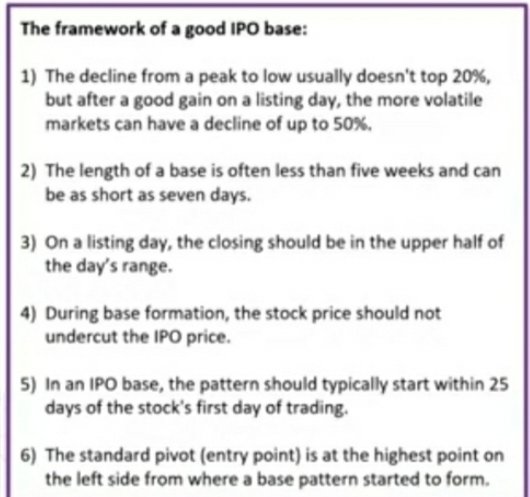

After watching for 27 days. This is this week's study name. I wud b posting detailed analysis on this one and further dig ins. In the meantime i except people here to share as much inputs as they can on this. Take a structured approach and start with Red flags first.

Upper pivot 818.80

Lower pivot 761

One can imagin a darvas box if one considers the top and bottom numbers provided in the chart.

Lower pivot 761

One can imagin a darvas box if one considers the top and bottom numbers provided in the chart.

Q1 FY21 Concall notes: Rossari Biotech

1/

WC Capital, repay loans, general activities.

Now a Debt free company.

2003: started

2009: into cos

Focus on developing strong platform providing sustainable solutions to clients.

1/

WC Capital, repay loans, general activities.

Now a Debt free company.

2003: started

2009: into cos

Focus on developing strong platform providing sustainable solutions to clients.

2/

3 division:

Revs 109.5 crs vs 127.8 crs

HPPC: home personal care and performance(soaps, detergents etc)

Strong performance in hygiene and anti viral prods in lockdown.

83.5 crs

TSC: textile spec chem(entire value chain of textile industry)

Impacted in lockdown.

17.3 crs

3 division:

Revs 109.5 crs vs 127.8 crs

HPPC: home personal care and performance(soaps, detergents etc)

Strong performance in hygiene and anti viral prods in lockdown.

83.5 crs

TSC: textile spec chem(entire value chain of textile industry)

Impacted in lockdown.

17.3 crs

3/

AHN: animal healthcare nutrition

(Poultry, pet grooming)

8.7 crs

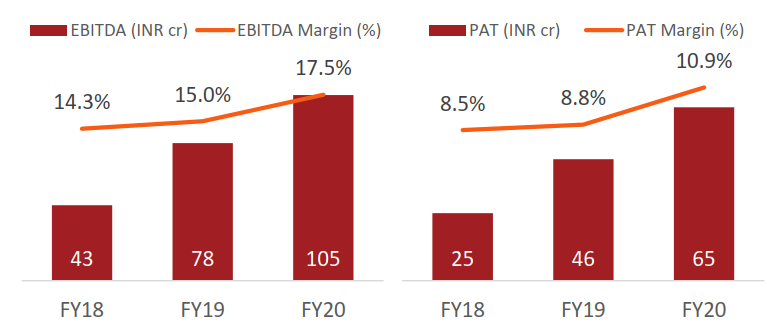

Ebidta 23.7 crs vs 22.3 crs

Notable improvement on ebidta margin.

Going forward Dahej depreciation wud b absorbed efficiently.

********15.5 vs 14.2 PAT*********

Expansion into water treatment solutions.

AHN: animal healthcare nutrition

(Poultry, pet grooming)

8.7 crs

Ebidta 23.7 crs vs 22.3 crs

Notable improvement on ebidta margin.

Going forward Dahej depreciation wud b absorbed efficiently.

********15.5 vs 14.2 PAT*********

Expansion into water treatment solutions.

4/

Customer centric company.

Very optimistic abt future prospects

Diversified products offering

Healthy balance sheet

Post IPO: new journey

Shareholders having 1 share is equally important.

Stupendous public listing.

July 23 1997: 1st invoice

July 23 2020: lisiting

Customer centric company.

Very optimistic abt future prospects

Diversified products offering

Healthy balance sheet

Post IPO: new journey

Shareholders having 1 share is equally important.

