Thread :

How I managed my today’s option selling trade inspite of spike on the call side

Overnight position :

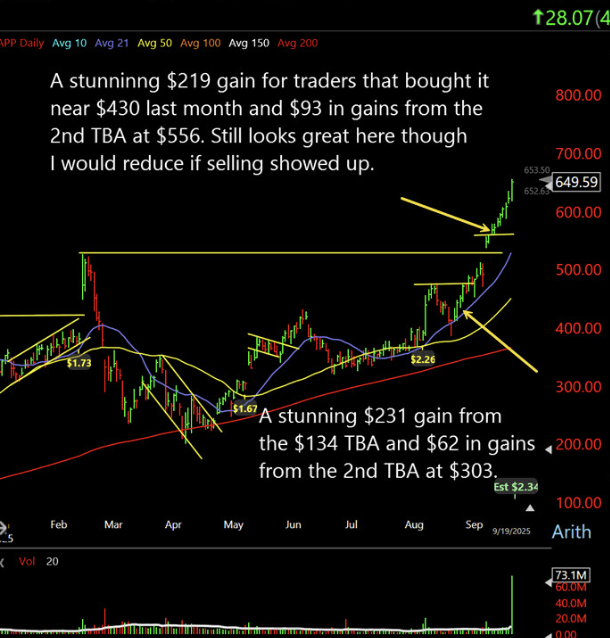

I had carried overnight 23000 PE ( sell at 155) & 24200 CE (sell at 135)

In the morning I booked profit in 23000 PE and shifted to 23200 at 120

(1)

How I managed my today’s option selling trade inspite of spike on the call side

Overnight position :

I had carried overnight 23000 PE ( sell at 155) & 24200 CE (sell at 135)

In the morning I booked profit in 23000 PE and shifted to 23200 at 120

(1)

24000 was a resistance for BNF and above that good spike was expected. So I kept SL in 24200 CE at 200 (as per system)

The SL in 24200 got hit at 200 around 10:30 am and I shifted to next resistance level 25000 CE at 63

Open now(Sell) :

23200 PE at 120

25000 CE at 63

(2)

The SL in 24200 got hit at 200 around 10:30 am and I shifted to next resistance level 25000 CE at 63

Open now(Sell) :

23200 PE at 120

25000 CE at 63

(2)

Calls were rising rapidly so I sold additional 23200 PE and also bought 25000 CE (10th sept expiry at 200)

The 25000 CE bought in next week was managing the deltas and MTM.

(3)

The 25000 CE bought in next week was managing the deltas and MTM.

(3)

Market pullbacked so Calls cooled of a bit and I booked profit in 25000 CE (10th sept expiry ) at 267

And put a buy stop in 25500 CE(3rd sept expiry at 65)

(4)

And put a buy stop in 25500 CE(3rd sept expiry at 65)

(4)

Market kept on rising and I kept rolling up my puts and also sold additional puts below 24K as 24 K was a strong support

(5)

(5)

So inspite of today being a trending day ended up in decent profit of around 1 L by active trade management and cutting losses quickly.

Learnings :

1) Don’t let options become ITM

2) Trending days can be managed only by buying so also know your max loss.

#OptionsTrading

Learnings :

1) Don’t let options become ITM

2) Trending days can be managed only by buying so also know your max loss.

#OptionsTrading

• • •

Missing some Tweet in this thread? You can try to

force a refresh