Data Driven Trader | Featured on @cnbc_awaaz, @moneycontrolcom & @timesnow

27 subscribers

How to get URL link on X (Twitter) App

1. Knight Capital wasn’t reckless or inexperienced.

1. Knight Capital wasn’t reckless or inexperienced.

1) Trading is a skill, not a gamble

1) Trading is a skill, not a gamble

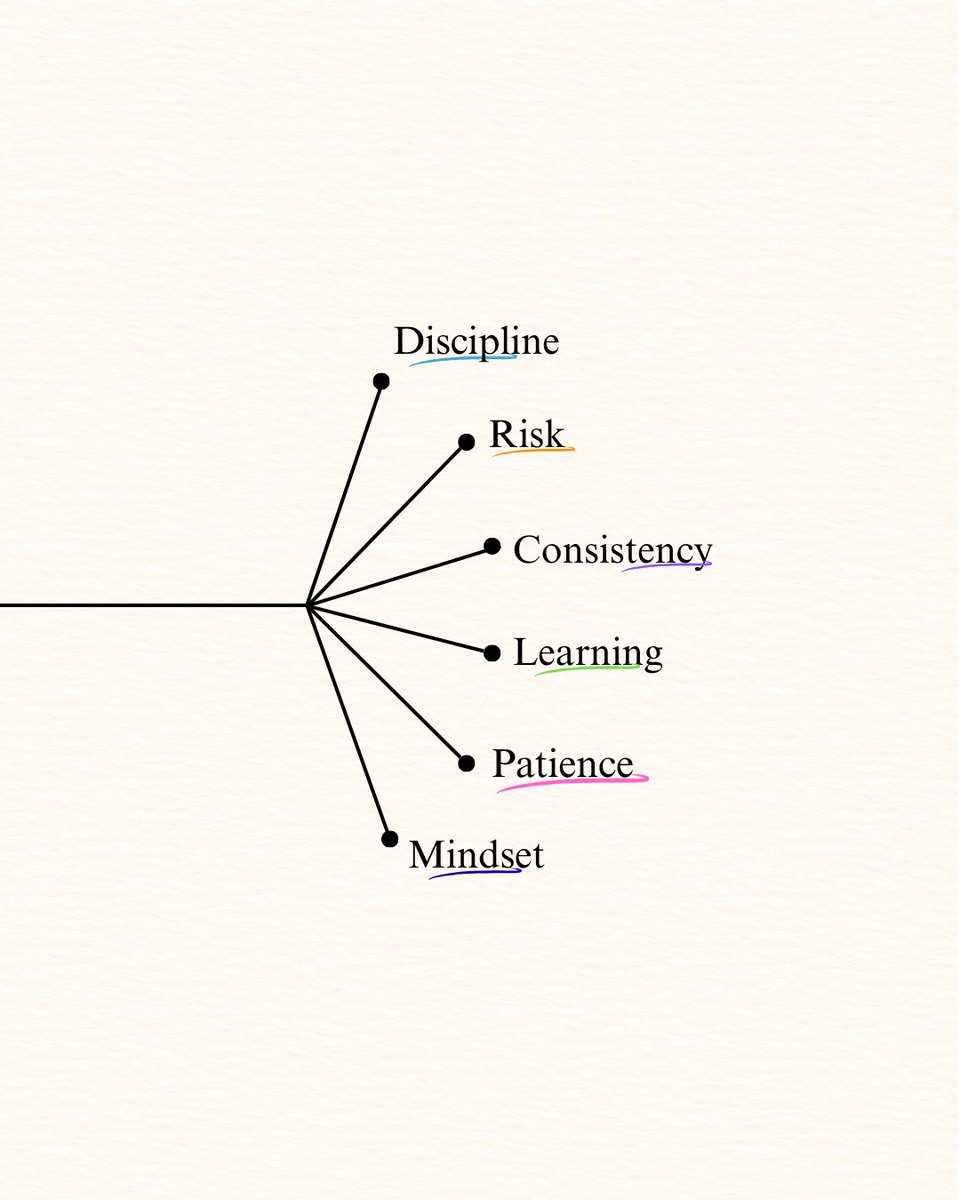

Trading success isn’t about the best strategy, it’s about mastering yourself:

Trading success isn’t about the best strategy, it’s about mastering yourself:

1) Young Buffett thought he struck gold

1) Young Buffett thought he struck gold

1)The Core Idea

1)The Core Idea

1. “Anything can happen.”

1. “Anything can happen.”

1) I was able to enter and ride uptrend but unable to exit when trend changes.

1) I was able to enter and ride uptrend but unable to exit when trend changes.

2) While

2) While

1)Monitors :

1)Monitors :

1) Sensex opened at 83,611 and dropped 400 points in just 20 minutes!

1) Sensex opened at 83,611 and dropped 400 points in just 20 minutes!

2) 18th may 2009

2) 18th may 2009

2) I was having a great month & that made me more complacement as I made around 24% returns in last 4 months

2) I was having a great month & that made me more complacement as I made around 24% returns in last 4 months

2) Look at his stance on the crease. Look at the balance. Perfect. Simply elegant. Looks so pleasing to the eye.

2) Look at his stance on the crease. Look at the balance. Perfect. Simply elegant. Looks so pleasing to the eye.

2) Didnt' do anything all day and it's 11:58 PM?

2) Didnt' do anything all day and it's 11:58 PM?