Stupendous public listing.

July 23 1997: 1st invoice

July 23 2020: lisiting

5/

Flexibility & agility in product offerings.

July 2020: 132500 MTPA commision 1st phase in DAHEJ Guj.

On track: Operational in march 2021.

IIT Mumbai: centre of excellence of rossari. R&D capabilities enhancement.

Flexibility & agility in product offerings.

July 2020: 132500 MTPA commision 1st phase in DAHEJ Guj.

On track: Operational in march 2021.

IIT Mumbai: centre of excellence of rossari. R&D capabilities enhancement.

6/

Customer base:

~key is the direct engagement.

~Demand generation & demand creation.

~Wide distribution network across India.

Raw materials: dependence on china well within 5% of sales in any category.

Not so depending on crude oil prices.

Gross margin wud remain stable

Customer base:

~key is the direct engagement.

~Demand generation & demand creation.

~Wide distribution network across India.

Raw materials: dependence on china well within 5% of sales in any category.

Not so depending on crude oil prices.

Gross margin wud remain stable

7/

Demand scenario in the country wud gradually improve.

Wallet share remains stable.

Opportunity in market medium to long term. Creation of long term shareholders value.

Q1: competitor:

Multiple nos of them

Not go headlong with any.

Demand scenario in the country wud gradually improve.

Wallet share remains stable.

Opportunity in market medium to long term. Creation of long term shareholders value.

Q1: competitor:

Multiple nos of them

Not go headlong with any.

8/

Q2. Outlook on TSC & AHN segments: (wierd qstn)

Done well in june & good in july. Going to improve as % of sales.

HPPC wud grow faster than others. +Ve & confident in all 3 segs.

Q2. Outlook on TSC & AHN segments: (wierd qstn)

Done well in june & good in july. Going to improve as % of sales.

HPPC wud grow faster than others. +Ve & confident in all 3 segs.

9/

Gross margin:

Exceptional in Q1. Demand of hygiene prods r high. Coming further it wud b maintained/normalised.

Confident of maintaining gross margins.

Asked abt quant nos for TSC & AHN segments,(wierd qstns)

Gross margin:

Exceptional in Q1. Demand of hygiene prods r high. Coming further it wud b maintained/normalised.

Confident of maintaining gross margins.

Asked abt quant nos for TSC & AHN segments,(wierd qstns)

10/

HPPC biz wud b higher than last yr as a % of sales. Lagging for last two months sales for TSC & AHN.

Q3: a. biz model:

Growth driving factors for HPPC vs TSC

~strategy of seeding into new bizs

6 yrs ago HPPC seeded. Now its big

~feeding into future biz like water trt biz

HPPC biz wud b higher than last yr as a % of sales. Lagging for last two months sales for TSC & AHN.

Q3: a. biz model:

Growth driving factors for HPPC vs TSC

~strategy of seeding into new bizs

6 yrs ago HPPC seeded. Now its big

~feeding into future biz like water trt biz

11/

b. Cost/raw material components for the businesses:

Crude oil pricing doesn't affect that much.

Its on demand vs supply economics.

c. 94% CAGR for HPPC for last 4 yrs.

~seeding and good customer like unilever.

Big market, small share is quite big.

b. Cost/raw material components for the businesses:

Crude oil pricing doesn't affect that much.

Its on demand vs supply economics.

c. 94% CAGR for HPPC for last 4 yrs.

~seeding and good customer like unilever.

Big market, small share is quite big.

12/

d. Last few years. TSC was 80%, HPPC was 16%.

Now other way round.

~u cannot time the market, % of wht biz could do(great answer)

e. Silicon, surfactant, enzymes(revenue mix)

~Don't digress from 4 chemistry

~limited the biz to these 4 chemistry

d. Last few years. TSC was 80%, HPPC was 16%.

Now other way round.

~u cannot time the market, % of wht biz could do(great answer)

e. Silicon, surfactant, enzymes(revenue mix)

~Don't digress from 4 chemistry

~limited the biz to these 4 chemistry

13/

~AHN had lot of enzymes like wht used in TSC, both similar so ventured

~dont get headon with ingredients supplier

~sell ingredients as formulation

~AHN, get in enzymes and get into other chemistry.

