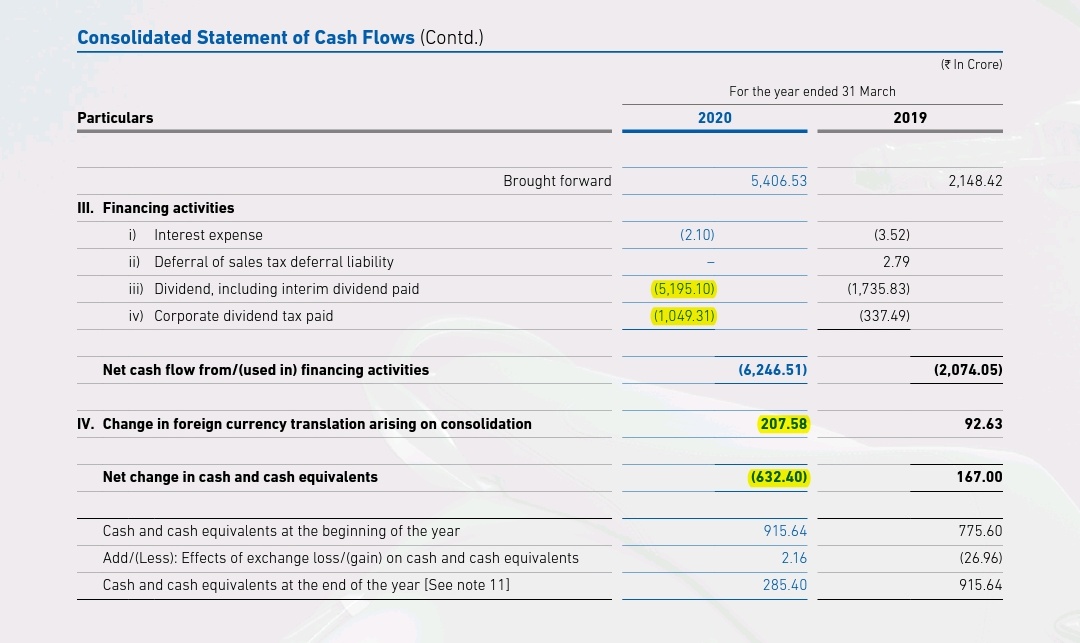

•Bajaj auto Ltd, one of the largest automobile manufacturers in India has paid dividend of Rs120/share for the FY 2020

•It is 100% increase of their past dividend of Rs 60/share

Let's understand the reason

•Shareholders have to pay tax on the slab rates applicable to them as per Income tax Act

