I help you make better money decisions. Open to collaborations - DM me.

10 subscribers

How to get URL link on X (Twitter) App

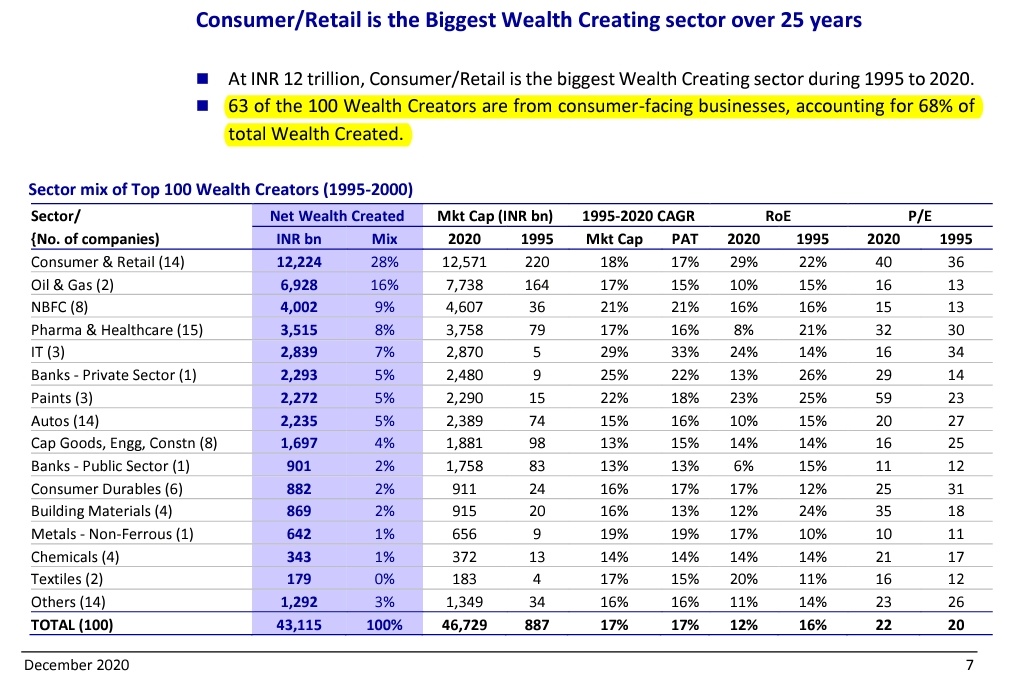

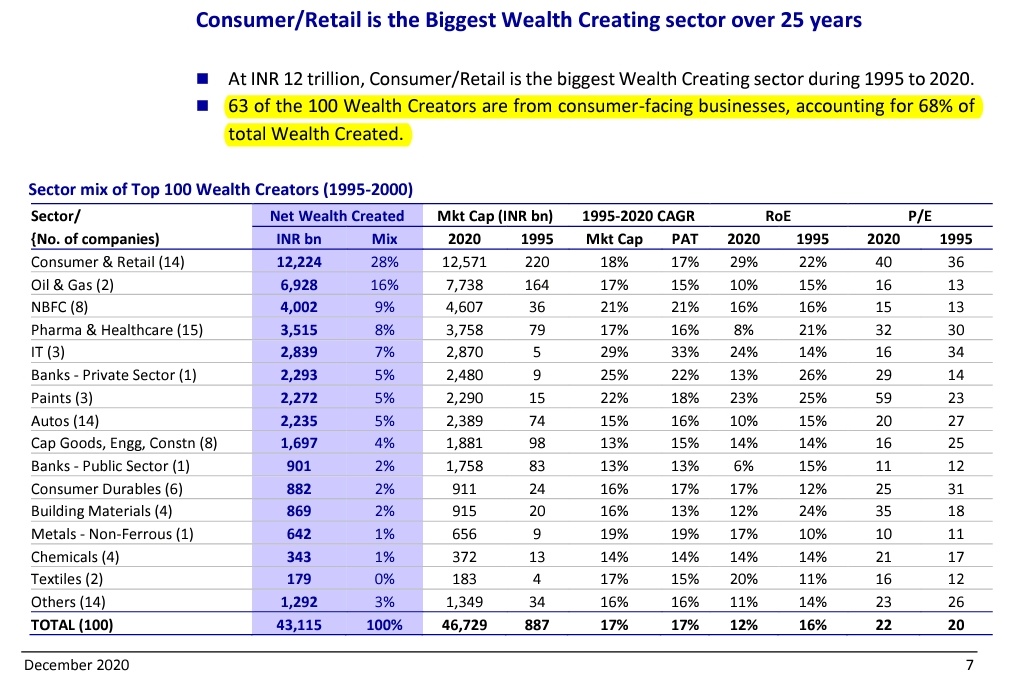

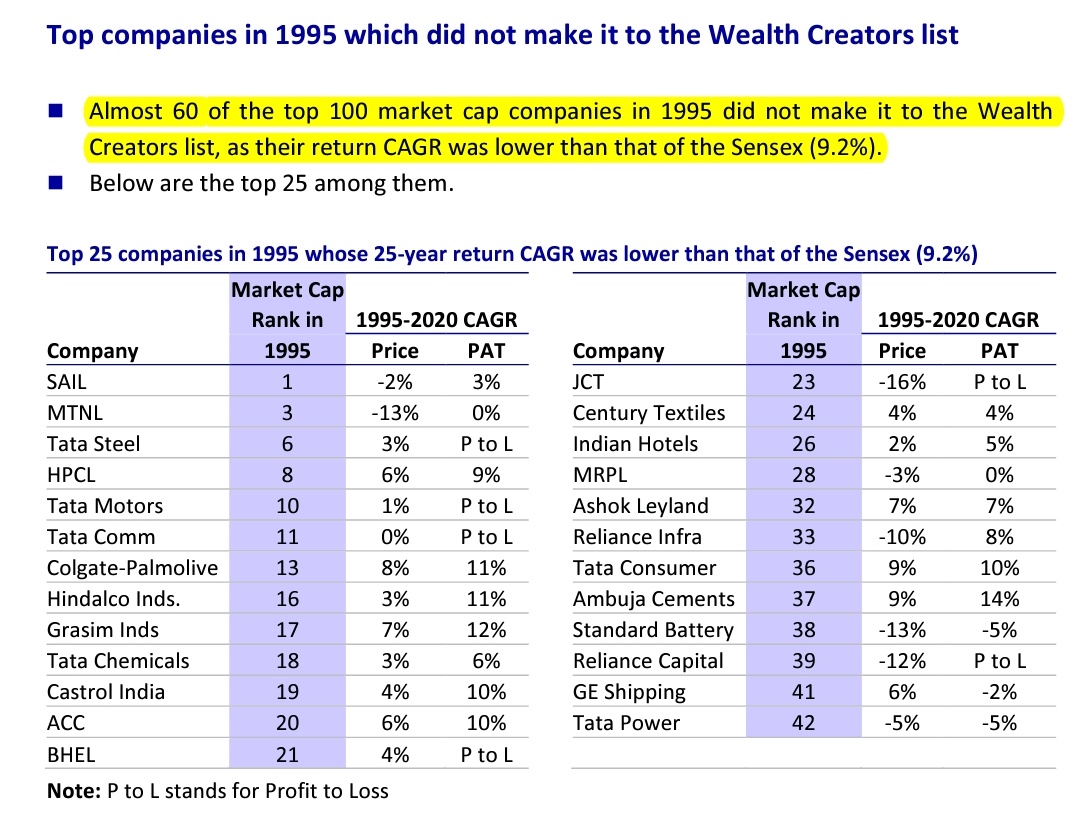

2. Almost 60 of the top 100 market cap companies in 1995 did not make it to the Wealth Creators list.