~starting with surfactant were major and later into silicon chemistry.

~AHN had lot of enzymes like wht used in TSC, both similar so ventured

~dont get headon with ingredients supplier

~sell ingredients as formulation

~AHN, get in enzymes and get into other chemistry.

~starting with surfactant were major and later into silicon chemistry.

14/

~4 chemistry r the platform. No discrimination.

f. Integration of biz:

~m/f lot of ingredients that go into formulation.

~dont sell ingredients directly but, formulation.

~all products are application based.

~4 chemistry r the platform. No discrimination.

f. Integration of biz:

~m/f lot of ingredients that go into formulation.

~dont sell ingredients directly but, formulation.

~all products are application based.

15/

Q4. a. Current mix of HPPC & after Dahej:

~not look at each segment separately. No bifurcation. Broad single one.

Soap and detergents

Paint.

Ceramic

Water care

Personal care

Q4. a. Current mix of HPPC & after Dahej:

~not look at each segment separately. No bifurcation. Broad single one.

Soap and detergents

Paint.

Ceramic

Water care

Personal care

16/

Keep the breakup confidential.

b. Subsidiary: 132500 MTPA Dahej personal care would be one part of it.

Rossari personal care like a marketing organization.

Just poking for nos and bifurcation.

Hopeful to maintain 16-18% EBIDTA margin going forward.

Keep the breakup confidential.

b. Subsidiary: 132500 MTPA Dahej personal care would be one part of it.

Rossari personal care like a marketing organization.

Just poking for nos and bifurcation.

Hopeful to maintain 16-18% EBIDTA margin going forward.

17/

1st quarter was exceptional, higher sales for higher margin products.

Rossari brazil +ve scenario

Q5. Wht % of 84 crs revenue wud fade away in coming qs.

~this is the new normal.

~u go out u wud have sanitiser

~stay forever

~demand is built up now, margins wud stabilize

1st quarter was exceptional, higher sales for higher margin products.

Rossari brazil +ve scenario

Q5. Wht % of 84 crs revenue wud fade away in coming qs.

~this is the new normal.

~u go out u wud have sanitiser

~stay forever

~demand is built up now, margins wud stabilize

18/

~got 1st mover advantage

~demand has built up and lot of competition wud come

~it wud taper and stabilization happen.

Abhi sabke ghar me cleaning badh he gya h na !

Hand wash, dish wash, hand wash, sanitiser, disinfectant etc

Demand is up.

~got 1st mover advantage

~demand has built up and lot of competition wud come

~it wud taper and stabilization happen.

Abhi sabke ghar me cleaning badh he gya h na !

Hand wash, dish wash, hand wash, sanitiser, disinfectant etc

Demand is up.

19/

Q5: increase capacity to almost double by next yr, any rollover cost, delay , how fungible ?

~no extra cost, no extra time

~sab kuch bana skte h usme.

Revenue growth (22-25%)

~ +ve to grow well in coming yrs

Q5: increase capacity to almost double by next yr, any rollover cost, delay , how fungible ?

~no extra cost, no extra time

~sab kuch bana skte h usme.

Revenue growth (22-25%)

~ +ve to grow well in coming yrs

20/

Exit utilisation for Dahej?

~silvasa really high capacity utilisation

~some wud go to dahej and debottle-neck silvasa

~3-4 yrs expect utilisation

Water treatment?

~seeded this biz last yr

~sales and marketing team on ground

~unfortunately not ramped up

~small sales there

Exit utilisation for Dahej?

~silvasa really high capacity utilisation

~some wud go to dahej and debottle-neck silvasa

~3-4 yrs expect utilisation

Water treatment?

~seeded this biz last yr

~sales and marketing team on ground

~unfortunately not ramped up

~small sales there

21/

Q6. Segment level ebidta margin.

~dont have segment wise margin

~everything is common

Highest margin is in AHN

AHN>HPPC>TSC

Key raw materials?

~surfactant(for the group)

~Acrylic acid

~acetic acid

Imports wud b less going further.

Q6. Segment level ebidta margin.

