Sorry for the delay. Thread on Waste and my thesis:

Waste is broken down in 3 segments:

Recycling, Disposal & Collection

Recycling, Disposal & Collection

Collection = high margin asset light

Disposal & Recycling = high margin asset-heavy

Disposal & Recycling = high margin asset-heavy

Collection is where you want to play -> Service based = recurring ebitda

Disposal & Recycling is more cyclical and capital heavy -> Weight based billing = not recurring ebitda

Disposal & Recycling is more cyclical and capital heavy -> Weight based billing = not recurring ebitda

As you can see from Republic Services: contracts are long term in service but not in weight-related segments of the company. Therefore, where you really want to play is purely service-related areas of this large 80bn market. Containers & Residential.

When containers are installed = servicer switch costs are high = very little turnover = good predictable recurring revenue

Disposal & Recycling have high fixed costs. I kept some notes from my ; but I assume costs are even higher now:

Therefore, in Disposal & Recycling, you are incentivized to keep volumes steady if you don't want to get hurt. Regulatory dynamics keep you protected but collectors really have the upper hand

So why have I allocated a large position in my rrsp?

I have kept in touch with several contacts from my time covering . The most important point they have shared with me is that new management is sleeping at the wheel. acquired over the years the best assets available while was focused on buybacks.

Pat Dovigi (who I remember playing hockey and getting drafted) built the most unique machine in the industry

As mentioned in the early part of this finthread, collection of containers and residential "pick-up" is the best area to play. These players generate higher-margin, have low fixed cost and predictable ebitda. And have upper hand on the disposal & recycling players(very important)

I am dumbfounded by the price reaction to this short seller report. I have read this report several times and it is easy to see that he has no comprehension of the waste business. Many waste contacts know that Pat is a strong opponent and his business is special:

Pat has the best revenue breakdown in the public market space (70% of his sales come from his collectors)!!!!

Capital expenditures run 5 to 7% of sales so if you get great cash flow margins and can have lots of leverage because these collectors have low turnover and good predictability

My valuation math:

-GFL: 11x ebitda

- republic 14x ebitda

so you are buying it at a discount to a business with a worse revenue breakdown and no growth!

-GFL: 11x ebitda

- republic 14x ebitda

so you are buying it at a discount to a business with a worse revenue breakdown and no growth!

last comment: was a very similar situation.The same Short seller wrote a Bullsh!t report about the business. If you bought it in November/decemeber like me. It was trading at a lower p/e than the us discount stores but had better management and better growth! that worked!

since some folks asked me about the differences between the big waste peers, here is a breakdown. As you can see, revenue mix is quite similar to but trades at an eye-popping discount. happy to have more constructive discussions with fellow owners or interested folks

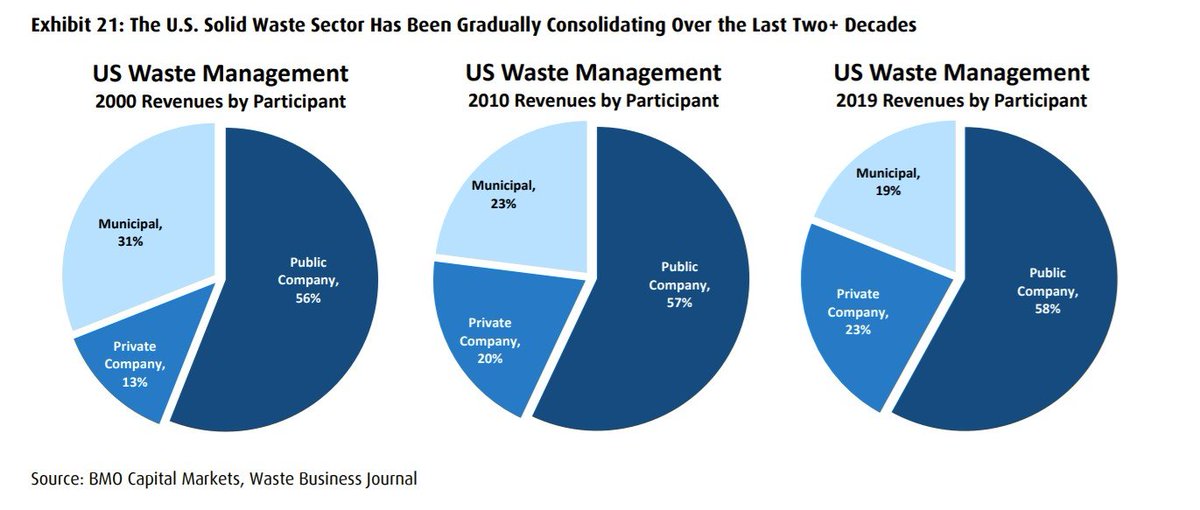

Found this article in my notes. As you can see, when enters markets, just like , the acquisition strategy allows them to gain better efficiencies and win market share by sharing those efficiencies.

thepeterboroughexaminer.com/news/peterboro…

thepeterboroughexaminer.com/news/peterboro…

is providing a great service to #America. Commercial and Residential services are cheaper and more reliable when operated by gfl.

• • •

Missing some Tweet in this thread? You can try to

force a refresh