2. Almost 60 of the top 100 market cap companies in 1995 did not make it to the Wealth Creators list.

1/

1/

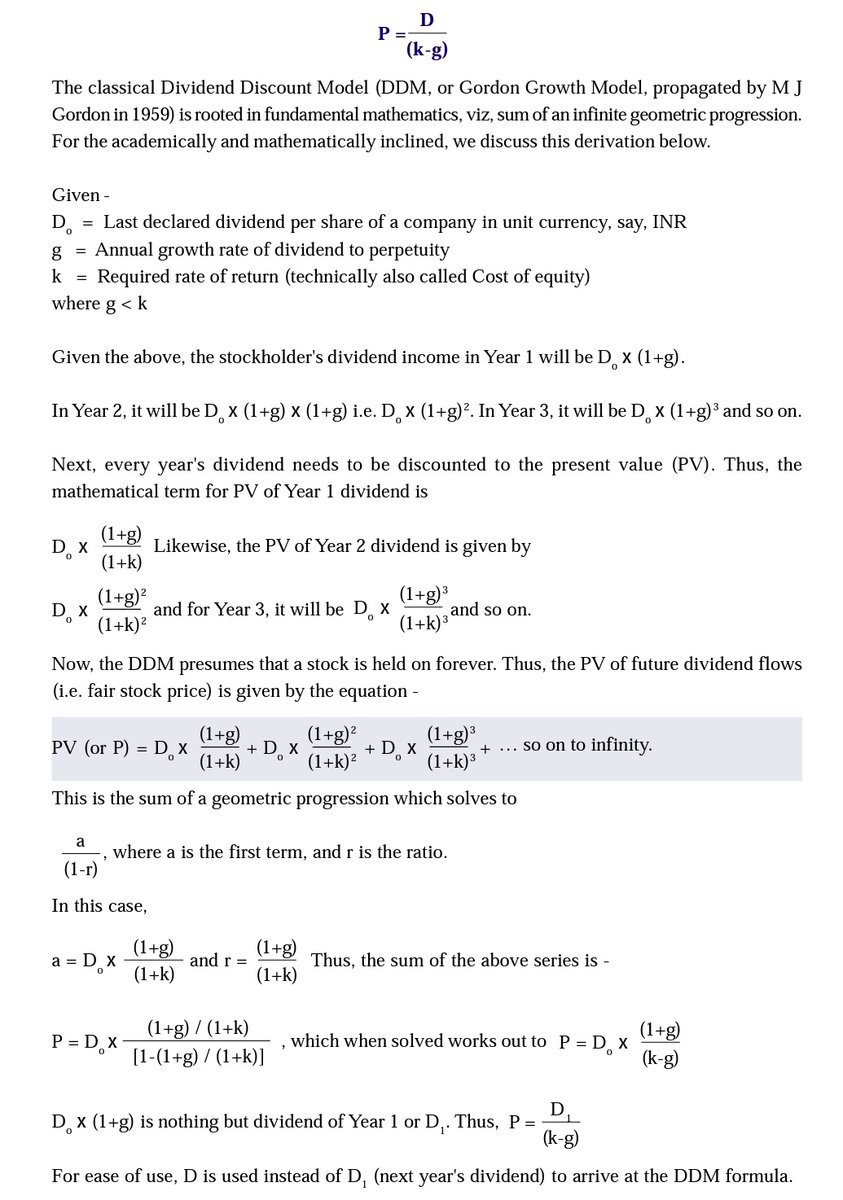

I believe you have read this before, but here is the definition of intrinsic value to start with.

I believe you have read this before, but here is the definition of intrinsic value to start with.

Imagine, you are a software coder. With a lot of effort and talent, you got a good job in a top IT firm.

Imagine, you are a software coder. With a lot of effort and talent, you got a good job in a top IT firm.

Imagine, you are a Chartered Accountant Aspirant.

Imagine, you are a Chartered Accountant Aspirant.