Lot of people have this high perception of only Nasdaq or tech stocks leading to it.

pretty baseless question though:)

A small thread

1/n

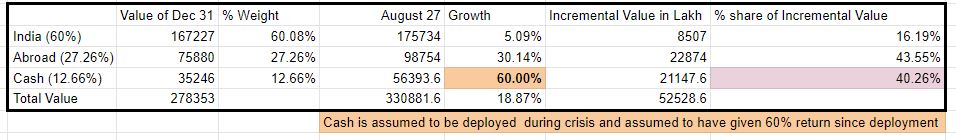

There is absolutely no right way or scientific way (except some complicated XIRR). I made some assumptions.

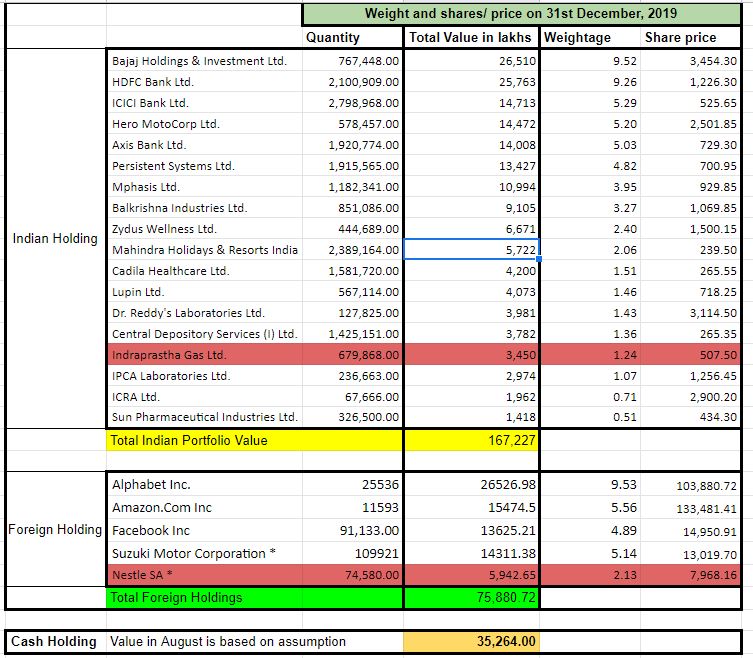

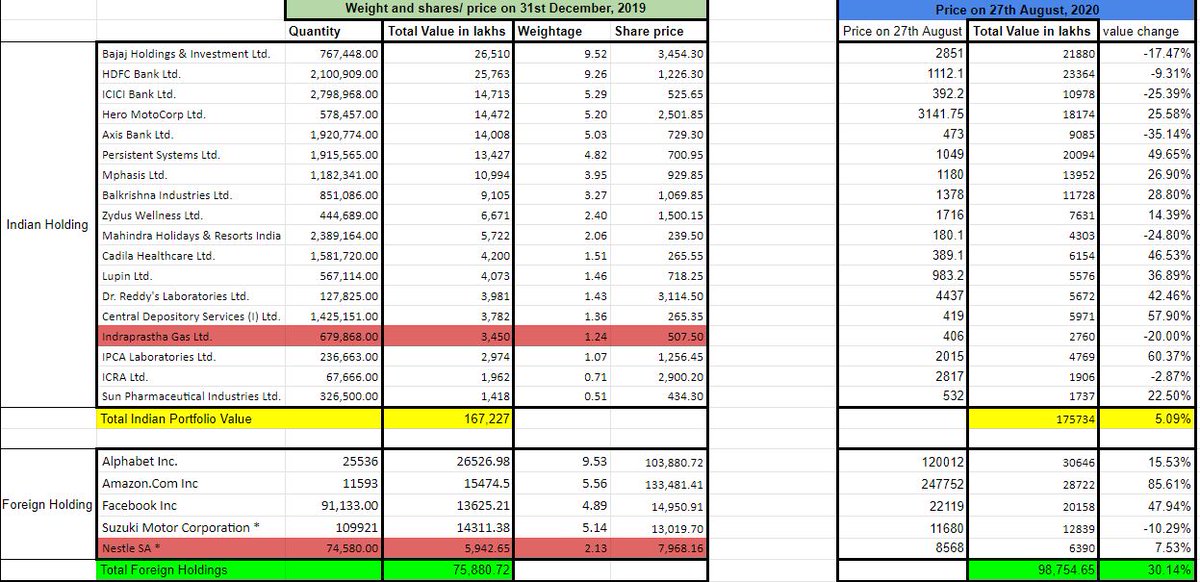

a. Portfolio, stock holding and assume no change in stocks during the duration.

b. 31st dec, 2019 as the stock holding

c. 27 august 2020 as the final value.

What happened?

Incremental cash deployment is what perhaps caused 45% of incremental returns on same portfolio since 31st December. Of-course the cash has been deployed between Indian and foreign stocks.

That is the REAL differentiation.

So it is not NASDAQ alone:)

This is not the most scientific way but the things that matter is process/ ability to take cash calls and more importantly deploy when need comes:)

So give weightage to process of the fund:)

choices of stock is part luck part knowledge:)