I think the Fed rightly sees its primary error as one of insufficient accommodation, but the reasoning and remedy are both flawed

medium.com/@skanda_97974/…

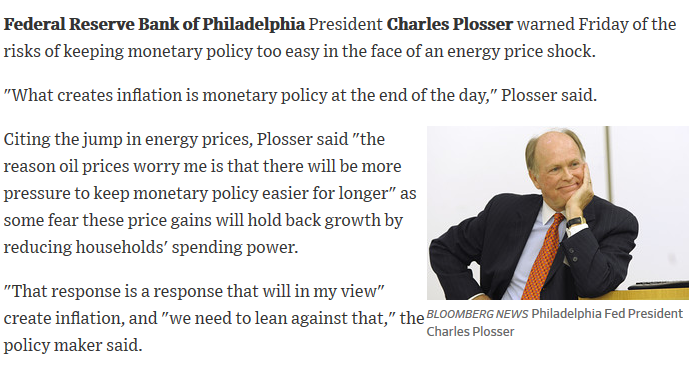

wsj.com/articles/SB121…

fraser.stlouisfed.org/files/docs/his…

blogs.wsj.com/economics/2011…