~dont have segment wise margin

~everything is common

Highest margin is in AHN

AHN>HPPC>TSC

Key raw materials?

~surfactant(for the group)

~Acrylic acid

~acetic acid

Imports wud b less going further.

22/

Q7. Capacity utilisation in Q1

~lower than 50%

Q2 picking up, expect abv 65%

It depends upon how textile biz opens and AHN wud show traction.

30k tonnes additional capacity this year from Dahej.

Completed in March 21.

Depreciation wud start from Q2 in phased manner.

Q7. Capacity utilisation in Q1

~lower than 50%

Q2 picking up, expect abv 65%

It depends upon how textile biz opens and AHN wud show traction.

30k tonnes additional capacity this year from Dahej.

Completed in March 21.

Depreciation wud start from Q2 in phased manner.

23/

Q8. Capitalised amt of depreciation in Q1. Employee cost also fallen.

~Good incentive to sales team, salary amount as % of sales is same of last year.

15% of total cost of dahej.

Qstn on stock price: stellar run in stock price.

RC & SRS rossari vs seciality company.

Q8. Capitalised amt of depreciation in Q1. Employee cost also fallen.

~Good incentive to sales team, salary amount as % of sales is same of last year.

15% of total cost of dahej.

Qstn on stock price: stellar run in stock price.

RC & SRS rossari vs seciality company.

24/

~I am an engineer, how wud i know. We know how to make chemicals. Marker pricing/market valuations we don't understand.

Commanding valuations of double than others.

Q9. Exports part of biz:

10-11%

Good enquiry in HPPC-AHN-TSC

Hopeful of maintaining.

~I am an engineer, how wud i know. We know how to make chemicals. Marker pricing/market valuations we don't understand.

Commanding valuations of double than others.

Q9. Exports part of biz:

10-11%

Good enquiry in HPPC-AHN-TSC

Hopeful of maintaining.

25/

Sustainable?

Expect in future the same.

Domestic market size is huge.

Lot of miles to cover.

Looking for big plants next yr, to next yr. Depends on next few quarters.

Q10. JV

not substantial

Done better than last year

Sustainable?

Expect in future the same.

Domestic market size is huge.

Lot of miles to cover.

Looking for big plants next yr, to next yr. Depends on next few quarters.

Q10. JV

not substantial

Done better than last year

26/

Fy 20 83% capacity utilisation.

A. 51%

Added big capacity in silvasa and dahej

20k at Silvasa, 30k at dahej

Last year 100k so, 50k added.

Margins:

1st Qs was exceptional one

Q11. Challenge in receivables:

Debtors level as in wht we had in past. No challenge

Fy 20 83% capacity utilisation.

A. 51%

Added big capacity in silvasa and dahej

20k at Silvasa, 30k at dahej

Last year 100k so, 50k added.

Margins:

1st Qs was exceptional one

Q11. Challenge in receivables:

Debtors level as in wht we had in past. No challenge

27/

Q12. Client concentration in HPPC:

Top 10: 55%(overall)

Fairly diversified.

AHN capacity addition:

~biz is fungible, same for AHN

Poultry and pet is growing well.

Expect to grow in animal nutrition.

Q13. Cash on books:

Post IPO, 85 crs cash in books

Repaid all debt

Q12. Client concentration in HPPC:

Top 10: 55%(overall)

Fairly diversified.

AHN capacity addition:

~biz is fungible, same for AHN

Poultry and pet is growing well.

Expect to grow in animal nutrition.

Q13. Cash on books:

Post IPO, 85 crs cash in books

Repaid all debt

28/

Growth and focus areas: Textile largest player

~hopeful to utilise capacity in next year ago. (dodged)

Focusing on all 3 bizs.

Textile is already the dominant player in the country.

Good traction in other two bizs.

Good growth expected.

Growth and focus areas: Textile largest player

~hopeful to utilise capacity in next year ago. (dodged)

Focusing on all 3 bizs.

Textile is already the dominant player in the country.

Good traction in other two bizs.

Good growth expected.

29/

Benefits due to domestic raw material:

Pricing in hand of BPCL. Hopeful.

