases as you add more investors and cash).

In a Post-Money Note, the POST-money is fixed (and the Pre-Money decreases as you add more cash).

They are the simplest to grok but you of course have to make sure you don’t raise crazy amounts.

If I invest $1M at $10M post I KNOW I will own 10%.

[These can create some circularity and can be a bit tougher to model but it’s not rocket science].

In a classic "priced round", the round size is agreed, the investors are agreed and everyone comes in together, though sometimes you leave some flex for a second closing.

Understand the definitions and build the cap table. Ask the investor for their cap table so you are sure there’s no confusion.

Compare offers on an apple-to-apples basis by comparing the Price Per Share.