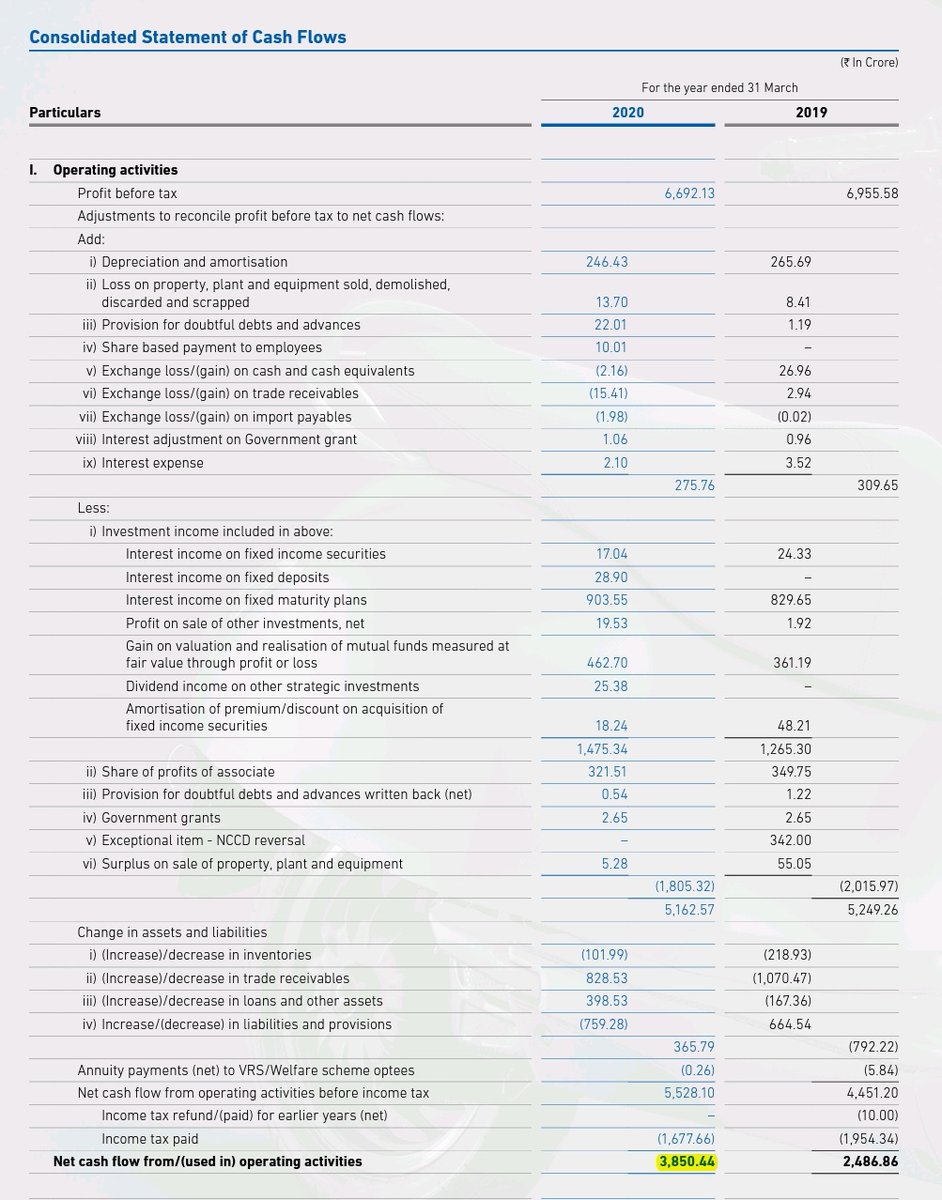

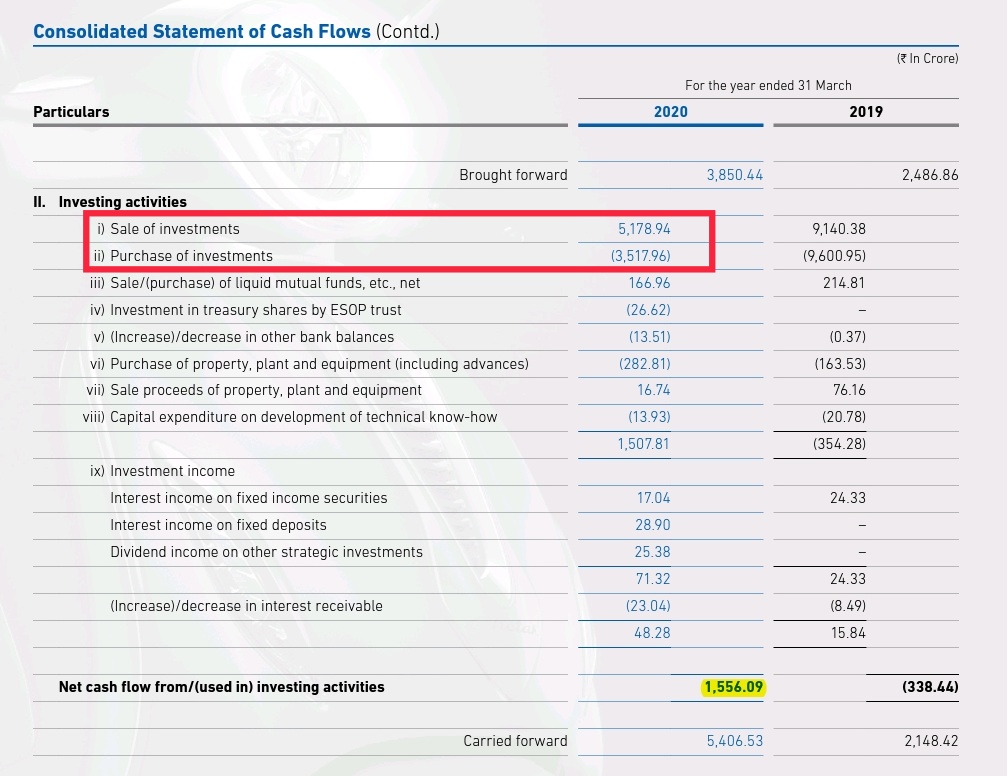

•The prob is they declared dividends in excess of Op cash flow

•If the co would have opted to pay dividend equivalent to previous year (1735 cr), then op cash + cash would have been sufficient to meet dividend requirements

•The co would have avoided paying this tax amount if it has rolled it's investments by not selling them to pay dividends

•Everyone (Promoters, FII, DII etc.,) who come under highest tax brackets have been benefitted

•The minority shareholders have been burnt

PS : Do check your portfolio companies cash flow statements & thread carefully.