Q14. Capacity at peak, how much sales ?peak reveue potential

~1300 crs +

Dahej plant:

14+ acres plot complete developed

All utility at place

Could double capacity when required

Benefits due to domestic raw material:

Pricing in hand of BPCL. Hopeful.

Q14. Capacity at peak, how much sales ?peak reveue potential

~1300 crs +

Dahej plant:

14+ acres plot complete developed

All utility at place

Could double capacity when required

30/

Market opportunities:

HPPC: 1 lcs crs

TSC: 5k-6k crs

AHN: 10K crs

How to compete with larger payers ?

Seeding into new bizs or niches like water treatment, ceramics, paper etc

Market opportunities:

HPPC: 1 lcs crs

TSC: 5k-6k crs

AHN: 10K crs

How to compete with larger payers ?

Seeding into new bizs or niches like water treatment, ceramics, paper etc

31/

B2C biz:

Primarily B2B

0.5 away from B2C

Pet is a big opportunity market size 1k crs growing 25% CAGR

IT will grow, base is smaller

Amount of sales would be smaller

B2C biz:

Primarily B2B

0.5 away from B2C

Pet is a big opportunity market size 1k crs growing 25% CAGR

IT will grow, base is smaller

Amount of sales would be smaller

32/

Q14. Normalised margins:

16-18%

AHN biz status?

Bigger market potential than TSC

Its more back on track than textile.

********End of concall notes*****

Q14. Normalised margins:

16-18%

AHN biz status?

Bigger market potential than TSC

Its more back on track than textile.

********End of concall notes*****

I have through a great concall and analysed what the management talks about & how does the message come out. It would be subjective from here on.

To start with, I must say @sunilchari2 was the star of the show. Few highlights from the call that I liked are as follows:

To start with, I must say @sunilchari2 was the star of the show. Few highlights from the call that I liked are as follows:

~I am engineer, I know how to make chemicals and don't know about market pricing & valuations. You guys must say these to me. @sunilchari2

an engineer myself I understand the pain about one loving his/her products and guys in front of u asks about valuations. Well handled.

an engineer myself I understand the pain about one loving his/her products and guys in front of u asks about valuations. Well handled.

~The way to not disclose the segmental breakup is superb. Well handled by #RossariBiotech management. Atleast 6 instances of analysts poking for segmental break-up, margins per segment, the question on realisation per kg was hilarious I must say. Still so much poke was handled.

~Qstn on competition & strategy:

Liked the way one focuses on the markets & products rather than competition.

It seems the analysts doesn't have parameters & data to value the company.

Its completely camouflaged the internal dynamics and people are in dilemma how to value ?

Liked the way one focuses on the markets & products rather than competition.

It seems the analysts doesn't have parameters & data to value the company.

Its completely camouflaged the internal dynamics and people are in dilemma how to value ?

At one point, the analyst got wild and declared that #Rossaribiotech gets 2× valuations against peers.

Expensive valuations. Now that's just opinion according to me and market is not listening to me. Also, the same goes for me too.

Expensive valuations. Now that's just opinion according to me and market is not listening to me. Also, the same goes for me too.

~ Long term approach vs short term approach:

Analysts claiming long term approach asking for next quarter guidance is like reading Balance sheet and trading Intraday.

This was well handled. No one can forecast what's going to happen next quarter. Next year is way too adventure

Analysts claiming long term approach asking for next quarter guidance is like reading Balance sheet and trading Intraday.

This was well handled. No one can forecast what's going to happen next quarter. Next year is way too adventure

~Being Conservative, Under-promise & over-deliver:

Reasonable guidance on margins and market growth suffice the need to forecast. As buffett said u need to know the heaviness of someone as very heavy or light and not in specifics

Challenges are well put forward with confidence.

Reasonable guidance on margins and market growth suffice the need to forecast. As buffett said u need to know the heaviness of someone as very heavy or light and not in specifics

Challenges are well put forward with confidence.

~Management driving the game:

Under the light of low information availability, the analysts were in a fix and management drove the game nicely.

It was all amicable and informative & sense of humour was great. Its great to know management doesn't believe in forecasting.

Under the light of low information availability, the analysts were in a fix and management drove the game nicely.

It was all amicable and informative & sense of humour was great. Its great to know management doesn't believe in forecasting.

~Good capital allocation:

Seeding into new segments looks great. It has been proven with recent success in HPPC segment. Other new segments could come to the fore.

Idea to increase capacity through internal accruals seems wise. Finer points within statements appealed.

Seeding into new segments looks great. It has been proven with recent success in HPPC segment. Other new segments could come to the fore.

Idea to increase capacity through internal accruals seems wise. Finer points within statements appealed.

~Building on its competitive advantage & strength:

Idea to work on only 4 chemistry from the beginning.

Venturing into segments with same or allied chemistry.

"Capacity is totally fungible"

Loved the analogy that u can make tea, soda, soup etc in all same vessel.

Idea to work on only 4 chemistry from the beginning.

Venturing into segments with same or allied chemistry.

"Capacity is totally fungible"

Loved the analogy that u can make tea, soda, soup etc in all same vessel.

Overall analysts are in a FUSS about the business and the valuations.

They are relying on comparative relative valuations only as a means to value #RossariBiotech. The value investors would stay away form this one forever. Growth investors still would be in a dilemma too (IPO).

They are relying on comparative relative valuations only as a means to value #RossariBiotech. The value investors would stay away form this one forever. Growth investors still would be in a dilemma too (IPO).

SBI Mutual Fund increased stake to 5.26% from 4.8% on August 25.

SBI MF buys 2,34,032 shares on 25th Aug.

SBI MF buys 2,34,032 shares on 25th Aug.

Breakdown of different funds:

SBI smallcap fund & multicap fund has great allocation. Recently increased in multicap fund.

SBI smallcap fund & multicap fund has great allocation. Recently increased in multicap fund.

SBI ,Nippon & Axis smallcap names are prominent ones.

Aggressive additions by SBI, Mirae & Sundaram MF's recently.

Aggressive additions by SBI, Mirae & Sundaram MF's recently.

Exceptional quarter as pointed out by the management.

High margins product realization leading to an expansion in margins which could normalize in the coming quarters.

High margins product realization leading to an expansion in margins which could normalize in the coming quarters.

Decent yoy growth.

As indicated by the management the margins would be in tunes of 16-18%

Not so stellar yet decent.

As indicated by the management the margins would be in tunes of 16-18%

Not so stellar yet decent.

Suppliers are paid off well on time. or bargaining power is not there. But, last year's change in Payables +ve 67 (CFS) shows it had the bargaining power or the payables declined or deferred.

Huges gross block addition and depreciation charge: Capacity expansion in place.

TBC

Huges gross block addition and depreciation charge: Capacity expansion in place.

TBC

Inventories and trade receivables change % as compared to % of sales growth yoy is not that significant. : +ve

CFS:

Payments delayed for suppliers in the previous year as compared to the previous before it. As mentioned earlier, that might be the bargaining power or deferment of payments.

The current cash flow is hampered due to payments to the suppliers/creditors. So, 71->55

Payments delayed for suppliers in the previous year as compared to the previous before it. As mentioned earlier, that might be the bargaining power or deferment of payments.

The current cash flow is hampered due to payments to the suppliers/creditors. So, 71->55

Very high cash on books. They should decide where to allocate/use the cash for future cash inflows or asset creation. Q1 FY21 cash standing in books at 85 crs(concall)

Big shakeout on low vols today.

3rd Higher low done. Big Institutional buying in action. Seems more like rising channel than a firm base or compression. Need to check EOD charts.

In bear market if the stock can go public. That's very valuable. Highest quality.

Valuable information. Some of the biggest winners were launched in bear. ~Jim Roppell

Valuable information. Some of the biggest winners were launched in bear. ~Jim Roppell

DAY 32: Rise on low delivery % & low vols. The day before it crashed to EMA21 and now jumping above it. A close above 818.80 is important to break the shackles.

+ve: Higher low formation in place. It's not giving up completely on bad market sentiments.

+ve: Higher low formation in place. It's not giving up completely on bad market sentiments.

DAY 36: Deliveries are still low. Though EMA 21 is giving strong support. Lower trendline approaching.

• • •

Missing some Tweet in this thread? You can try to

force a refresh